Question: (8 Marks) Under the CAPM model, we can assign a beta (B) to both equities and bonds. The beta is a sensitivity measure. If a

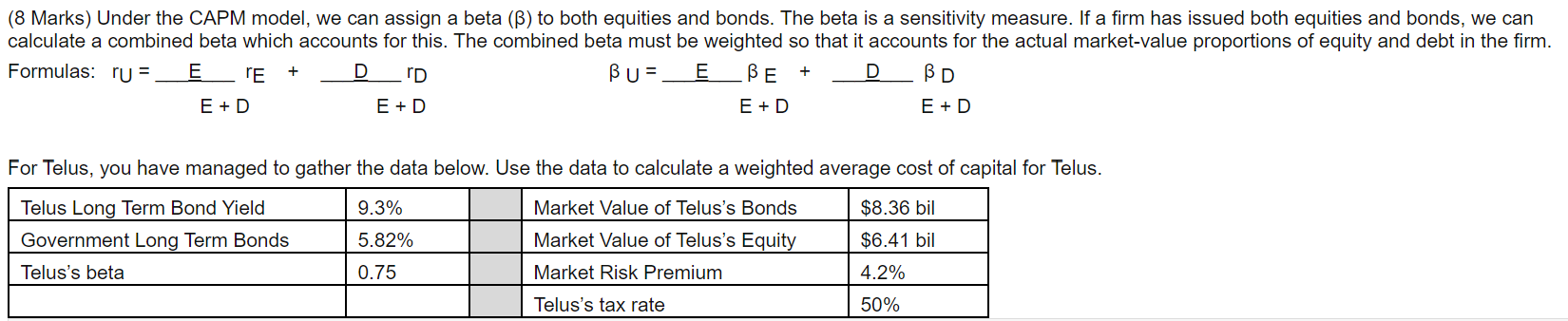

(8 Marks) Under the CAPM model, we can assign a beta (B) to both equities and bonds. The beta is a sensitivity measure. If a firm has issued both equities and bonds, we can calculate a combined beta which accounts for this. The combined beta must be weighted so that it accounts for the actual market value proportions of equity and debt in the firm. Formulas: ru = ErE DID BU= E D BD E +D E + D E + D E + D + + For Telus, you have managed to gather the data below. Use the data to calculate a weighted average cost of capital for Telus. 9.3% Market Value of Telus's Bonds $8.36 bil Telus Long Term Bond Yield Government Long Term Bonds Telus's beta 5.82% $6.41 bil 0.75 Market Value of Telus's Equity Market Risk Premium Telus's tax rate 4.2% 50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts