Question: People Tab Window Help * [3] US Sun 4:27 PM CengageNOWV2 Online teac x G what is non current liabilities - x + takeAssignment/takeAssignmentMain.do?inprogress=true Exercise

![People Tab Window Help * [3] US Sun 4:27 PM CengageNOWV2](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6a5c120149_74466e6a5c073e9c.jpg)

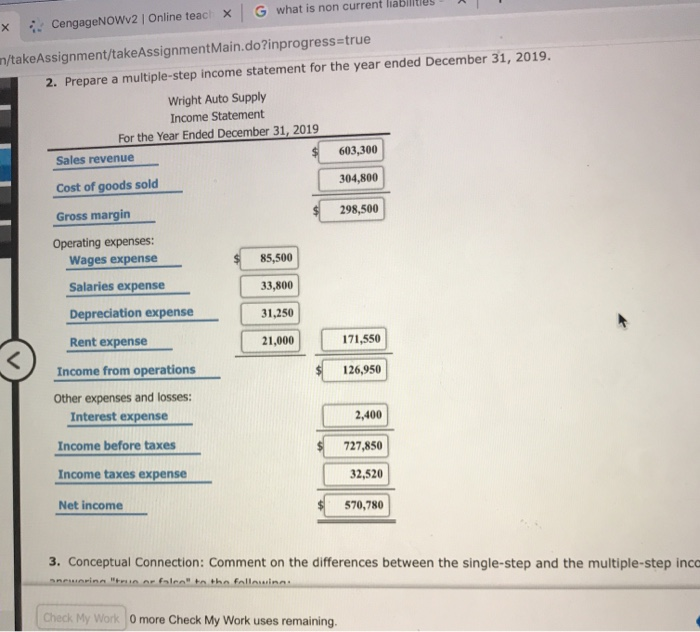

People Tab Window Help * [3] US Sun 4:27 PM CengageNOWV2 Online teac x G what is non current liabilities - x + takeAssignment/takeAssignmentMain.do?inprogress=true Exercise 1-48 (Algorithmic) Income Statement The following information is available for Wright Auto Supply at December 31, 2019. Cost of goods sold $304,800 Rent expense Depreciation expense 31,250 Salaries (administrative) Income taxes expense 32,520 Sales revenue Interest expense 2,400 Wages expense (salespeople) Required: $21,000 33,800 603,300 85,500 1. Prepare a single-step income statement for the year ended December 31, 2019. Wright Auto Supply Income Statement For the Year Ended December 31, 2019 Revenues: Sales revenue $ 603,300 Expenses: Cost of goods sold 304,800 Wages expense 85.500 Salaries expense 33,800 Depreciation expense 31,250 Rent expense 21,000 Check My Work Omore Check My Work uses remaining.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts