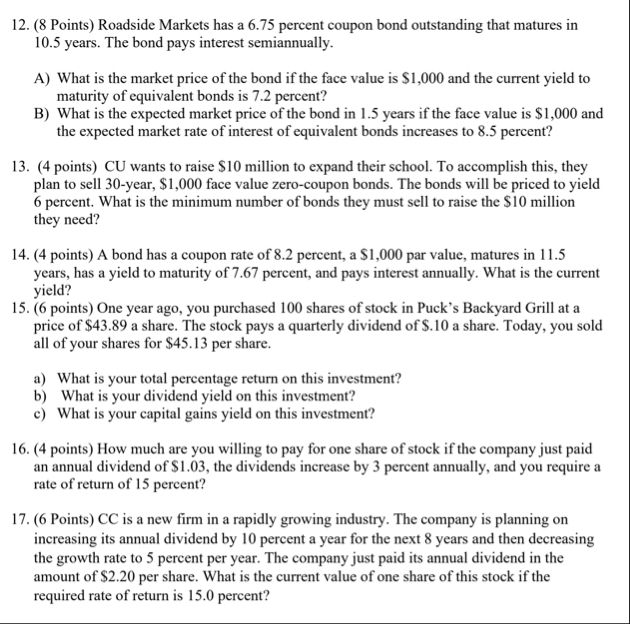

Question: ( 8 Points ) Roadside Markets has a 6 . 7 5 percent coupon bond outstanding that matures in 1 0 . 5 years. The

Points Roadside Markets has a percent coupon bond outstanding that matures in years. The bond pays interest semiannually.

A What is the market price of the bond if the face value is $ and the current yield to maturity of equivalent bonds is percent?

B What is the expected market price of the bond in years if the face value is $ and the expected market rate of interest of equivalent bonds increases to percent?

points CU wants to raise $ million to expand their school. To accomplish this, they plan to sell year, $ face value zerocoupon bonds. The bonds will be priced to yield percent. What is the minimum number of bonds they must sell to raise the $ million they need?

points A bond has a coupon rate of percent, a $ par value, matures in years, has a yield to maturity of percent, and pays interest annually. What is the current yield?

points One year ago, you purchased shares of stock in Puck's Backyard Grill at a price of $ a share. The stock pays a quarterly dividend of $ a share. Today, you sold all of your shares for $ per share.

a What is your total percentage return on this investment?

b What is your dividend yield on this investment?

c What is your capital gains yield on this investment?

points How much are you willing to pay for one share of stock if the company just paid an annual dividend of $ the dividends increase by percent annually, and you require a rate of return of percent?

Points CC is a new firm in a rapidly growing industry. The company is planning on increasing its annual dividend by percent a year for the next years and then decreasing the growth rate to percent per year. The company just paid its annual dividend in the amount of $ per share. What is the current value of one share of this stock if the required rate of return is percent?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock