Question: 8) Numerical application for the bonds defined in question 6 above. An investor considers putting 1,000,000 $ in one of the following 6 bonds :

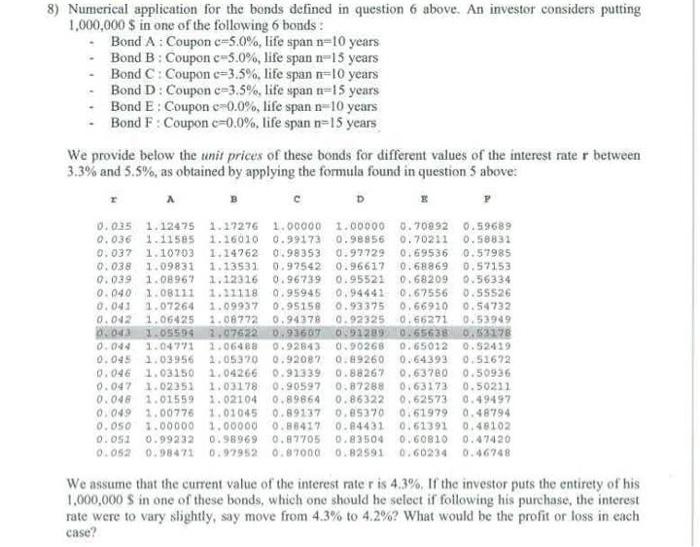

8) Numerical application for the bonds defined in question 6 above. An investor considers putting 1,000,000 $ in one of the following 6 bonds : Bond A : Coupon c=5.0%, life span 1-10 years Bond B : Coupon c-5.0%, life span -15 years Bond C : Coupon c=3.5%, life span 10 years Bond D : Coupon c-3.5%, life span 15 years Bond E: Coupon c 0.0%, life span n-10 years Bond F. Coupon c=0.0%, life span n-15 years We provide below the unit prices of these bonds for different values of the interest rate r between 3.3% and 5.5%, as obtained by applying the formula found in question 5 above: D B 0.035 1.12475 1.17276 1.00000 1.00000 0.70892 0.59689 0.036 1.11585 1.16010 0.99173 0.98856 0.70211 0.58831 0.037 1.10703 1.14762 0.98353 0.97729 0.69536 0.57985 0.038 1.09831 1.13531 0.92542 0.96617 0.68869 0.57153 0.039 1.08967 1.12316 0.96739 0.95521 0.68209 0.56334 0.040 1.08111 1.11118 0.95945 0.94441 0.67556 0.SSS26 0.041 1.07264 1.09937 0.95158 0.93375 0.66920 0.54732 0.002 1.06425 1.08772 0.94378 0.92325 0.66271 0.53949 0.043 1.05594 2.07622 0.93607 0912090.65638 0.53178 0.044 1.04721 1.06488 0.92843 090268 0.65012 0.52419 0.045 1.03956 2.05370 0.92087 0.89260 0.64393 0.51672 0.046 1.03150 1.04266 0.91339 0.88267 0.63780 0.50936 0.047 1.02351 1.03178 0.90597 0.87288 0.63173 0.50211 0.048 1.01559 1.02104 0.89864 0.86322 0.62573 0.49497 0.049 1.00775 1.01045 0.89137 0.89370 0.51979 0.48794 0.050 1.00000 1.00000 0.86417 0.84431 0.61391 0.48102 0.053 0.99232 0.98969 0.87705 0.83504 0.60810 0.47420 0.052 0.98471 0.97952 0.870000.B2591 0.60234 0.46748 We assume that the current value of the interest rater is 4.3%. If the investor puts the entirety of his 1,000,000 S in one of these bonds, which one should he select if following his purchase, the interest rate were to vary slightly, say move from 4.3% to 4.2%? What would be the profit or loss in each case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts