Question: Part B Question PLEASE ATTEMPT THE FOLLOWING QUESTION Ella Kahn, the chief executive officer of Kelvin Ltd, has assembled her top advisers to evaluate an

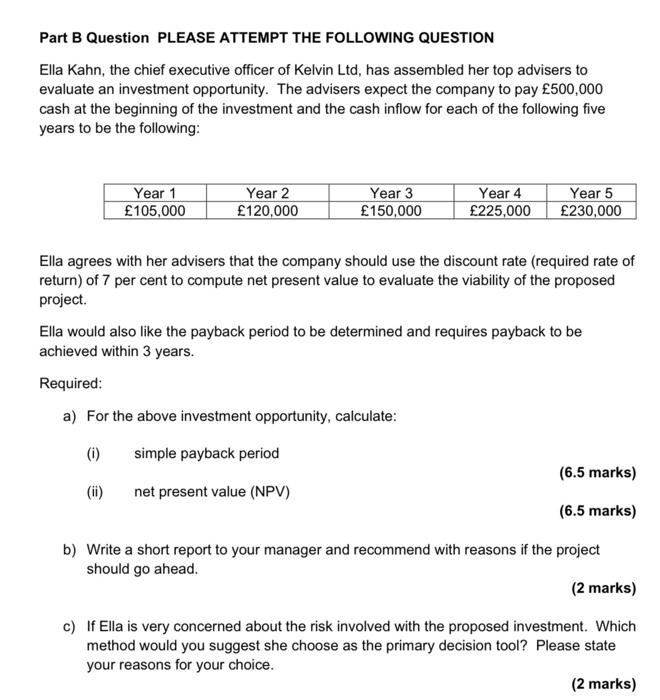

Part B Question PLEASE ATTEMPT THE FOLLOWING QUESTION Ella Kahn, the chief executive officer of Kelvin Ltd, has assembled her top advisers to evaluate an investment opportunity. The advisers expect the company to pay 500,000 cash at the beginning of the investment and the cash inflow for each of the following five years to be the following: Year 1 105,000 Year 2 120,000 Year 3 150,000 Year 4 225,000 Year 5 230,000 Ella agrees with her advisers that the company should use the discount rate (required rate of return) of 7 per cent to compute net present value to evaluate the viability of the proposed project. Ella would also like the payback period to be determined and requires payback to be achieved within 3 years. Required: a) For the above investment opportunity, calculate: (0) simple payback period (6.5 marks) (ii) net present value (NPV) (6.5 marks) b) Write a short report to your manager and recommend with reasons if the project should go ahead. (2 marks) c) If Ella is very concerned about the risk involved with the proposed investment. Which method would you suggest she choose as the primary decision tool? Please state your reasons for your choice. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts