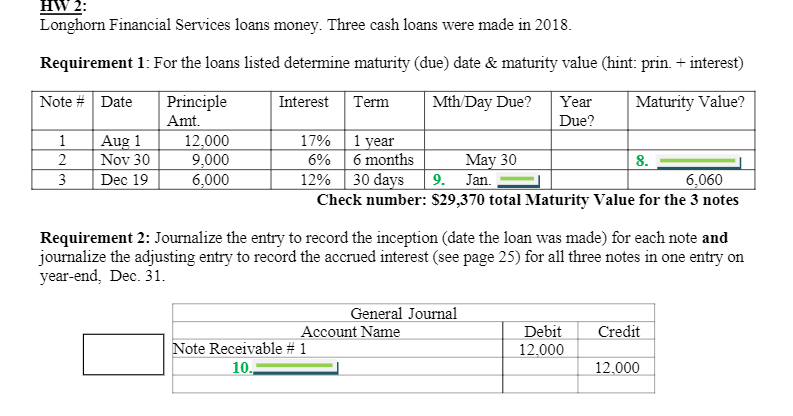

Question: 8) What is the maturity value amount for Note #2? 9) What day in January is note #3 due? (include only the day number) 10)

8) What is the maturity value amount for Note #2?

8) What is the maturity value amount for Note #2?

9) What day in January is note #3 due? (include only the day number)

10) What is the account title of the account that should be credited?

HW 2: Longhorn Financial Services loans money. Three cash loans were made in 2018. Requirement 1: For the loans listed determine maturity (due) date & maturity value (hint: prin. + interest) Note # Date Principle Interest Term Mth Day Due? Year Maturity Value? Amt. Due? 1 Aug 1 12,000 17% 1 year 2 Nov 30 9,000 6% 6 months May 30 8. 3 Dec 19 6,000 12% 30 days 9. Jan. 6,060 Check number: $29,370 total Maturity Value for the 3 notes Requirement 2: Journalize the entry to record the inception (date the loan was made) for each note and journalize the adjusting entry to record the accrued interest (see page 25) for all three notes in one entry on year-end, Dec. 31. Credit General Journal Account Name Note Receivable # 1 10. Debit 12.000 12.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts