Question: Given these expectations and objectives, complete the following table to calculate the present value of the property using the discounted cash-flow method and the interest

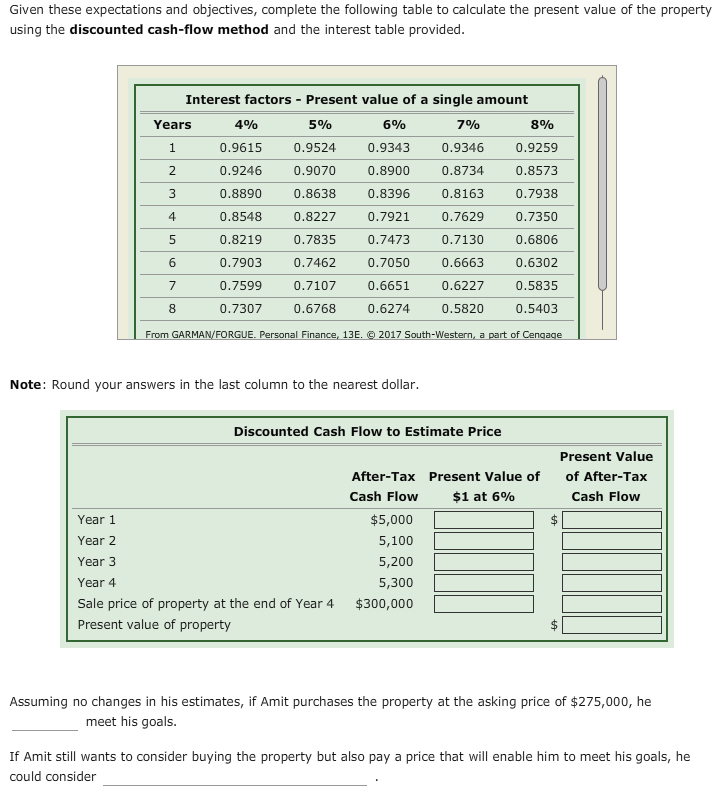

Given these expectations and objectives, complete the following table to calculate the present value of the property using the discounted cash-flow method and the interest table provided Interest factors Present value of a single amount 4% Years 8% 0.9615 0.9524 0.9343 0.9346 0.9259 0.9246 0.9070 0.8900 0.87340.8573 0.8890 0.8638 0.8396 0.8163 0.7938 0.8548 0.82270.7921 0.7629 0.7350 0.8219 0.7835 0.7473 0.71300.6806 0.7903 0.7462 0.7050 0.6663 0.6302 0.7599 0.7107 0.6651 0.62270.5835 0.7307 0.6768 0.6274 0.5820 0.5403 5% 690 7% 8 RGUE Note: Round your answers in the last column to the nearest dollar Discounted Cash Flow to Estimate Price Present Value of After-Tax Cash Flow After-Tax Present Value of Cash Flow $1 at 6% $5,000 5,100 5,200 5,300 $300,000 Year 1 Year 2 Year 3 Year 4 Sale price of property at the end of Year 4 Present value of property Assuming no changes in his estimates, if Amit purchases the property at the asking price of $275,000, he meet his goals If Amit still wants to consider buying the property but also pay a price that will enable him to meet his goals, he could consider

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts