Question: 8. You are looking to value Microchip based on the following information. In 2022, which will be year one of your analysis, the company will

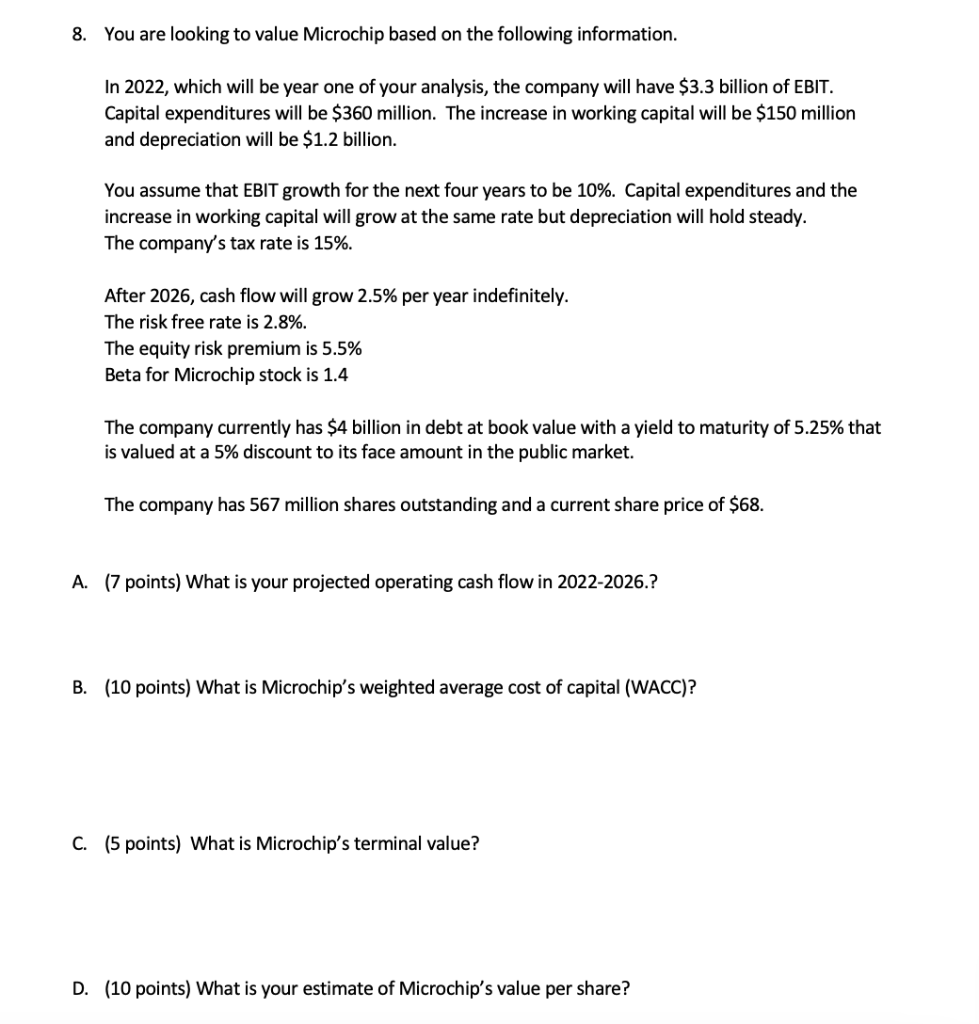

8. You are looking to value Microchip based on the following information. In 2022, which will be year one of your analysis, the company will have $3.3 billion of EBIT. Capital expenditures will be $360 million. The increase in working capital will be $150 million and depreciation will be $1.2 billion. You assume that EBIT growth for the next four years to be 10%. Capital expenditures and the increase in working capital will grow at the same rate but depreciation will hold steady. The company's tax rate is 15%. After 2026, cash flow will grow 2.5% per year indefinitely. The risk free rate is 2.8%. The equity risk premium is 5.5% Beta for Microchip stock is 1.4 The company currently has $4 billion in debt at book value with a yield to maturity of 5.25% that is valued at a 5% discount to its face amount in the public market. The company has 567 million shares outstanding and a current share price of $68. A. (7 points) What is your projected operating cash flow in 2022-2026.? B. (10 points) What is Microchip's weighted average cost of capital (WACC)? C. (5 points) What is Microchip's terminal value? D. (10 points) What is your estimate of Microchip's value per share? 8. You are looking to value Microchip based on the following information. In 2022, which will be year one of your analysis, the company will have $3.3 billion of EBIT. Capital expenditures will be $360 million. The increase in working capital will be $150 million and depreciation will be $1.2 billion. You assume that EBIT growth for the next four years to be 10%. Capital expenditures and the increase in working capital will grow at the same rate but depreciation will hold steady. The company's tax rate is 15%. After 2026, cash flow will grow 2.5% per year indefinitely. The risk free rate is 2.8%. The equity risk premium is 5.5% Beta for Microchip stock is 1.4 The company currently has $4 billion in debt at book value with a yield to maturity of 5.25% that is valued at a 5% discount to its face amount in the public market. The company has 567 million shares outstanding and a current share price of $68. A. (7 points) What is your projected operating cash flow in 2022-2026.? B. (10 points) What is Microchip's weighted average cost of capital (WACC)? C. (5 points) What is Microchip's terminal value? D. (10 points) What is your estimate of Microchip's value per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts