Question: 8. It is important to identify and use only incremental cash flows in capital budgeting decisions A) because ultimately it is the change in a

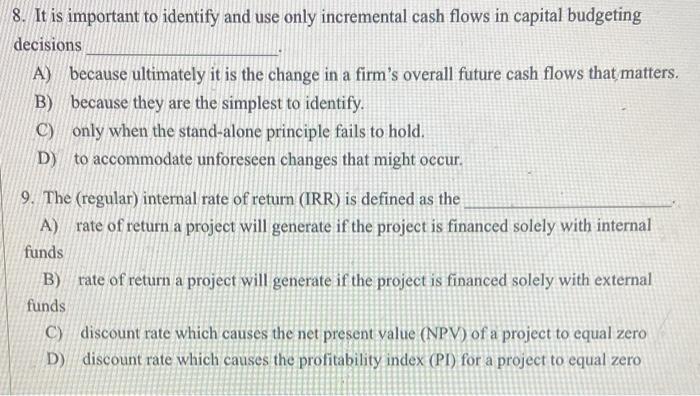

8. It is important to identify and use only incremental cash flows in capital budgeting decisions A) because ultimately it is the change in a firm's overall future cash flows that matters. B) because they are the simplest to identify. C) only when the stand-alone principle fails to hold. D) to accommodate unforeseen changes that might occur. 9. The (regular) internal rate of return (IRR) is defined as the A) rate of return a project will generate if the project is financed solely with internal funds B) rate of return a project will generate if the project is financed solely with external funds C) discount rate which causes the net present value (NPV) of a project to equal zero D) discount rate which causes the profitability index (PI) for a project to equal zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts