Question: 8. You have been asked to make a decision regarding two alternatives. To make your decision, use Benefit Cost Analysis. One of the alternatives (from

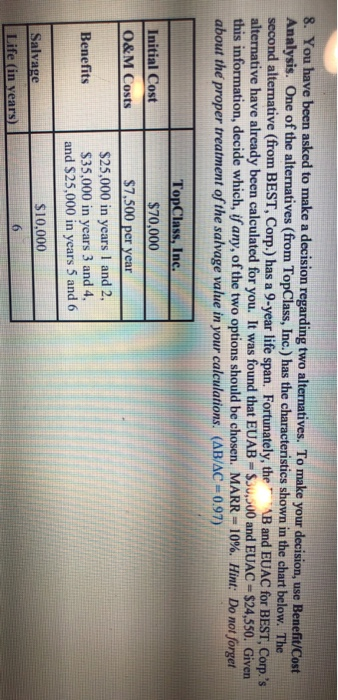

8. You have been asked to make a decision regarding two alternatives. To make your decision, use Benefit Cost Analysis. One of the alternatives (from TopClass, Inc.) has the characteristics shown in the chart below. The second alternative (from BEST, Corp.) has a 9-year life span. Fortunately, the AB and EUAC for BEST, Corp.'s alternative have already been calculated for you. It was found that EUAB - $50.00 and EUAC = $24,550. Given this information, decide which, if any, of the two options should be chosen. MARR = 10%. Hint: Do not forget about the proper treatment of the salvage value in your calculations. (AB/AC =0.97) Initial Cost O&M Costs TopClass, Inc. $70,000 $7,500 per year $25,000 in years 1 and 2, $35,000 in years 3 and 4, and $25,000 in years 5 and 6 Benefits $10,000 Salvage Life (in years) 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts