Question: Question 5 (29 marks) a. Consider short rate models such as Vasicek or Cox-Ingersoll-Ross. Write down down their dynamics and explain their mean-reversion behavior. In

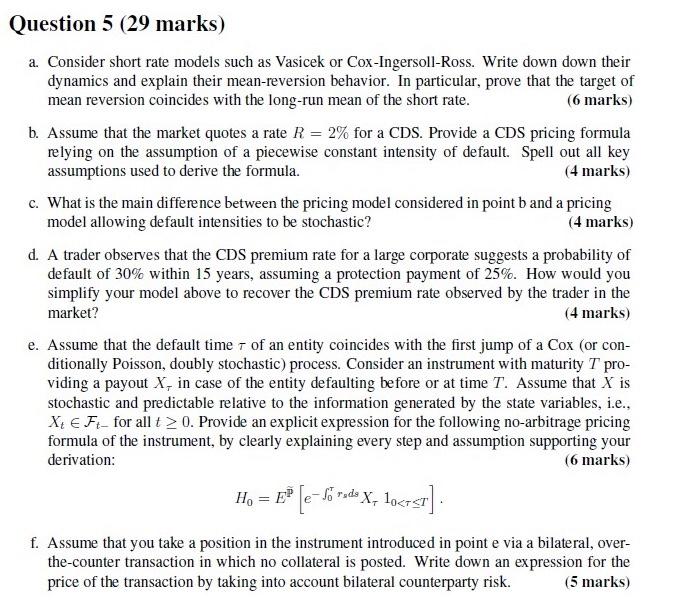

Question 5 (29 marks) a. Consider short rate models such as Vasicek or Cox-Ingersoll-Ross. Write down down their dynamics and explain their mean-reversion behavior. In particular, prove that the target of mean reversion coincides with the long-run mean of the short rate. (6 marks) b. Assume that the market quotes a rate R = 2% for a CDS. Provide a CDS pricing formula relying on the assumption of a piecewise constant intensity of default. Spell out all key assumptions used to derive the formula. (4 marks) c. What is the main difference between the pricing model considered in point b and a pricing model allowing default intensities to be stochastic? (4 marks) d. A trader observes that the CDS premium rate for a large corporate suggests a probability of default of 30% within 15 years, assuming a protection payment of 25%. How would you simplify your model above to recover the CDS premium rate observed by the trader in the market? (4 marks) e. Assume that the default time of an entity coincides with the first jump of a Cox (or con- ditionally Poisson, doubly stochastic) process. Consider an instrument with maturity T pro- viding a payout X, in case of the entity defaulting before or at time T. Assume that X is stochastic and predictable relative to the information generated by the state variables, i.e., X: Ft- for all t > 0. Provide an explicit expression for the following no-arbitrage pricing formula of the instrument, by clearly explaining every step and assumption supporting your derivation: (6 marks) Ho = B [e-frdo X, lorst] f. Assume that you take a position in the instrument introduced in point e via a bilateral, over- the-counter transaction in which no collateral is posted. Write down an expression for the price of the transaction by taking into account bilateral counterparty risk. (5 marks) = Question 5 (29 marks) a. Consider short rate models such as Vasicek or Cox-Ingersoll-Ross. Write down down their dynamics and explain their mean-reversion behavior. In particular, prove that the target of mean reversion coincides with the long-run mean of the short rate. (6 marks) b. Assume that the market quotes a rate R = 2% for a CDS. Provide a CDS pricing formula relying on the assumption of a piecewise constant intensity of default. Spell out all key assumptions used to derive the formula. (4 marks) c. What is the main difference between the pricing model considered in point b and a pricing model allowing default intensities to be stochastic? (4 marks) d. A trader observes that the CDS premium rate for a large corporate suggests a probability of default of 30% within 15 years, assuming a protection payment of 25%. How would you simplify your model above to recover the CDS premium rate observed by the trader in the market? (4 marks) e. Assume that the default time of an entity coincides with the first jump of a Cox (or con- ditionally Poisson, doubly stochastic) process. Consider an instrument with maturity T pro- viding a payout X, in case of the entity defaulting before or at time T. Assume that X is stochastic and predictable relative to the information generated by the state variables, i.e., X: Ft- for all t > 0. Provide an explicit expression for the following no-arbitrage pricing formula of the instrument, by clearly explaining every step and assumption supporting your derivation: (6 marks) Ho = B [e-frdo X, lorst] f. Assume that you take a position in the instrument introduced in point e via a bilateral, over- the-counter transaction in which no collateral is posted. Write down an expression for the price of the transaction by taking into account bilateral counterparty risk. (5 marks) =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts