Question: 86% 20:02 Read Only - You can't save changes to t... 3. Which of the following items would not be trading stock under $70-10? (i)

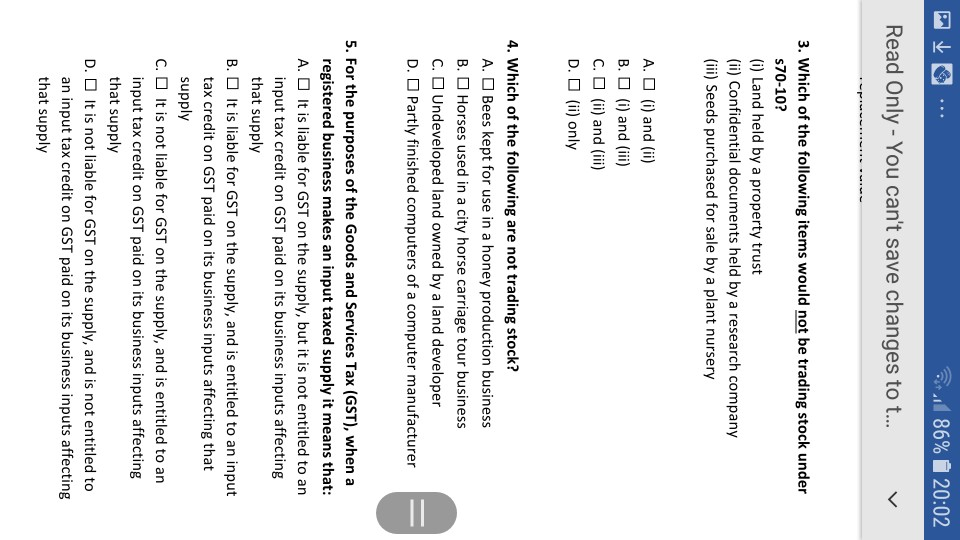

86% 20:02 Read Only - You can't save changes to t... 3. Which of the following items would not be trading stock under $70-10? (i) Land held by a property trust (ii) Confidential documents held by a research company (iii) Seeds purchased for sale by a plant nursery A. (i) and (ii) B. (i) and (iii) C. (ii) and (iii) D. (ii) only 4. Which of the following are not trading stock? A. O Bees kept for use in a honey production business B. O Horses used in a city horse carriage tour business C. O Undeveloped land owned by a land developer D. O Partly finished computers of a computer manufacturer = 5. For the purposes of the Goods and Services Tax (GST), when a registered business makes an input taxed supply it means that: A. It is liable for GST on the supply, but it is not entitled to an input tax credit on GST paid on its business inputs affecting that supply B. O It is liable for GST on the supply, and is entitled to an input tax credit on GST paid on its business inputs affecting that supply C. O It is not liable for GST on the supply, and is entitled to an input tax credit on GST paid on its business inputs affecting that supply D. It is not liable for GST on the supply, and is not entitled to an input tax credit on GST paid on its business inputs affecting that supply

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts