Question: (8 Marks) Under the CAPM model, we can assign a beta () to both equities and bonds. The beta is a sensitivity measure. If a

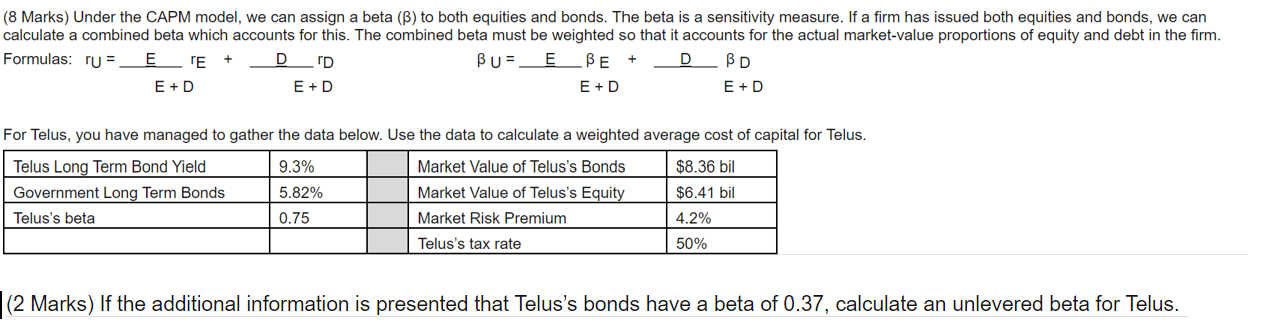

(8 Marks) Under the CAPM model, we can assign a beta () to both equities and bonds. The beta is a sensitivity measure. If a firm has issued both equities and bonds, we can calculate a combined beta which accounts for this. The combined beta must be weighted so that it accounts for the actual market value proportions of equity and debt in the firm. Formulas: ru= ETE D D BU=_EBE + D BD E + D E +D E+D E + D + For Telus, you have managed to gather the data below. Use the data to calculate a weighted average cost of capital for Telus. Telus Long Term Bond Yield 9.3% Market Value of Telus's Bonds $8.36 bil Government Long Term Bonds 5.82% Market Value of Telus's Equity $6.41 bil Telus's beta 0.75 Market Risk Premium 4.2% Telus's tax rate 50% |(2 Marks) If the additional information is presented that Telus's bonds have a beta of 0.37, calculate an unlevered beta for Telus. (8 Marks) Under the CAPM model, we can assign a beta () to both equities and bonds. The beta is a sensitivity measure. If a firm has issued both equities and bonds, we can calculate a combined beta which accounts for this. The combined beta must be weighted so that it accounts for the actual market value proportions of equity and debt in the firm. Formulas: ru= ETE D D BU=_EBE + D BD E + D E +D E+D E + D + For Telus, you have managed to gather the data below. Use the data to calculate a weighted average cost of capital for Telus. Telus Long Term Bond Yield 9.3% Market Value of Telus's Bonds $8.36 bil Government Long Term Bonds 5.82% Market Value of Telus's Equity $6.41 bil Telus's beta 0.75 Market Risk Premium 4.2% Telus's tax rate 50% |(2 Marks) If the additional information is presented that Telus's bonds have a beta of 0.37, calculate an unlevered beta for Telus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts