Question: 8. Your firm is considering two mutually exclusive projects, code-named X and Y, that would each require an initial cash outflow of $10,000. They would

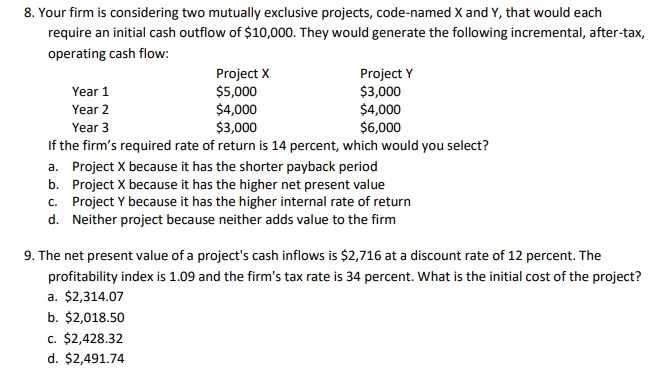

8. Your firm is considering two mutually exclusive projects, code-named X and Y, that would each require an initial cash outflow of $10,000. They would generate the following incremental, after-tax, operating cash flow: Project x Project Y Year 1 $5,000 $3,000 Year 2 $4,000 $4,000 Year 3 $3,000 $6,000 If the firm's required rate of return is 14 percent, which would you select? a. Project X because it has the shorter payback period b. Project X because it has the higher net present value C. Project Y because it has the higher internal rate of return d. Neither project because neither adds value to the firm 9. The net present value of a project's cash inflows is $2,716 at a discount rate of 12 percent. The profitability index is 1.09 and the firm's tax rate is 34 percent. What is the initial cost of the project? a. $2,314.07 b. $2,018.50 C. $2,428.32 d. $2,491.74

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts