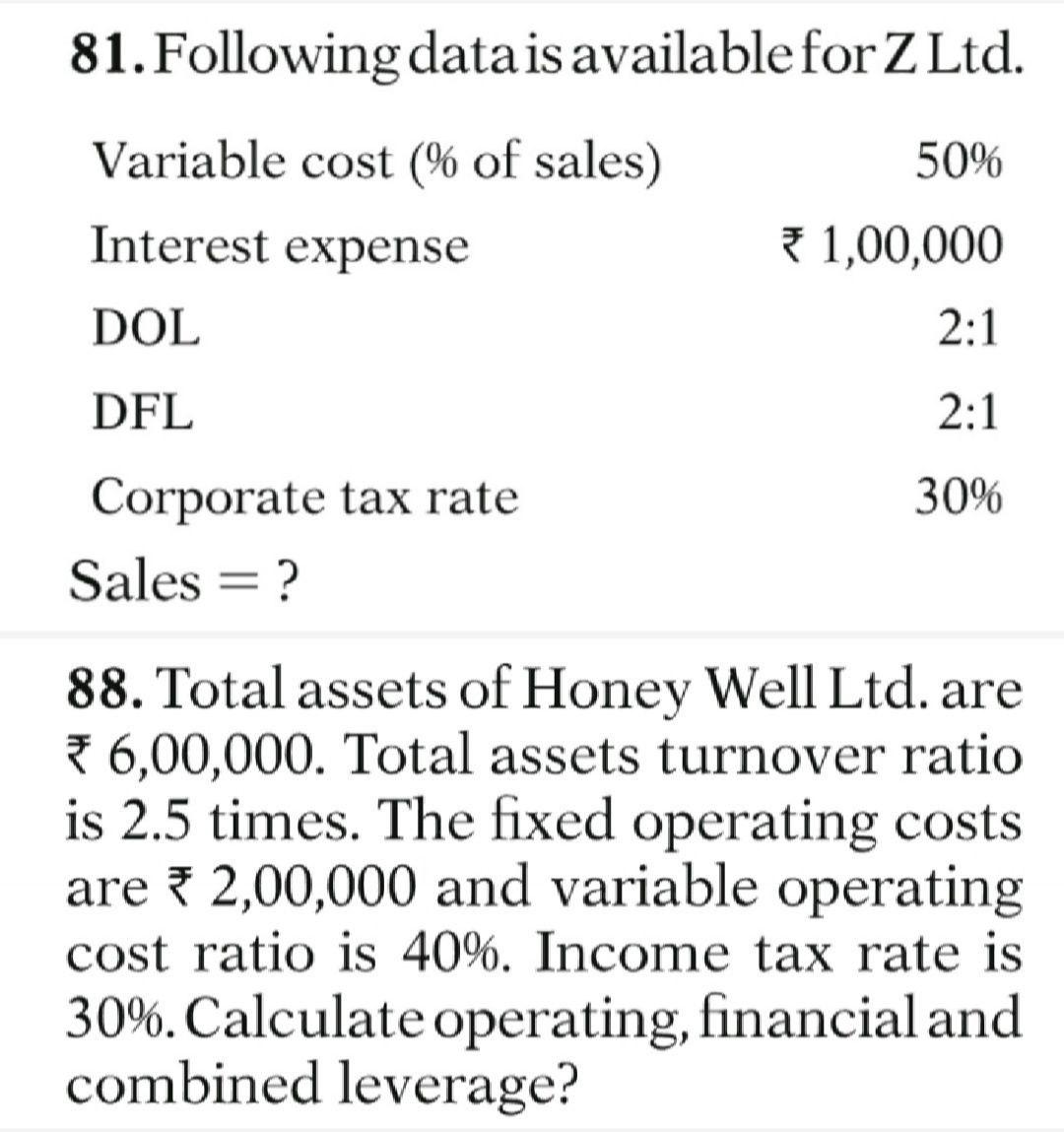

Question: 81. Following data is available for Z Ltd. Variable cost (% of sales) 50% Interest expense 1,00,000 DOL 2:1 DFL 2:1 30% Corporate tax rate

81. Following data is available for Z Ltd. Variable cost (% of sales) 50% Interest expense 1,00,000 DOL 2:1 DFL 2:1 30% Corporate tax rate Sales = ? 88. Total assets of Honey Well Ltd. are * 6,00,000. Total assets turnover ratio is 2.5 times. The fixed operating costs are 2,00,000 and variable operating cost ratio is 40%. Income tax rate is 30%. Calculate operating, financial and combined leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts