Question: 8. You have been asked to make a decision regarding two alternatives. To make your decision, use Benefit/Cost Analysis. One of the alternatives (from TopClass,

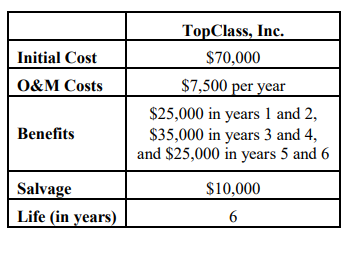

8. You have been asked to make a decision regarding two alternatives. To make your decision, use Benefit/Cost Analysis. One of the alternatives (from TopClass, Inc.) has the characteristics shown in the chart below. The second alternative (from BEST, Corp.) has a 9-year life span. Fortunately, the EUAB and EUAC for BEST, Corp.s alternative have already been calculated for you. It was found that EUAB = $30,500 and EUAC = $24,550. Given this information, decide which, if any, of the two options should be chosen. MARR = 10%. Hint: Do not forget about the proper treatment of the salvage value in your calculations. (B/C = 0.97)

\begin{tabular}{|l|c|} \hline & TopClass, Inc. \\ \hline Initial Cost & $70,000 \\ \hline O\&M Costs & $7,500 per year \\ \hline Benefits & $25,000 in years 1 and 2, $35,000 in years 3 and 4, and $25,000 in years 5 and 6 \\ \hline Salvage & $10,000 \\ \hline Life (in years) & 6 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts