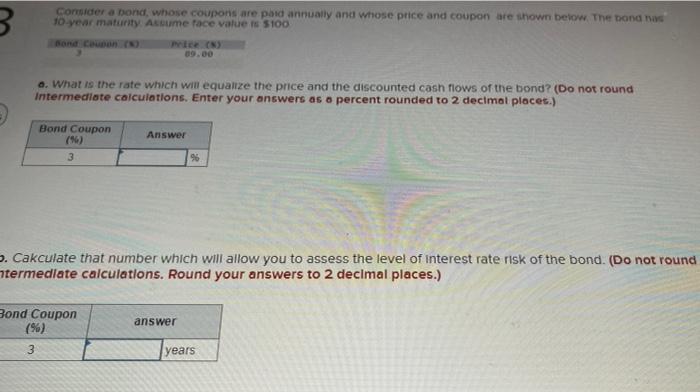

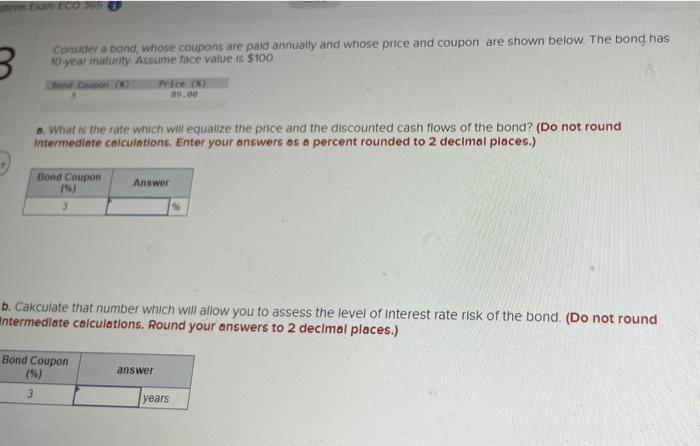

Question: 89 B. Consider a bond, whose coupons are paid annually and whose price and coupon are shown below. The Dond nas 10-year maturity. Acume face

B. Consider a bond, whose coupons are paid annually and whose price and coupon are shown below. The Dond nas 10-year maturity. Acume face value is $100 09.00 a. What is the rate which will equalize the price and the discounted cash flows of the bond? (Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Bond Coupon Answer 3 96 . Cakculate that number which will allow you to assess the level of interest rate risk of the bond. (Do not round termediate calculations. Round your answers to 2 decimal places.) answer Bond Coupon (%) 3 years ECO 300 3 Consider a bond, whose coupons are paid annually and whose price and coupon are shown below. The bond has 10 year maturity. Assume face value is $100 Price (2 0.00 a. What is the rate which will equalize the price and the discounted cash flows of the bond? (Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Bond Coupon Answer 3 b. Cakculate that number which will allow you to assess the level of interest rate risk of the bond. (Do not round Antermediate calculations, Round your answers to 2 decimal places.) Bond Coupon answer 3 years B. Consider a bond, whose coupons are paid annually and whose price and coupon are shown below. The Dond nas 10-year maturity. Acume face value is $100 09.00 a. What is the rate which will equalize the price and the discounted cash flows of the bond? (Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Bond Coupon Answer 3 96 . Cakculate that number which will allow you to assess the level of interest rate risk of the bond. (Do not round termediate calculations. Round your answers to 2 decimal places.) answer Bond Coupon (%) 3 years ECO 300 3 Consider a bond, whose coupons are paid annually and whose price and coupon are shown below. The bond has 10 year maturity. Assume face value is $100 Price (2 0.00 a. What is the rate which will equalize the price and the discounted cash flows of the bond? (Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Bond Coupon Answer 3 b. Cakculate that number which will allow you to assess the level of interest rate risk of the bond. (Do not round Antermediate calculations, Round your answers to 2 decimal places.) Bond Coupon answer 3 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts