Question: 84) A project that is very sensitive to the selection of a discount rate will have a steep net present value profile. 84) 85) The

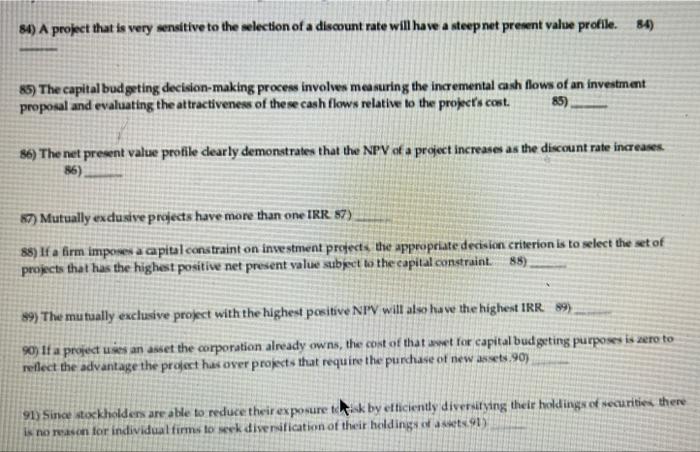

84) A project that is very sensitive to the selection of a discount rate will have a steep net present value profile. 84) 85) The capital budgeting decision-making process involves measuring the incremental cash flows of an investment proposal and evaluating the attractiveness of these cash flows relative to the project's cost. 85) 86) The net present value profile dearly demonstrates that the NPV of a project increases as the discount rate increases 86) 17) Mutually excusive projects have more than one IRR. 57) 88) If a firm imposes a capital constraint on investment projects the appropriate decision criterion is to select the set of projects that has the highest positive net present value subject to the capital constraint. 85) 99) The mutually exclusive project with the highest positive NIV will also have the highest IRR 69 90) If a project uses an awet the corporation already owns, the cost of that awet for capital budgeting purposes is zero to reflect the advantage the project has over projects that require the purchase of new assets.90) 91) Since stockholders are able to reduce their exposure tik by etticiently diversifying their holdings of securities there is no reason for individual firms to seek disentication of their holdingseid asets 91)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts