Question: 8. Optional Bonus Problem Arbitrage in Montral. As an arbitrageur with Banque de 80 Montral in Montreal, Province Qubec, Canada you see the following CAD/USD

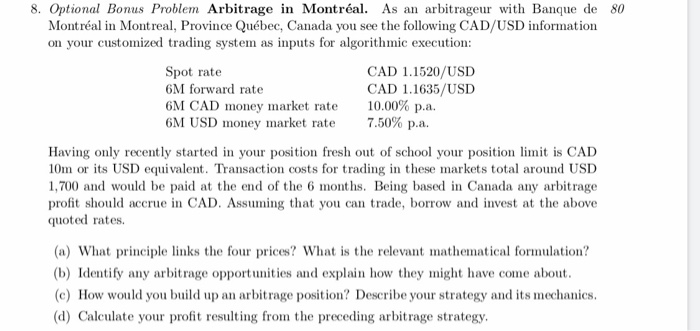

8. Optional Bonus Problem Arbitrage in Montral. As an arbitrageur with Banque de 80 Montral in Montreal, Province Qubec, Canada you see the following CAD/USD information on your customized trading system as inputs for algorithmic execution: Spot rate 6M forward rate 6M CAD money market rate 6M USD money market rate CAD 1.1520/USD CAD 1.1635/USD 10.00% p.a. 7.50% p.a. Having only recently started in your position fresh out of school your position limit is CAD 10m or its USD equivalent. Transaction costs for trading in these markets total around USD 1,700 and would be paid at the end of the 6 months. Being based in Canada any arbitrage profit should accrue in CAD. Assuming that you can trade, borrow and invest at the above quoted rates. (a) What principle links the four prices? What is the relevant mathematical formulation? (b) Identify any arbitrage opportunities and explain how they might have come about. (c) How would you build up an arbitrage position? Describe your strategy and its mechanics, (d) Calculate your profit resulting from the preceding arbitrage strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts