Question: For question B how do you construct NPV profiles for Project A and B. I need help on the steps for the graphs A B

For question B how do you construct NPV profiles for Project A and B. I need help on the steps for the graphs

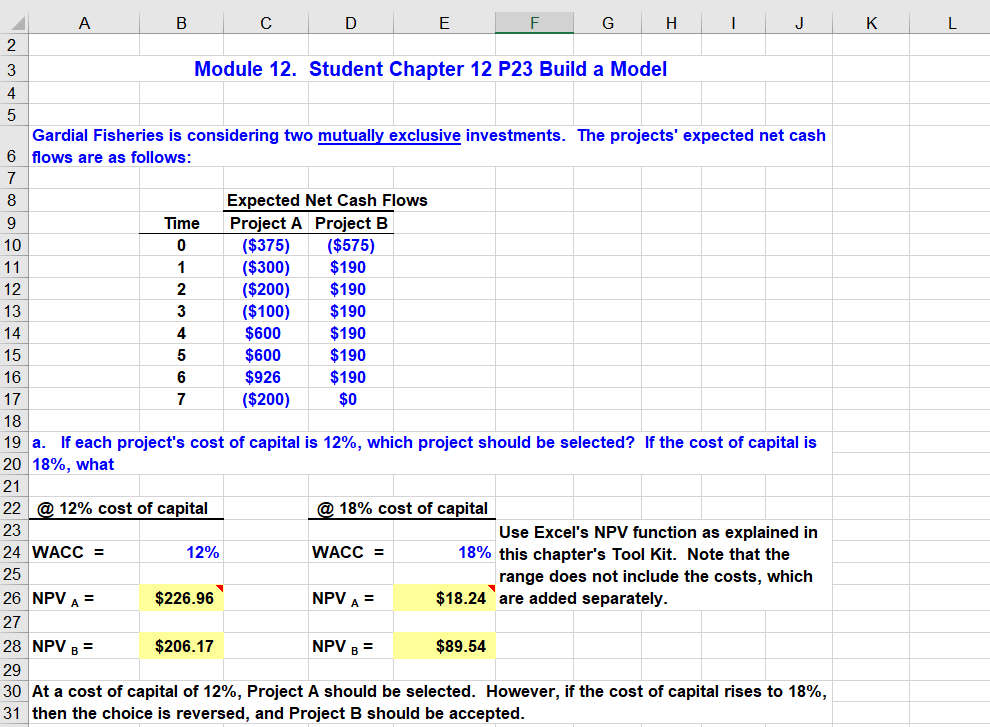

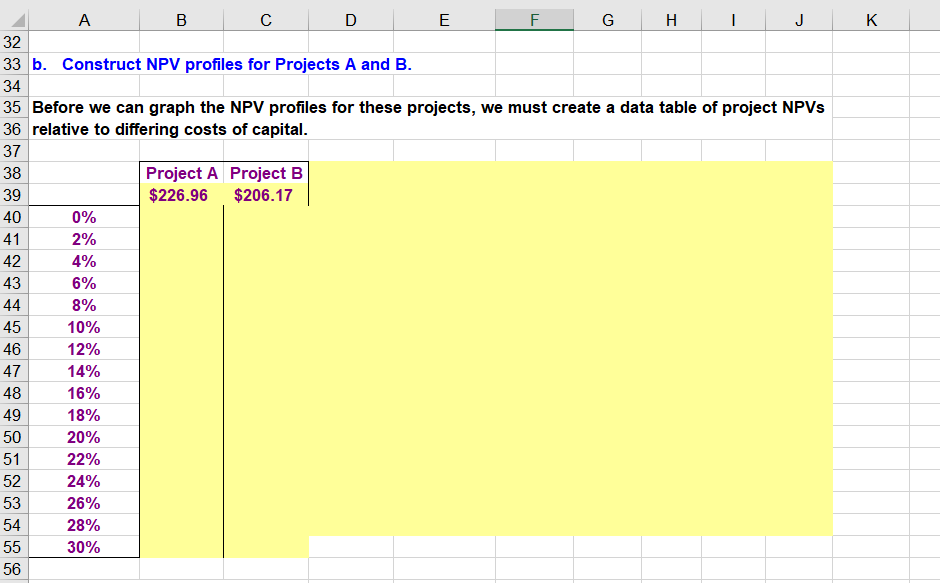

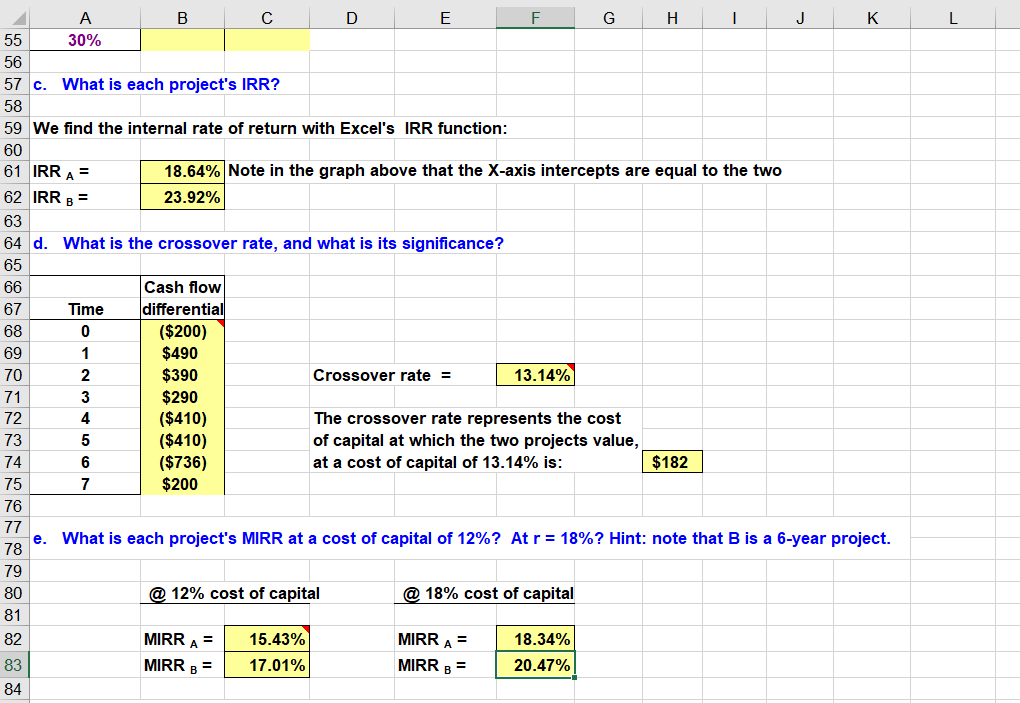

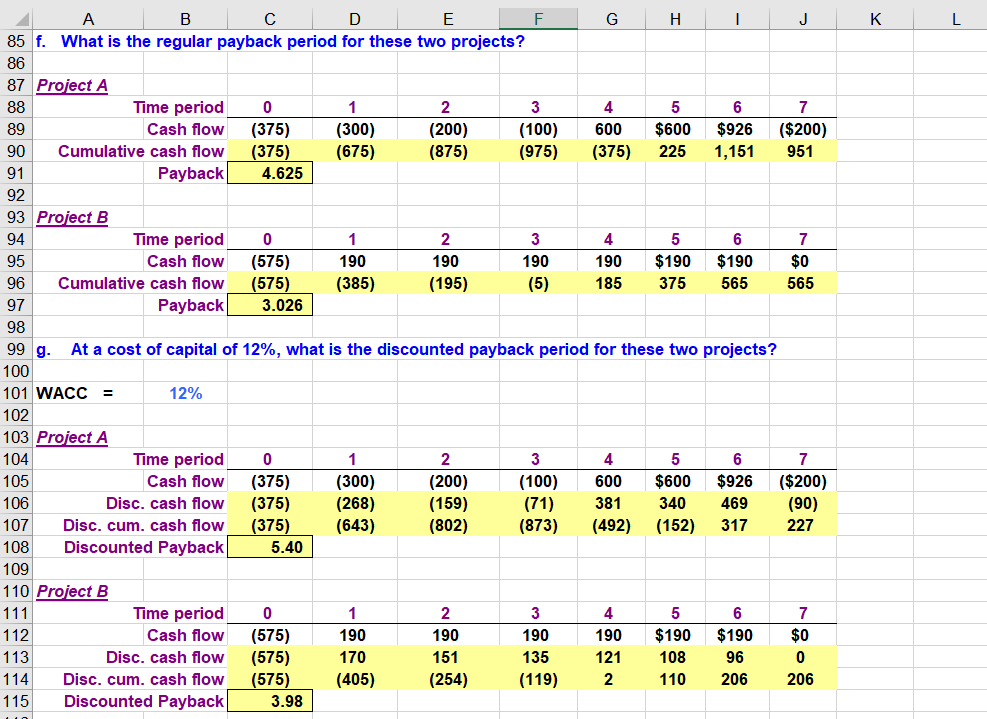

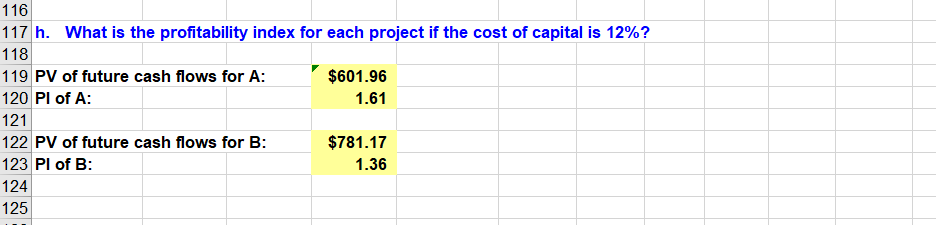

A B C D E F G H I J K L Module 12. Student Chapter 12 P23 Build a Model Gardial Fisheries is considering two mutually exclusive investments. The projects' expected net cash flows are as follows: 6 Time Expected Net Cash Flows Project A Project B ($375) ($575) ($300) $190 ($200) $190 ($100) $190 $600 $190 $600 $190 $926 $190 ($200) 13 14 AWN 15 16 17 18 19 a. If each project's cost of capital is 12%, which project should be selected? If the cost of capital is 20 18%, what 21 22 @ 12% cost of capital @ 18% cost of capital Use Excel's NPV function as explained in 24 WACC = 12% WACC = 18% this chapter's Tool Kit. Note that the 25 range does not include the costs, which 26 NPV A = $226.96 NPV A = $18.24 are added separately. 23 28 NPV 8 = $206.17 NPV 8 = $89.54 29 30 At a cost of capital of 12%, Project A should be selected. However, if the cost of capital rises to 18%, 31 then the choice is reversed, and Project B should be accepted. E F G H I JK C D 32 33 b. Construct NPV profiles for Projects A and B. 38 39 41 35 Before we can graph the NPV profiles for these projects, we must create a data table of project NPVs 36 relative to differing costs of capital. 37 Project A Project B $226.96 $206.17 40 0% 2% 42 4% 43 6% 44 8% 10% 46 12% 47 14% 16% 18% 20% 22% 24% 26% 28% 30% 45 B C D E F G H I J K L 30% 55 56 30%BC 57 c. What is each project's IRR? 58 59 We find the internal rate of return with Excel's IRR function: 60 61 IRR A = 62 IRR 8 = 18.64% Note in the graph above that the X-axis intercepts are equal to the two 23.92% 63 64 d. What is the crossover rate, and what is its significance? 65 66 Cash flow Time differential 69 70 Crossover rate = 13.14% $490 $390 $290 ($410) ($410) ($736) $200 The crossover rate represents the cost of capital at which the two projects value, at a cost of capital of 13.14% is: projects value $182 e. What is each project's MIRR at a cost of capital of 12%? At r = 18%? Hint: note that B is a 6-year project. @ 12% cost of capital @ 18% cost of capital 82 MIRR A = MIRR = 15.43% 17.01% MIRR A = MIRR 8 = 18.34% 20.47% 83 G H I J | 4 A B C D E F 85 f. What is the regular payback period for these two projects? 86 87 Project A 88 Time period 0 3 89 Cash flow (375) (300) (200) (100) 90 Cumulative cash flow (375) (675) (875) (975) Payback 4.625 4 600 (375) 5 $600 225 6 $926 1,151 7 ($200) 951 91 92 1 93 Project B 94 Time period 0 4 5 6 7 95 Cash flow (575) 190 190 190 190 $190 $190 $0 96 Cumulative cash flow (575) (385) (195) (5) 185 375 565 565 97 Payback 3.026 98 99 g. At a cost of capital of 12%, what is the discounted payback period for these two projects? 100 101 WACC = 12% 102 103 Project A 104 Time period 0 1 2 3 4 5 6 7 105 Cash flow (375) (300) (200) (100) 600 $600 $926 ($200) 106 Disc. cash flow (375) (268) (159) (71) 381 340 469 (90) 107 Disc. cum. cash flow (375) (643) (802) (873) (492) (152) 317 227 108 Discounted Payback 5.40 109 110 Project B 111 Time period 0 1 2 3 4 5 6 7 112 Cash flow (575) 190 190 190 190 $190 $190 $0 113 Disc. cash flow (575) 170 151 135121 108960 114 Disc. cum. cash flow (575) (405) (254) (119) 2 1 10 206 206 115 Discounted Payback 3.98 116 117 h. What is the profitability index for each project if the cost of capital is 12%? 118 119 PV of future cash flows for A: $601.96 120 PI of A: 1.61 121 122 PV of future cash flows for B: $781.17 123 PI of B: 1.36 124 125

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts