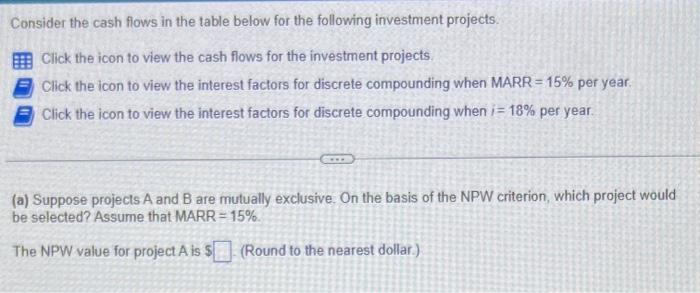

Question: Consider the cash flows in the table below for the following investment projects. Click the icon to view the cash flows for the investment projects.

Consider the cash flows in the table below for the following investment projects. Click the icon to view the cash flows for the investment projects. Click the icon to view the interest factors for discrete compounding when MARR =15% per year. Click the icon to view the interest factors for discrete compounding when i=18% per year. (a) Suppose projects A and B are mutually exclusive. On the basis of the NPW criterion, which project would be selected? Assume that MARR =15%. The NPW value for project A is $ (Round to the nearest dollar.) Consider the cash flows in the table below for the following investment projects. Click the icon to view the cash flows for the investment projects. Click the icon to view the interest factors for discrete compounding when MARR =15% per year. Click the icon to view the interest factors for discrete compounding when i=18% per year. (a) Suppose projects A and B are mutually exclusive. On the basis of the NPW criterion, which project would be selected? Assume that MARR =15%. The NPW value for project A is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts