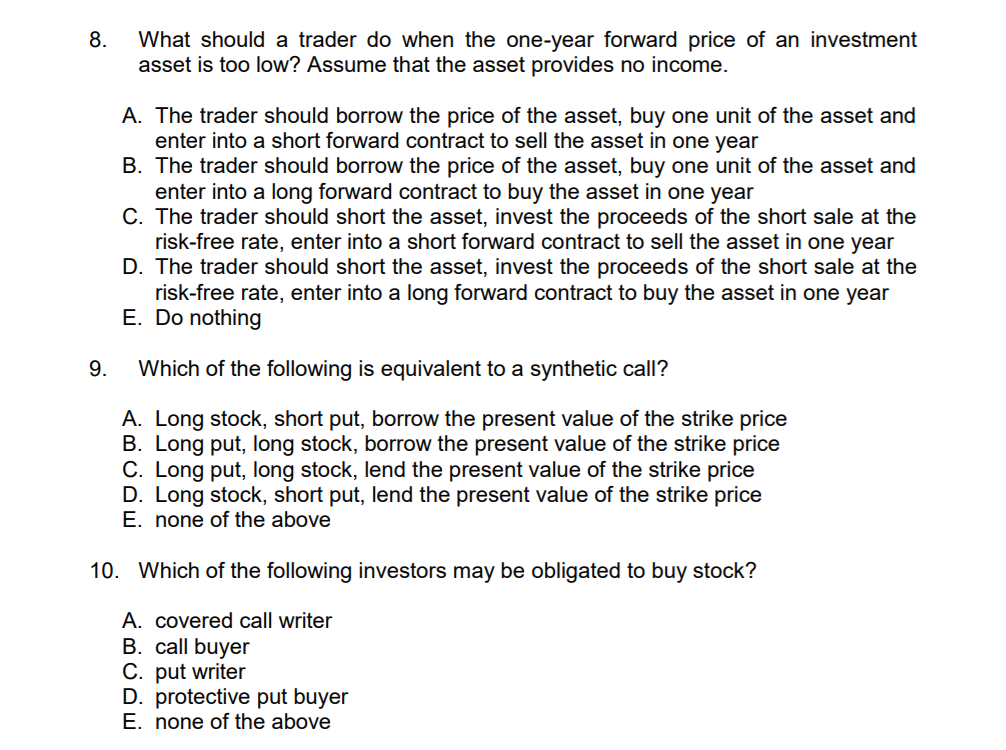

Question: 8 What should a trader do when the one-year forward price of an investment asset is too low? Assume that the asset provides no income

8 What should a trader do when the one-year forward price of an investment asset is too low? Assume that the asset provides no income A. The trader should borrow the price of the asset, buy one unit of the asset and enter into a short forward contract to sell the asset in one year B. The trader should borrow the price of the asset, buy one unit of the asset and enter into a long forward contract to buy the asset in one year C. The trader should short the asset, invest the proceeds of the short sale at the risk-free rate, enter into a short forward contract to sell the asset in one year D. The trader should short the asset, invest the proceeds of the short sale at the risk-free rate, enter into a long forward contract to buy the asset in one year E. Do nothing 9. Which of the following is equivalent to a synthetic call? A. Long stock, short put, borrow the present value of the strike price B. Long put, long stock, borrow the present value of the strike price C. Long put, long stock, lend the present value of the strike price D. Long stock, short put, lend the present value of the strike price E. none of the above 10. Which of the following investors may be obligated to buy stock? A. covered call writer B. call buyer C. put writer D. protective put buyer E. none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts