Question: 8. Stuart is considering at a bond with a $1000 face value, a 6.5% semiannual coupon, and 11 years to maturity. Stuart requires a rate

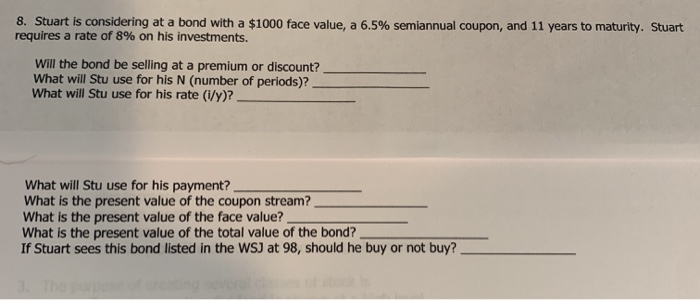

8. Stuart is considering at a bond with a $1000 face value, a 6.5% semiannual coupon, and 11 years to maturity. Stuart requires a rate of 8% on his investments. Will the bond be selling at a premium or discount? What will Stu use for his N (number of periods)?__ What will Stu use for his rate (l/y)?_ What will Stu use for his payment? What is the present value of the coupon stream? What is the present value of the face value? What is the present value of the total value of the bond? If Stuart sees this bond listed in the WSJ at 98, should he buy or not buy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts