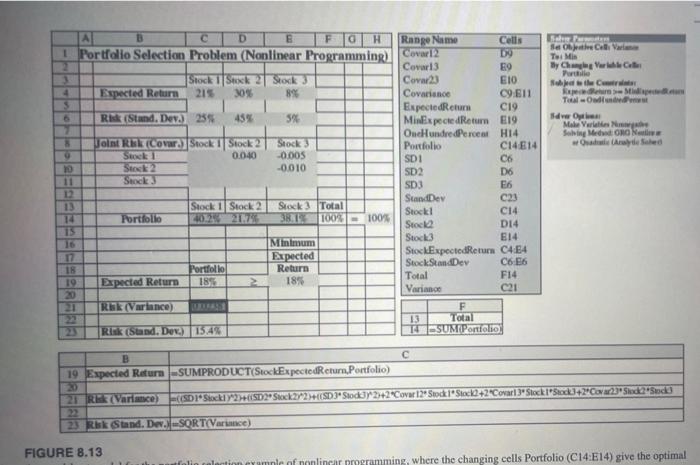

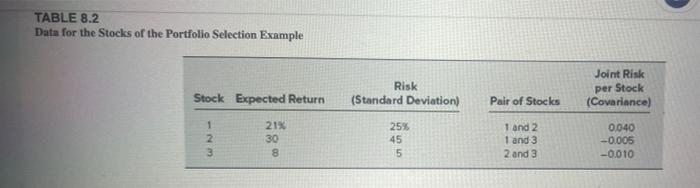

Question: 8.6. Reconsider the portfolio selection example, including its spreadsheet model in Figure 8.13. given in Section 8.2. Note in Table 8.2 that Stock2the highest expected

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock