Question: 8. Refer to Self-Test Problem 7. What would be the ending amount if the payments were made at the beginning of each year? a. $6,691.13

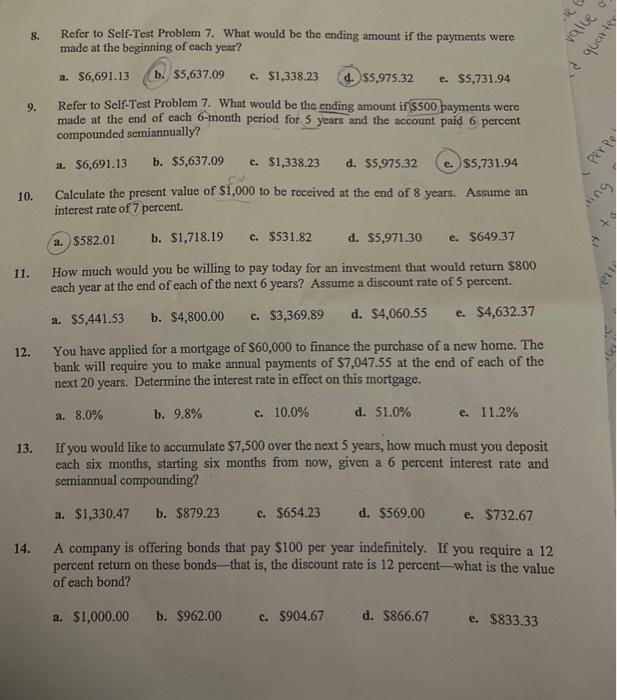

8. Refer to Self-Test Problem 7. What would be the ending amount if the payments were made at the beginning of each year? a. $6,691.13 b. $5,637,09 c. $1,338.23 4. $5,975.32 e. $5,731.94 9. Refer to Self-Test Problem 7. What would be the ending amount if $500 payments were made at the end of each 6-month period for 5 years and the account paid 6 percent compounded semiannually? a. $6,691.13 b. $5,637.09 c. $1,338.23 d. $5,975.32 e. $5,731.94 10. Calculate the present value of $1,000 to be received at the end of 8 years. Assume an interest rate of 7 percent. a. $582.01 b. $1,718.19 c. $531.82 d. $5,971.30 e. $649.37 11. How much would you be willing to pay today for an investment that would return $800 each year at the end of each of the next 6 years? Assume a discount rate of 5 percent. a. $5,441.53 b. $4,800.00 c. $3,369.89 d. $4,060.55 e. $4,632.37 12. You have applied for a mortgage of $60,000 to finance the purchase of a new home. The bank will require you to make annual payments of $7,047.55 at the end of each of the next 20 years. Determine the interest rate in effect on this mortgage. a. 8.0% b. 9.8% c. 10.0% d. 51.0% e. 11.2% 13. If you would like to accumulate $7,500 over the next 5 years, how much must you deposit each six months, starting six months from now, given a 6 percent interest rate and semiannual compounding? a. $1,330.47 b. $879.23 c. $654.23 d. $569.00 e. $732.67 14. A company is offering bonds that pay $100 per year indefinitely. If you require a 12 percent return on these bonds - that is, the discount rate is 12 percent - what is the value of each bond? a. $1,000.00 b. $962.00 c. $904.67 d. $866.67 e. $833.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts