Question: 8. Suppose you hold a one-year security with a yield to maturity of 3.6 per cent. Expected inflation for the year ahead at the time

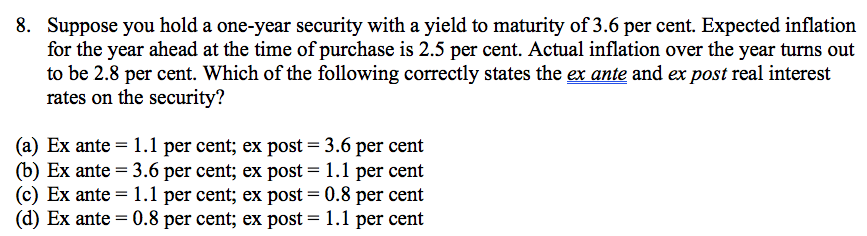

8. Suppose you hold a one-year security with a yield to maturity of 3.6 per cent. Expected inflation for the year ahead at the time of purchase is 2.5 per cent. Actual inflation over the year turns out to be 2.8 per cent. Which of the following correctly states the ex ante and ex post real interest rates on the security? (a) Ex ante = 1.1 per cent; ex post = 3.6 per cent (b) Ex ante = 3.6 per cent; ex post = 1.1 per cent (c) Ex ante = 1.1 per cent; ex post = 0.8 per cent (d) Ex ante = 0.8 per cent; ex post = 1.1 per cent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock