Question: [8 points] [15 points] [25 points] 5) 5) 7) Calculate the covariance and correlation of returns between Company A and Company B for the 09/01/2017

![[8 points] [15 points] [25 points] 5) 5) 7) Calculate the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f68b8d4e312_61366f68b8d287af.jpg)

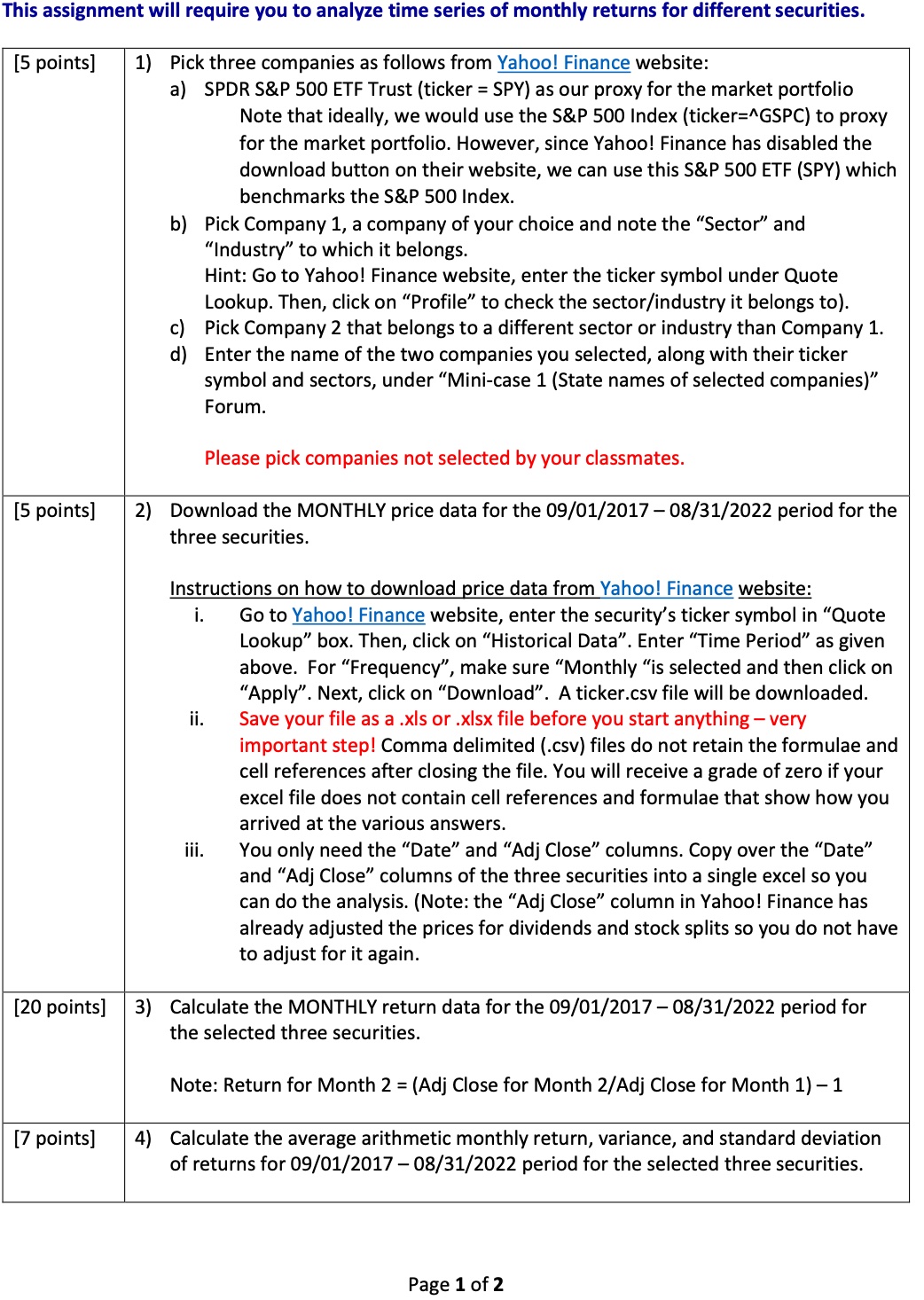

[8 points] [15 points] [25 points] 5) 5) 7) Calculate the covariance and correlation of returns between Company A and Company B for the 09/01/2017 03/31/2022 period. What does the correlation indicate? Calculate the stock betas for Company A and Company B for the 09/01/2017 08/31/2022 period. What do the betas indicate? Hint: Remember that we have used SPDR S&P 500 ETF Trust (ticker = SPY) as our proxy for the market portfolio. What should go in the known-x5 array and what should go in the known-ys array? Suppose you invest 50% in Company A and 50% in Company B. What is your portfolio average return and standard deviation? [15 points] 3) Compare the average return and standard deviation of Company A and Company B from #4 with the portfolio average return and standard deviation from #7. What do you observe? What can you conclude from your findings? This assignment will require you to analyze time series of monthly returns for different securities. [5 points] [5 points] [20 points] 1) 2! 3! Pick three companies as follows from Yahoo! Finance website: a) SPDR S&P 500 ETF Trust (ticker = SPY) as our proxy for the market portfolio Note that ideally, we would use the S&P 500 Index (ticker="GSPC) to proxy for the market portfolio. However, since Yahoo! Finance has disabled the download button on their website, we can use this S&P 500 ETF (SPY) which benchmarks the S&P 500 Index. b) Pick Company 1, a company of your choice and note the \"Sector" and "Industry\" to which it belongs. Hint: Go to Yahoo! Finance website, enter the ticker symbol under Quote Lookup. Then, click on \"Profile\" to check the sector/industry it belongs to). c} Pick Company 2 that belongs to a different sector or industry than Company 1. d) Enter the name of the two companies you selected, along with their ticker symbol and sectors, under \"Mini-case 1 (State names of selected companies)\" Forum. Please pick companies not selected by your classmates. Download the MONTHLY price data for the 09/01/2017 08/31/2022 period for the three securities. nlstructions on how to download price data from Yahoo! Finance website: i. Go to Yahoo! Finance website, enter the security's ticker symbol' In \"Quote Lookup\" box. Then, click on \"Historical Data\" . Enter \"Time Period" as given above. For \"Frequency\

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts