Question: 8. Using the discounted cash-flow method to estimate the present value of a real estate investment Amit is considering buying a rental property that has

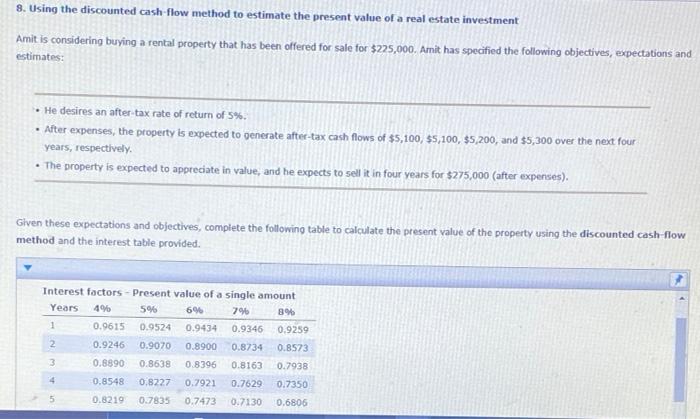

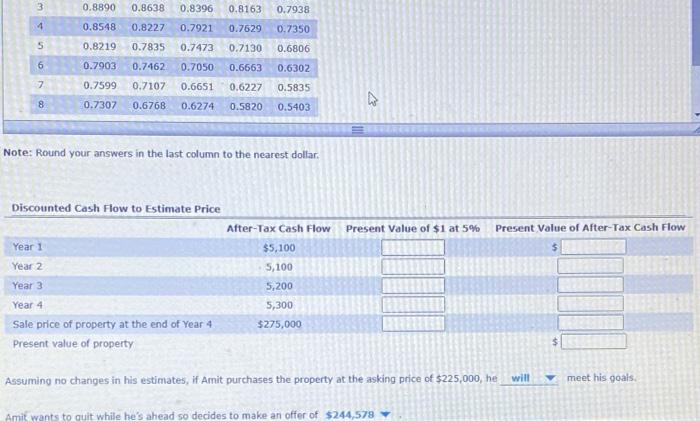

8. Using the discounted cash-flow method to estimate the present value of a real estate investment Amit is considering buying a rental property that has been offered for sale for $225,000. Amit has specified the following objectives, expectations and estimates: He desires an after-tax rate of return of 5%. After expenses, the property is expected to generate after-tax cash flows of $5,100, 55,100, $5,200, and $5,300 over the next four years, respectively. The property is expected to appreciate in value, and he expects to sell it in four years for $275,000 (after expenses). Given these expectations and objectives, complete the following table to calculate the present value of the property using the discounted cash-flow method and the interest table provided. Interest factors - Present value of a single amount Years 49 596 6% 79 8% 1 0.9615 0.9524 0.9434 0.9346 0.9259 2 0.9246 0.9070 0.8900 0.8734 0.8573 3 0.8890 0.8638 0.8396 0.8163 0.7938 4 0.8548 0.8227 0.7921 0.7629 0.7350 0.8219 0.7835 0.7473 0.7130 0.6806 3 0.8890 0.8638 0.8163 0.7938 0.8396 0.7921 4 0.8548 0.8227 0.7629 0.7350 5 0.8219 0.7835 0.7473 0.7130 0.6806 6 0.7903 0.7050 0.6663 0.6302 0.7462 0.7107 7 0.7599 0.6651 0.6227 0.5835 8 0.7307 0.6768 0.6274 0.5820 0.5403 Note: Round your answers in the last column to the nearest dollar. Discounted Cash Flow to Estimate Price After-Tax Cash Flow Present Value of $1 at 5% Present Value of After-Tax Cash Flow Year 1 $5,100 Year 2 5,100 5,200 $ Year 3 Year 4 5,300 $275,000 Sale price of property at the end of Year 4 Present value of property $ Assuming no changes in his estimates, if Amit purchases the property at the asking price of $225,000, he will meet his goals Amit wants to guit while he's ahead so decides to make an offer of $244,579

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts