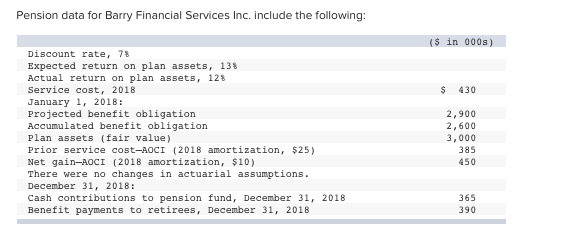

Question: 8 Pension data for Barry Financial Services Inc. include the following: ($in 000s ) Discount rate, 78 Expected return on plan assets, 13 Actual return

8

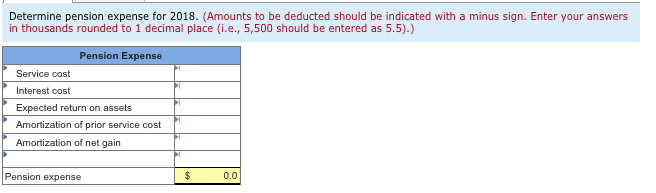

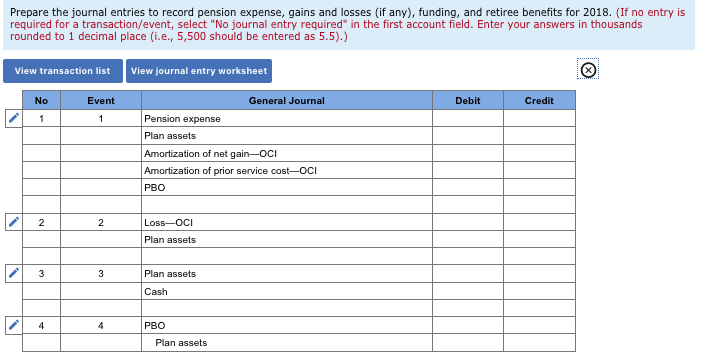

Pension data for Barry Financial Services Inc. include the following: ($in 000s ) Discount rate, 78 Expected return on plan assets, 13 Actual return on plan assets, 12 Service cost, 2018 S 430 January 1, 2018: Projected benefit obliqation Accumulated benefit obligation Plan assets (fair value) Prior service cost-AOCI (2018 amortization, $25) Net gain-AOCI (2018 amortization, $10) There were no changes in actuarial assumptions December 31, 2018: Cash contributions to pension fund, December 31, 2018 Benefit payments to retirees, December 31, 2018 2,900 2,600 3,000 385 450 365 390 Determine pension expense for 2018. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands rounded to 1 decimal place (i.e., 5,500 should be entered as 5.5).) Pension Expense Service cost Interest cost Expected return on assets Amortization of prior service cost Amortization of net gain Pension expense 0.0 Prepare the journal entries to record pension expense, gains and losses (if any), funding, and retiree benefits for 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands rounded to 1 decimal place (i.e., 5,500 should be entered as 5.5).) View transaction list View journal entry worksheet General Journal No Event Debit Credit 1 Pension expense Plan assets Amortization of net gain-OCI Amortization of prior service cost-OCI PBO 2 2 Loss-OCI Plan assets Plan assets 3 3 Cash 4 PBO Plan assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts