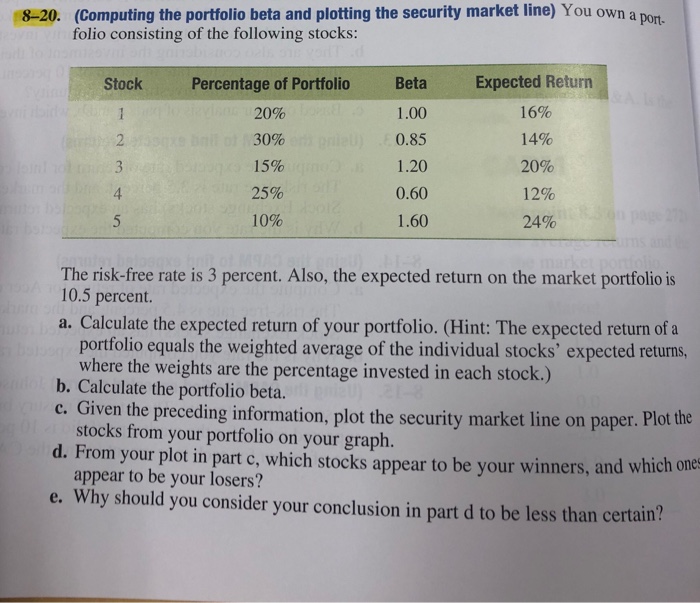

Question: 8-20. (Computing the portfolio beta and plotting the security market line) You own a pon. folio consisting of the following stocks: Expected Return 16% 14%

8-20. (Computing the portfolio beta and plotting the security market line) You own a pon. folio consisting of the following stocks: Expected Return 16% 14% 20% 12% 24% Stock Percemtage af Pornfol Beta pet 20% 30% 15% 25% 10% 1.00 0.85 1.20 0.60 1.60 4 The risk-free rate is 3 percent. Also, the expected return on the market portfolio is 10.5 percent. a. Calculate the expected return of your portfolio. (Hint: The expected return of a portfolio equals the weighted average of the individual stocks' expected returns, where the weights are the percentage invested in each stock.) stocks from your portfolio on your graph. appear to be your losers? b. Calculate the portfolio beta. c. Given the preceding information, plot the security market line on paper. Plot the d. From your plot in part c, which stocks appear to be your winners, and wh e. Why should you consider your conclusion in part d to be less than certain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts