Question: Please complete. I will rate, thanks! 5. Please read the case titled Term Sheet Negotiations for Trendsetter, Inc. to answer the following questions. In the

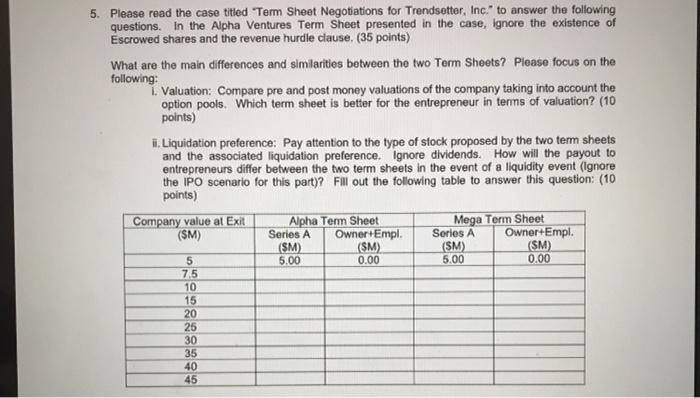

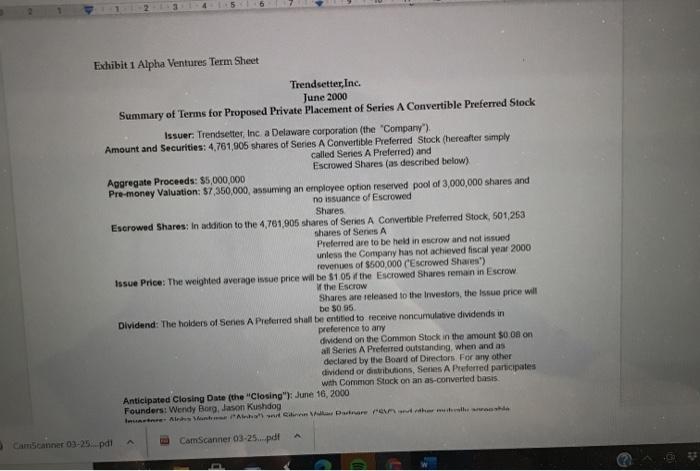

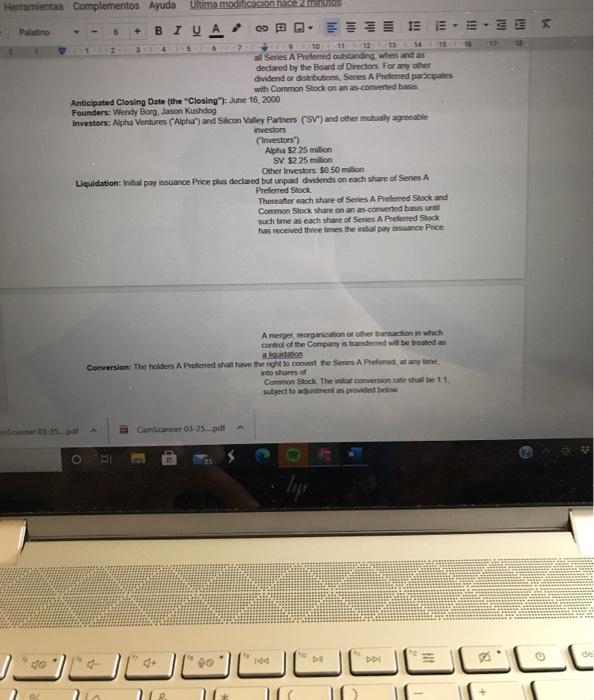

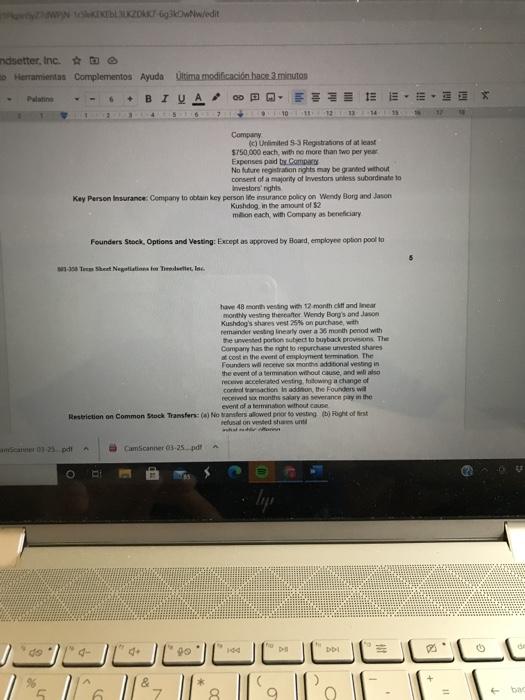

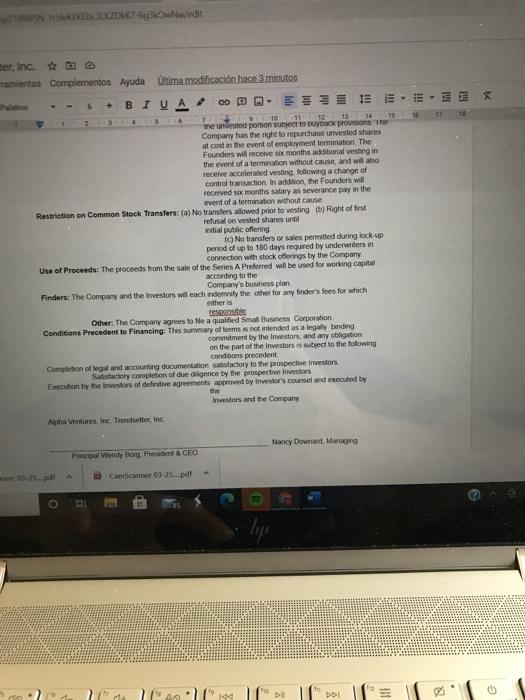

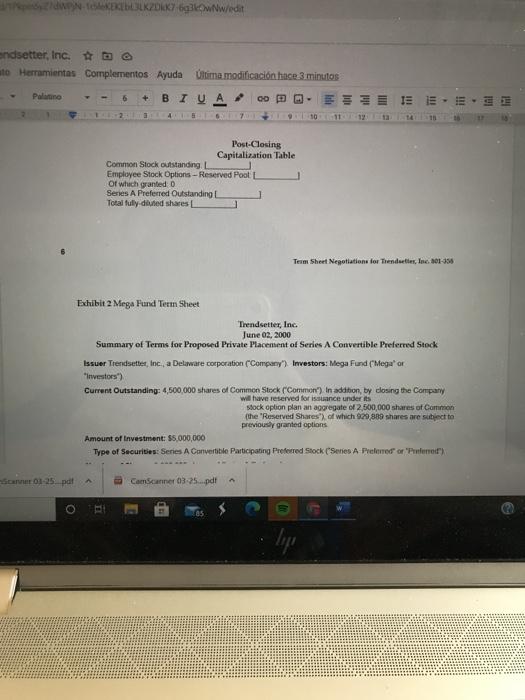

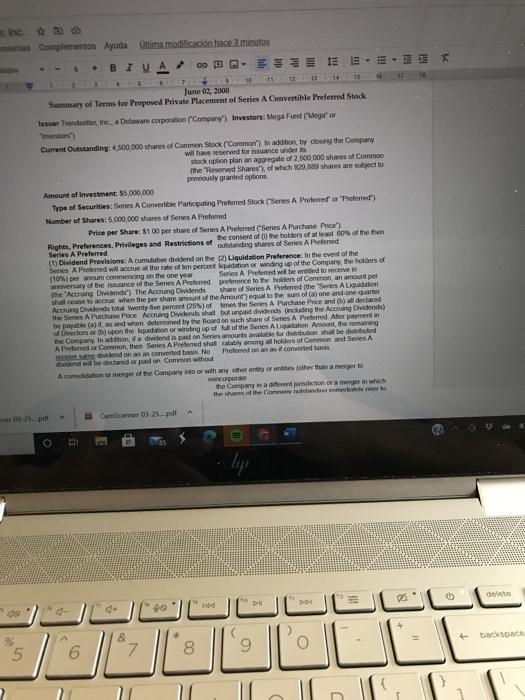

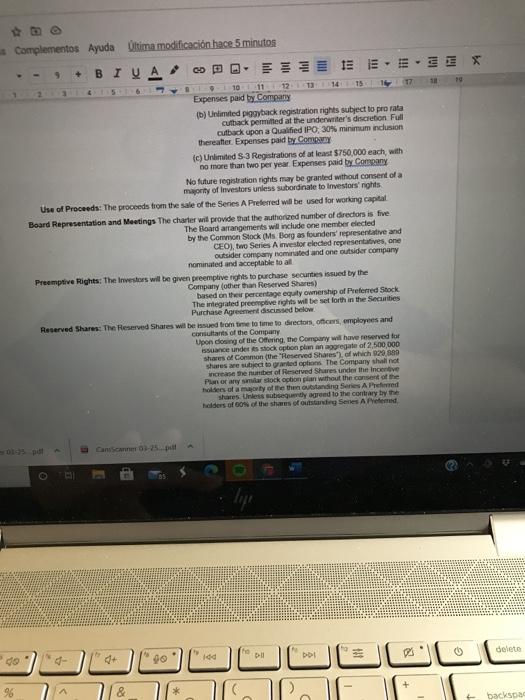

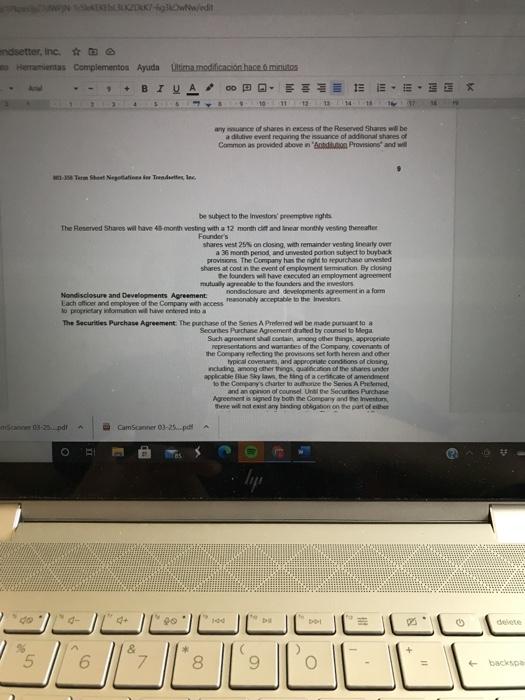

5. Please read the case titled Term Sheet Negotiations for Trendsetter, Inc." to answer the following questions. In the Alpha Ventures Term Sheet presented in the case, Ignore the existence of Escrowed shares and the revenue hurdle clause (35 points) What are the main differences and similarities between the two Term Sheets? Please focus on the following: 1. Valuation: Compare pre and post money valuations of the company taking into account the option pools. Which term sheet is better for the entrepreneur in terms of valuation? (10 points) i. Liquidation preference: Pay attention to the type of stock proposed by the two term sheets and the associated liquidation preference. Ignore dividends. How will the payout to entrepreneurs differ between the two term sheets in the event of a liquidity event (Ignore the IPO scenario for this party? Fill out the following table to answer this question: (10 points) Company value at Exit Alpha Ter Sheet Mega Term Sheet (SM) Series A Owner+Empl. Sories A Owner+Empl. ($M) (SM) (SM) (SM) 5.00 5.00 0.00 7,5 10 15 20 25 30 35 40 45 5 0.00 Abrir con Documentos de Google 50 60 100 200 500 Hi. Vesting and Employment terms (5 points) iv. Anti-dilution: Calculate the following numerical example based on the Mega Term sheet as presented in the Trendsetter case. Assume that $3M are raised at a share price of $0.5 per share in Series B (second round of funding). We already know that $5M were raised in Series A (first round of funding) at a price of $1 per share. The series A pre money valuation is $7M for a post money of $12M. The post Series A ownership structure looks as follows: Common Stock (founders & management) 7,000,000 shares 58.3% Series A 5,000,000 shares 41.7% Series B None 0.0% Total 12,000,000 shares 100% Please calculate the post Series B ownership structure in a format similar to the above under the following three scenarios: 1. No antidilution protection for Series A shareholders. (2 points) li. Full ratchet antidilution protection for Series A shareholders. (4 points) Ill. Weighted average antidilution protection for Series A shareholders. (4 points) 11 12 13 14 15 15 Term Sheet Negotiations for Trendsetter, Inc. Wendy Borg and Jason Kushdog had some big decisions to make on this muggy June 30, 2000. And probably for the first time since the founding of their company in March 2000 they were entirely uncertain what to do. They were the CEO and COO, respectively and co-Founders of Trendsetter, Inc., a software start-up that would provide innovative warehouse and distribution solutions for clothing retailers. The software would contain a demand forecasting module that was better than anything else in the industry. The entrepreneurs expected that their software would do for fashion retailing what the spreadsheet had done for accounting - not a small feat. The two had been meeting with several venture capital firms (VCs) and had just received offering documents known as term sheets from two of the VCs: Alpha Ventures and Mega Fund (see Exhibits 1 and 2). With neither having any experience in raising capital from venture investors, Borg and Kushdog were not sure where to begin evaluating each proposal let alone deciding upon which one to take. "This is all very confusing." lamented Kushdog, and scary as well. We are running out of the seed money that we have both contributed to the venture so we need to act fast." Kushdog estimated that Trendsetter, Inc. had about six more weeks of cash to bum. As the two sat across from each other for lunch at one of the tables of their "corporate dining room" (a local Weston restaurant called Ye Olde Cottage), they knew they should get a grasp of the relative merits of each proposal before they were finished with the day. The question was where to start? Getting It Started: The Background of Trendsetter, Inc. Wendy Borg had many years of experience as a supply chain management consultant and worked with many fashion retailers in the past. It was in this capacity that she and Jason Kushdog had met while she was working on an assignment. Kushdog had been the head buyer for Livin' Large (LL.), a bricks-and-mortar retailer of specialty fashion clothing for big and tall people. The two had worked with each other for a number of years and each individually had a desire to start his own business One nicht while working late on a proiect for LL. Kushdo revealed to Bore his desire to start his own 03.2di CamSranar 2.5 ili IAE 15 experience in raising capital from venture investors, Borg and Kushdog were not sure where to begin evaluating each proposal let alone deciding upon which one to take. This is all very confusing. lamented Kushdog, and scary as well. We are running out of the seed money that we have both contributed to the venture so we need to act fast." Kushdog estimated that Trendsetter, Inc had about six more weeks of cash to bum. As the two sat across from each other for lunch at one of the tables at their corporate dining room" (a local Weston restaurant called Ye Olde Cottage) they knew they should get a grasp of the relative merits of each proposal before they were finished with the day. The question was where to start? Getting It Started: The Background of Trendsetter, Inc. Wendy Borg had many years of experience as a supply chain management consultant and worked with many fashion retailers in the past. It was in this capacity that she and Jason Kushdog had met while she was working on an assignment. Kushdog had been the head buyes for Livin' Large (LL),a bricks-and-mortar retailer of specialty fashion clothing for big and tall people. The two had worked with each other for a number of years and each individually had a desire to start his own business. One night while working late on a project for L1, Kushdog revealed to Borg his desire to start his own company. It just so happens that Borg had been working on an idea for a warehouse and distribution management software program for retailers and Borg suggested to Kushdog that the two start the company together. After thinking it over, Kushdog agreed to work with Borg and the two quit their jobs to start Trendsetter Dearow With Coah O) corde permet de Web de Goes terred to deal de wecharges are solen Hill Ady GAA S M DE ARCO on the Camicin 03-25 pidi Can Scanner 03-25.pdf . lip 14 100 + Test nam. Palatino U 12 13 15 16 3 15 At first, the two operated with their own capital but knowing very well that they would need to raise outside money. Borg explained. This type of sottware solution will take a lot of money to develop. Also, we needed a partner firm for the development phase. Luckily, I was able to get a former dient Waldo, a major fashion retailer, to commit to work with us while we were developing the product. Although we hadn't signed any contracts yet. I had a good relationship with the CEO and I was promised that we would get a signed agreement from them once we got funding. That's why we approached the VC Borg and Kushdog were no fools and knew that most top-tier venture capitalists received more than 2,000 unsolicited business plans per year. In most of these venture capital firms all 2000 plans made it straight into the garbage can - without receiving any consideration Experience had shown VCs that it was not worth their time to look for needles in a haystack. Rather, VCs focused on plans that came with recommendations and endorsements (from other VCs, entrepreneurs whom the VC bud previously backed, investors in the VC'fund and from other friends. Fortunately, Borg and Kushdog knew two insiders who were well-connected in the venture capital community. "Our friends got us in the door at several firms," Kushdog recalled, "Once a first meeting had been arranged we knew that the ball had been teed up for us and we needed to hit it. We knew that we were on to something when our first meeting with a VC that was originally scheduled for 30 minutes ended up lasting 2 hours--and the VC did not complain." Borg and Kushdog received a lot of interest from the VC community. They presented to seven VC And six of them really liked the plan and the team that was in place. The process of meetings and presentations took almost two months, however. This was longer than the entrepreneurs had expected. So it was a real relief for the two when they finally received term sheets from the VGs they wanted the most: Alpha Ventures and Mega Fund. Both funds were top tier VCs and had a lot of experience in retail and software. Plus the chemistry with both firms seemed good. Borg explained: With Mega everything went smoothly. Alpha I think really liked our idea but was pretty skeptical about our ability to get a five star dient like Waldo on board early. As a result they really liked us but wanted to invest at a lower valuation than other Vs because they did not 14 11 10 or Trendsetter, Inc. O Formato Herramientas Complementos Ayuda ltima modificacin hace unos segundos Palatino 6 + BIVAO 5 6 7 9 15 16 minutes ended up lasting 2 hours and the VC did not complain Borg and Kushdog received a lot of interest from the VC community. They presented to seven Vs. And six of them really liked the plan and the team that was in place. The process of meetings and presentations took almost two months, however. This was longer than the entrepreneurs had expected. So it was a real relief for the two when they finally received term sheets from the VCs they wanted the most: Alpha Ventures and Mega Fund. Both funds were top tier VCs and had a lot of experience in retail and software. Plus the chemistry with both firms seemned good. Borg explained: With Mega everything went smoothly. Alpha I think really liked our idea but was pretty skeptical about our ability to get a five-star client like Waldo on board early. As a result they really liked us but wanted to invest at a lower valuation than other VCs because they did not think we could book $500,000 in revenues in the first year. After a lot of talking they came around and made a fair offer. Since Borg and Kushdog thought that both VC firms, Alpha Ventures and Mega, were an equally good fit it would come down to who gave Trendsetter a better offer. Neither of the entrepreneurs had any experience in analyzing term sheets and although the top-line valuations from both VC firms were not that different the entrepreneurs knew that they had to be very careful when comparing covenants in both term sheets. "I don't like lawyers but I think we need one, now," said Kushdog as they left the restaurant. "I agree," replied Borg "but wouldn't it be reassuring if we could figure this out on our own first?" Exhibit 1 Alpha Ventures Term Sheet Trendsetter, Inc. June 2000 Summary of Terms for Proposed Private Placement of Series A Convertible Preferred Stock Issuer: Trendsetter Inc a Delaware corporation (the "Company") Amount and Securities: 4,761,905 shares of Series A Convertible Preferred Stock (hereafter simply called Series A Preferred) and Escrowed Shares (as described below) Aggregate Proceeds: $5,000,000 Pre-money Valuation: 7,350,000, assuming an employee option reserved pool of 3,000,000 shares and no issuance of Escrowed Shares Escrowed Shares: In addition to the 4,701,905 shares of Series A Convertible Preferred Stock, 501,263 shares of Series A Preferred are to be held in escrow and not issued unless the Company has not achieved fiscal year 2000 revenues of $500,000 ('Escrowed Shares") Issue Price: The weighted average issue price will be $1.05 the Escrowed Shares remain in Escrow the Escrow Shares are released to the investors, the issue price will be SO 55 Dividend: The holders of Series A Preferred shall be entitled to receive noncumulative dividends in preference to any dividend on the Common Stock in the amount $0 08 on all Series A Preferred outstanding, when and as declared by the Board of Directors For any other dividend or distributions Series A Preferred participates with Common Stock on an as-converted basis Anticipated Closing Date (the "Closing"): June 16, 2000 Founders: Wendy Borg, Jason Kushdog Im Ali Dar es CamScanner 03-25 pdl CamScanner 03-25....pdf tter, Inc. $ erramientas Complementos Ayuda ltima modificacin hace 2 minutos Iml = =, Palatino + BIU A 18 12 13 14 151612 10 11 5 2 6 7 A merger, reorganization or other transaction in which control of the Company is transferred will be treated as a liquidation Conversion: The holders A Preferred shall have the night to convert the Series A Preferred at any time, into shares of Common Stock. The initial conversion rate shall be 1.1, subject to adjustment as provided below. 3 301-355 Teres Sheet Negotiations for Trendsetter, Inc. Automatic Conversion: The Series A Preferred shall be automatically converted into Common Stock, at the then applicable conversion price, (i) in the event that the holders of at least a majority of the outstanding Series A Preferred consent to such conversion or (i) upon the closing of a firmly underwritten public offering of shares of Common Stock of the Company at a per share price not less than $500 per share and for a total offering of not less than $15 million (before deduction of underwriters commissions an expenses) (a "Qualified IPO") Antidilution Provisions: The Series A Preferred shall have broad based weighted average antidilution protection on issuances of shares. No adjustment will be made for the issuance of up to 3,000,000 shares of Common Stock (or any Scanner 03-25.pdt CamScanner 03-25....pdf 53) WN 15XXELUK ZDKK7-693koww/edit rendsetter, Inc. mato Herramientas Complementos Ayuda Ultima modificacin hace 2 minutos Palto 6 BIUA 6 7 1011 12 13 14 of the company at a per share pnce not less than 58.00 per share and for a total offering of not less than $15 million (before deduction of underwriters commissions an expenses) (a "Qualified IPO") Antidilution Provisions: The Series A Preferred shall have broad-based weighted average anticlution protection on issuances of shares No adjustment will be made for the issuance of up to 3,000,000 shares of Common Stock (or any options for Common Stock) to employees, directors or consultants pursuant to board-approved equity incentive plans Voting Rights: Series A Preferred votes on an as converted basis, but also has dass vote as provided by law. Also, approval of at least 60% of Series A Preferred is required for) the creation or issuance of any senior of pari passu security, an increase in the number of authorized shares of Preferred Stock, () any adverse change to the rights, preferences and privileges of the Preferred Stock (lv) an increase in the sure of the Board of Directors, (M) repurchase of Common Stock except upon termination of employment, (i) repurchase or redemption of any Preferred Stock (except pursuant to redemption provisions of Articles): (v) any transaction in which control of the Company is transferred (m) any amendment to the Bylaws or Articles of Incorporation (c) any dividend or distribution on capital stock of the Company, and any sale, pledge, license or transfer of all or substantially all of the Company's assets Representations and Warranties: Standard representations and warranties from the Company Nondisclosure and Development Agreements: information and inventions agreement in a form Each officer, employee and consultant of the acceptable to the Investors Company will have entered into a proprietary Right of First Refusal: The Investors shall have a pro rata night, based on the percentage equity ownership of Preferred Stock to participate in subsequent equity financings of the Company If any shareholder of Common stock (or equivalents) wants to sell shares he must offer them CamScanner 03-25 pdt CamScanner 03-25 pdf backs 5. Please read the case titled Term Sheet Negotiations for Trendsetter, Inc." to answer the following questions. In the Alpha Ventures Term Sheet presented in the case, Ignore the existence of Escrowed shares and the revenue hurdle clause (35 points) What are the main differences and similarities between the two Term Sheets? Please focus on the following: 1. Valuation: Compare pre and post money valuations of the company taking into account the option pools. Which term sheet is better for the entrepreneur in terms of valuation? (10 points) i. Liquidation preference: Pay attention to the type of stock proposed by the two term sheets and the associated liquidation preference. Ignore dividends. How will the payout to entrepreneurs differ between the two term sheets in the event of a liquidity event (Ignore the IPO scenario for this party? Fill out the following table to answer this question: (10 points) Company value at Exit Alpha Ter Sheet Mega Term Sheet (SM) Series A Owner+Empl. Sories A Owner+Empl. ($M) (SM) (SM) (SM) 5.00 5.00 0.00 7,5 10 15 20 25 30 35 40 45 5 0.00 Abrir con Documentos de Google 50 60 100 200 500 Hi. Vesting and Employment terms (5 points) iv. Anti-dilution: Calculate the following numerical example based on the Mega Term sheet as presented in the Trendsetter case. Assume that $3M are raised at a share price of $0.5 per share in Series B (second round of funding). We already know that $5M were raised in Series A (first round of funding) at a price of $1 per share. The series A pre money valuation is $7M for a post money of $12M. The post Series A ownership structure looks as follows: Common Stock (founders & management) 7,000,000 shares 58.3% Series A 5,000,000 shares 41.7% Series B None 0.0% Total 12,000,000 shares 100% Please calculate the post Series B ownership structure in a format similar to the above under the following three scenarios: 1. No antidilution protection for Series A shareholders. (2 points) li. Full ratchet antidilution protection for Series A shareholders. (4 points) Ill. Weighted average antidilution protection for Series A shareholders. (4 points) 11 12 13 14 15 15 Term Sheet Negotiations for Trendsetter, Inc. Wendy Borg and Jason Kushdog had some big decisions to make on this muggy June 30, 2000. And probably for the first time since the founding of their company in March 2000 they were entirely uncertain what to do. They were the CEO and COO, respectively and co-Founders of Trendsetter, Inc., a software start-up that would provide innovative warehouse and distribution solutions for clothing retailers. The software would contain a demand forecasting module that was better than anything else in the industry. The entrepreneurs expected that their software would do for fashion retailing what the spreadsheet had done for accounting - not a small feat. The two had been meeting with several venture capital firms (VCs) and had just received offering documents known as term sheets from two of the VCs: Alpha Ventures and Mega Fund (see Exhibits 1 and 2). With neither having any experience in raising capital from venture investors, Borg and Kushdog were not sure where to begin evaluating each proposal let alone deciding upon which one to take. "This is all very confusing." lamented Kushdog, and scary as well. We are running out of the seed money that we have both contributed to the venture so we need to act fast." Kushdog estimated that Trendsetter, Inc. had about six more weeks of cash to bum. As the two sat across from each other for lunch at one of the tables of their "corporate dining room" (a local Weston restaurant called Ye Olde Cottage), they knew they should get a grasp of the relative merits of each proposal before they were finished with the day. The question was where to start? Getting It Started: The Background of Trendsetter, Inc. Wendy Borg had many years of experience as a supply chain management consultant and worked with many fashion retailers in the past. It was in this capacity that she and Jason Kushdog had met while she was working on an assignment. Kushdog had been the head buyer for Livin' Large (LL.), a bricks-and-mortar retailer of specialty fashion clothing for big and tall people. The two had worked with each other for a number of years and each individually had a desire to start his own business One nicht while working late on a proiect for LL. Kushdo revealed to Bore his desire to start his own 03.2di CamSranar 2.5 ili IAE 15 experience in raising capital from venture investors, Borg and Kushdog were not sure where to begin evaluating each proposal let alone deciding upon which one to take. This is all very confusing. lamented Kushdog, and scary as well. We are running out of the seed money that we have both contributed to the venture so we need to act fast." Kushdog estimated that Trendsetter, Inc had about six more weeks of cash to bum. As the two sat across from each other for lunch at one of the tables at their corporate dining room" (a local Weston restaurant called Ye Olde Cottage) they knew they should get a grasp of the relative merits of each proposal before they were finished with the day. The question was where to start? Getting It Started: The Background of Trendsetter, Inc. Wendy Borg had many years of experience as a supply chain management consultant and worked with many fashion retailers in the past. It was in this capacity that she and Jason Kushdog had met while she was working on an assignment. Kushdog had been the head buyes for Livin' Large (LL),a bricks-and-mortar retailer of specialty fashion clothing for big and tall people. The two had worked with each other for a number of years and each individually had a desire to start his own business. One night while working late on a project for L1, Kushdog revealed to Borg his desire to start his own company. It just so happens that Borg had been working on an idea for a warehouse and distribution management software program for retailers and Borg suggested to Kushdog that the two start the company together. After thinking it over, Kushdog agreed to work with Borg and the two quit their jobs to start Trendsetter Dearow With Coah O) corde permet de Web de Goes terred to deal de wecharges are solen Hill Ady GAA S M DE ARCO on the Camicin 03-25 pidi Can Scanner 03-25.pdf . lip 14 100 + Test nam. Palatino U 12 13 15 16 3 15 At first, the two operated with their own capital but knowing very well that they would need to raise outside money. Borg explained. This type of sottware solution will take a lot of money to develop. Also, we needed a partner firm for the development phase. Luckily, I was able to get a former dient Waldo, a major fashion retailer, to commit to work with us while we were developing the product. Although we hadn't signed any contracts yet. I had a good relationship with the CEO and I was promised that we would get a signed agreement from them once we got funding. That's why we approached the VC Borg and Kushdog were no fools and knew that most top-tier venture capitalists received more than 2,000 unsolicited business plans per year. In most of these venture capital firms all 2000 plans made it straight into the garbage can - without receiving any consideration Experience had shown VCs that it was not worth their time to look for needles in a haystack. Rather, VCs focused on plans that came with recommendations and endorsements (from other VCs, entrepreneurs whom the VC bud previously backed, investors in the VC'fund and from other friends. Fortunately, Borg and Kushdog knew two insiders who were well-connected in the venture capital community. "Our friends got us in the door at several firms," Kushdog recalled, "Once a first meeting had been arranged we knew that the ball had been teed up for us and we needed to hit it. We knew that we were on to something when our first meeting with a VC that was originally scheduled for 30 minutes ended up lasting 2 hours--and the VC did not complain." Borg and Kushdog received a lot of interest from the VC community. They presented to seven VC And six of them really liked the plan and the team that was in place. The process of meetings and presentations took almost two months, however. This was longer than the entrepreneurs had expected. So it was a real relief for the two when they finally received term sheets from the VGs they wanted the most: Alpha Ventures and Mega Fund. Both funds were top tier VCs and had a lot of experience in retail and software. Plus the chemistry with both firms seemed good. Borg explained: With Mega everything went smoothly. Alpha I think really liked our idea but was pretty skeptical about our ability to get a five star dient like Waldo on board early. As a result they really liked us but wanted to invest at a lower valuation than other Vs because they did not 14 11 10 or Trendsetter, Inc. O Formato Herramientas Complementos Ayuda ltima modificacin hace unos segundos Palatino 6 + BIVAO 5 6 7 9 15 16 minutes ended up lasting 2 hours and the VC did not complain Borg and Kushdog received a lot of interest from the VC community. They presented to seven Vs. And six of them really liked the plan and the team that was in place. The process of meetings and presentations took almost two months, however. This was longer than the entrepreneurs had expected. So it was a real relief for the two when they finally received term sheets from the VCs they wanted the most: Alpha Ventures and Mega Fund. Both funds were top tier VCs and had a lot of experience in retail and software. Plus the chemistry with both firms seemned good. Borg explained: With Mega everything went smoothly. Alpha I think really liked our idea but was pretty skeptical about our ability to get a five-star client like Waldo on board early. As a result they really liked us but wanted to invest at a lower valuation than other VCs because they did not think we could book $500,000 in revenues in the first year. After a lot of talking they came around and made a fair offer. Since Borg and Kushdog thought that both VC firms, Alpha Ventures and Mega, were an equally good fit it would come down to who gave Trendsetter a better offer. Neither of the entrepreneurs had any experience in analyzing term sheets and although the top-line valuations from both VC firms were not that different the entrepreneurs knew that they had to be very careful when comparing covenants in both term sheets. "I don't like lawyers but I think we need one, now," said Kushdog as they left the restaurant. "I agree," replied Borg "but wouldn't it be reassuring if we could figure this out on our own first?" Exhibit 1 Alpha Ventures Term Sheet Trendsetter, Inc. June 2000 Summary of Terms for Proposed Private Placement of Series A Convertible Preferred Stock Issuer: Trendsetter Inc a Delaware corporation (the "Company") Amount and Securities: 4,761,905 shares of Series A Convertible Preferred Stock (hereafter simply called Series A Preferred) and Escrowed Shares (as described below) Aggregate Proceeds: $5,000,000 Pre-money Valuation: 7,350,000, assuming an employee option reserved pool of 3,000,000 shares and no issuance of Escrowed Shares Escrowed Shares: In addition to the 4,701,905 shares of Series A Convertible Preferred Stock, 501,263 shares of Series A Preferred are to be held in escrow and not issued unless the Company has not achieved fiscal year 2000 revenues of $500,000 ('Escrowed Shares") Issue Price: The weighted average issue price will be $1.05 the Escrowed Shares remain in Escrow the Escrow Shares are released to the investors, the issue price will be SO 55 Dividend: The holders of Series A Preferred shall be entitled to receive noncumulative dividends in preference to any dividend on the Common Stock in the amount $0 08 on all Series A Preferred outstanding, when and as declared by the Board of Directors For any other dividend or distributions Series A Preferred participates with Common Stock on an as-converted basis Anticipated Closing Date (the "Closing"): June 16, 2000 Founders: Wendy Borg, Jason Kushdog Im Ali Dar es CamScanner 03-25 pdl CamScanner 03-25....pdf tter, Inc. $ erramientas Complementos Ayuda ltima modificacin hace 2 minutos Iml = =, Palatino + BIU A 18 12 13 14 151612 10 11 5 2 6 7 A merger, reorganization or other transaction in which control of the Company is transferred will be treated as a liquidation Conversion: The holders A Preferred shall have the night to convert the Series A Preferred at any time, into shares of Common Stock. The initial conversion rate shall be 1.1, subject to adjustment as provided below. 3 301-355 Teres Sheet Negotiations for Trendsetter, Inc. Automatic Conversion: The Series A Preferred shall be automatically converted into Common Stock, at the then applicable conversion price, (i) in the event that the holders of at least a majority of the outstanding Series A Preferred consent to such conversion or (i) upon the closing of a firmly underwritten public offering of shares of Common Stock of the Company at a per share price not less than $500 per share and for a total offering of not less than $15 million (before deduction of underwriters commissions an expenses) (a "Qualified IPO") Antidilution Provisions: The Series A Preferred shall have broad based weighted average antidilution protection on issuances of shares. No adjustment will be made for the issuance of up to 3,000,000 shares of Common Stock (or any Scanner 03-25.pdt CamScanner 03-25....pdf 53) WN 15XXELUK ZDKK7-693koww/edit rendsetter, Inc. mato Herramientas Complementos Ayuda Ultima modificacin hace 2 minutos Palto 6 BIUA 6 7 1011 12 13 14 of the company at a per share pnce not less than 58.00 per share and for a total offering of not less than $15 million (before deduction of underwriters commissions an expenses) (a "Qualified IPO") Antidilution Provisions: The Series A Preferred shall have broad-based weighted average anticlution protection on issuances of shares No adjustment will be made for the issuance of up to 3,000,000 shares of Common Stock (or any options for Common Stock) to employees, directors or consultants pursuant to board-approved equity incentive plans Voting Rights: Series A Preferred votes on an as converted basis, but also has dass vote as provided by law. Also, approval of at least 60% of Series A Preferred is required for) the creation or issuance of any senior of pari passu security, an increase in the number of authorized shares of Preferred Stock, () any adverse change to the rights, preferences and privileges of the Preferred Stock (lv) an increase in the sure of the Board of Directors, (M) repurchase of Common Stock except upon termination of employment, (i) repurchase or redemption of any Preferred Stock (except pursuant to redemption provisions of Articles): (v) any transaction in which control of the Company is transferred (m) any amendment to the Bylaws or Articles of Incorporation (c) any dividend or distribution on capital stock of the Company, and any sale, pledge, license or transfer of all or substantially all of the Company's assets Representations and Warranties: Standard representations and warranties from the Company Nondisclosure and Development Agreements: information and inventions agreement in a form Each officer, employee and consultant of the acceptable to the Investors Company will have entered into a proprietary Right of First Refusal: The Investors shall have a pro rata night, based on the percentage equity ownership of Preferred Stock to participate in subsequent equity financings of the Company If any shareholder of Common stock (or equivalents) wants to sell shares he must offer them CamScanner 03-25 pdt CamScanner 03-25 pdf backs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts