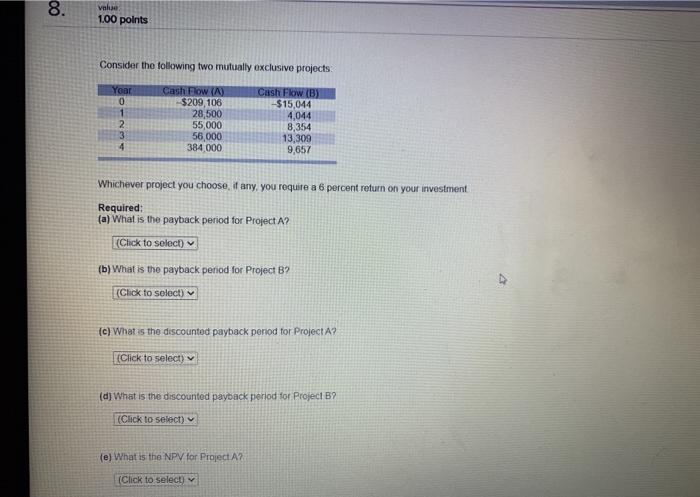

Question: 8. vek 1.00 points Consider the following two mutually exclusive projects Yoar 0 2 3 4 Cash Flow (A) $209,106 28,500 55,000 56,000 384 000

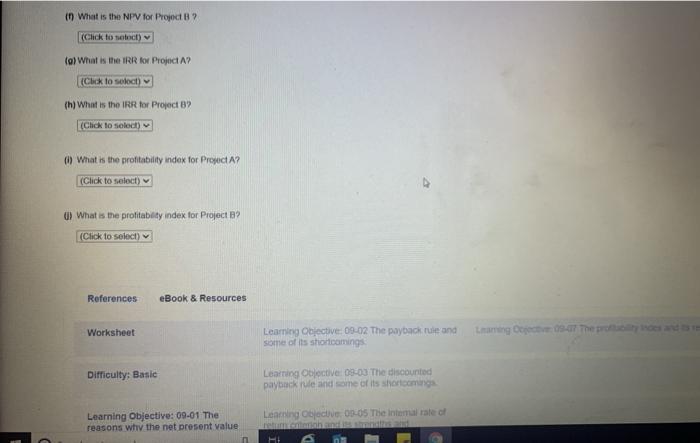

8. vek 1.00 points Consider the following two mutually exclusive projects Yoar 0 2 3 4 Cash Flow (A) $209,106 28,500 55,000 56,000 384 000 Cash Flow (1) -$15,044 4,044 8,354 13,309 9,657 Whichever project you choose, if any, you require a 6 percent return on your investment Required: (a) What is the payback period for Project A? (Click to select) (b) What is the payback period for Project B? (Click to select) (c) What is the discounted payback period for Project A? (Click to select) (d) What is the discounted payback period for Project B9 (Click to select) (e) What is the NPV for Project A? (Click to select) in What is the NPV for Project B? (Click to stot) to) What is the IRR for Project A? (Click to soot) (h) What is the IRR for Project 82 (Click to select What is the profitability index for Project A? (Click to select) u What is the profitability index for Project B? (Click to select) References eBook & Resources Worksheet Leaming Objective: 09-02 The payback rule and some of its shortcomings Difficulty: Basic Learning Objective 03.03The discounted payback rule and some of its shortcomings Learning objective 00-05 The intemurale Learning Objective: 09-01 The reasons why the net present value HE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts