Question: A mining company is deciding whether to open a strip mine, which costs $2.5 million. Cash inflows of $12.5 million would occur at the end

A mining company is deciding whether to open a strip mine, which costs $2.5 million. Cash inflows of $12.5 million would occur at the end of Year 1. The land must be returned to its natural state at a cost of $11 million, payable at the end of Year 2.

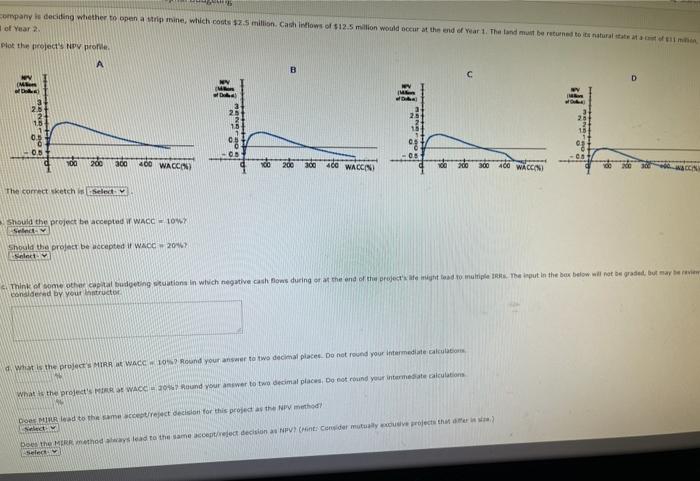

- Plot the project's NPV profile. The correct sketch is -Select-ABCDItem 1 .

- Should the project be accepted if WACC = 10%? -Select-YesNoItem 2 Should the project be accepted if WACC = 20%? -Select-YesNoItem 3

- Think of some other capital budgeting situations in which negative cash flows during or at the end of the project's life might lead to multiple IRRs. The input in the box below will not be graded, but may be reviewed and considered by your instructor.

- What is the project's MIRR at WACC = 10%? Round your answer to two decimal places. Do not round your intermediate calculations. % What is the project's MIRR at WACC = 20%? Round your answer to two decimal places. Do not round your intermediate calculations. % Does MIRR lead to the same accept/reject decision for this project as the NPV method? -Select-YesNoItem 7 Does the MIRR method always lead to the same accept/reject decision as NPV? (Hint: Consider mutually exclusive projects that differ in size.) -Select-YesNoItem 8

A firm is considering two mutually exclusive projects, X and Y, with the following cash flows:

| 0 | 1 | 2 | 3 | 4 |

| Project X | -$1,000 | $90 | $320 | $370 | $650 |

| Project Y | -$1,000 | $1,000 | $90 | $50 | $55 |

The projects are equally risky, and their WACC is 13%. What is the MIRR of the project that maximizes shareholder value? Round your answer to two decimal places. Do not round your intermediate calculations.

company is deciding whether to open a strip mine, which costs $2.5 million. Cashines of $12.5 million would occur at the end of year. The land must be returned to naturalem of Year 2 plot the project's NP probe A B C 2 4 08 OS 05 -08 ya 200 300 400 WACCO 100 200 300 400 WACC) 100 300 400 WACAN The correct sketch Select Should the project be accepted WACC - 10W SV Should the project be accepted i WACC 2017 Shoc Think of some other capital budgeting situation in which negative cash flows during at the end of the projected to multiple. The input in the box below will not be graded but may considered by your intructor d. What is the projects MIRRWACC w 10. Round your answer to two decimal places. Do not round your intermediate action What the projects MARSEWACC 20 Round your answer to two decimal places, Do not round your intermediate calculations Does MR lead to the same preject decision for this project as the method Does the MERRathod way lead to the same accepter decision NV?Hint: Cinder med that elect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts