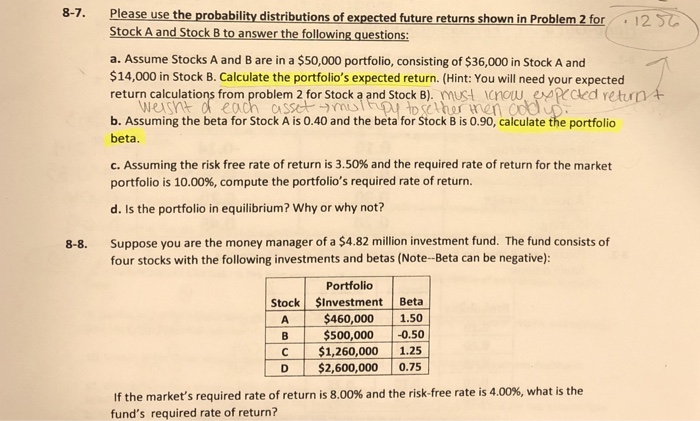

Question: 87. Please use theprobability distributions ofexpectedfuturereturnsshownin Problem2for Stock A and Stock B to answer the following questions a. Assume Stocks A and B are in

87. Please use theprobability distributions ofexpectedfuturereturnsshownin Problem2for Stock A and Stock B to answer the following questions a. Assume Stocks A and B are in a $50,000 portfolio, consisting of $36,000 in Stock A and $14,000 in Stock B. Calculate the portfolio's expected return. (Hint: You will need your expected return calculations from problem 2 for Stock a and Stock B) mUst noweed etrn b. Assuming the beta for Stock A is 0.40 and the beta for Stock B is 0.90, calculate the portfolio beta. '12 er n C. Assuming the risk free rate of return is 3.50% and the required rate of return for the market portfolio is 10.00%, compute the portfolio's required rate of return. d. Is the portfolio in equilibrium? Why or why not? Suppose you are the money manager of a $4.82 million investment fund. The fund consists of four stocks with the following investments and betas (Note-Beta can be negative): 8-8. Portfolio Stock SInvestment Beta A $460,000 1.50 B $500,000 0.50 C$1,260,000 1.25 D $2,600,000 0.75 If the market's required rate of return is 8.00% and the risk-free rate is 4.00%, what is the fund's required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts