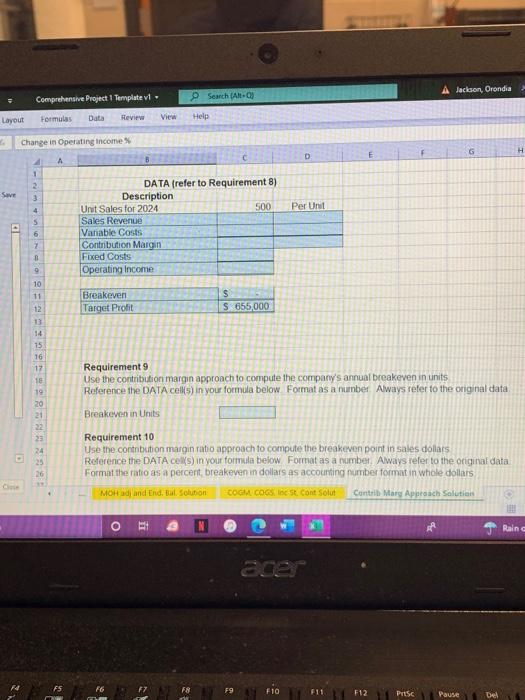

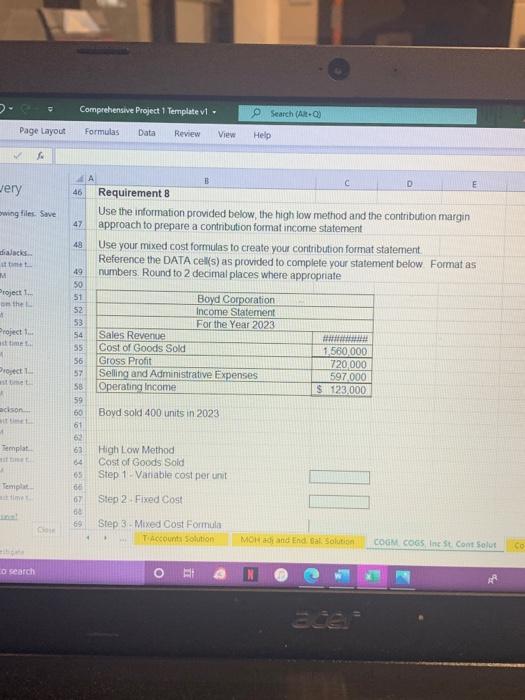

Question: 8.use the information provided the high low method and the contribution margin approach to prepare a contribution format income statement. 9.Use the contribution margin approach

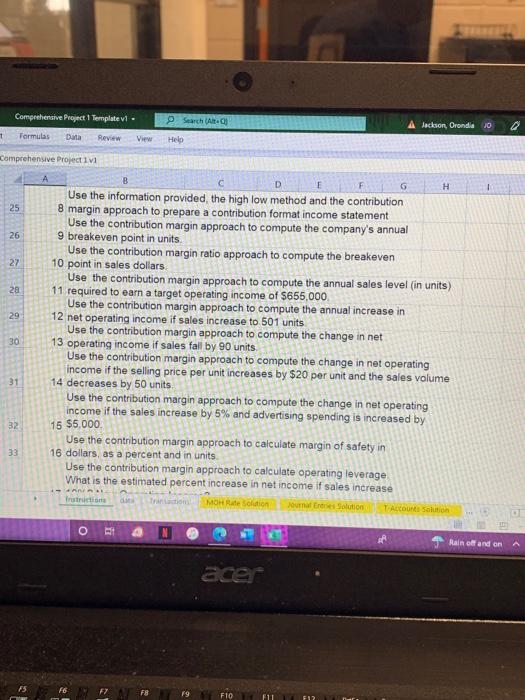

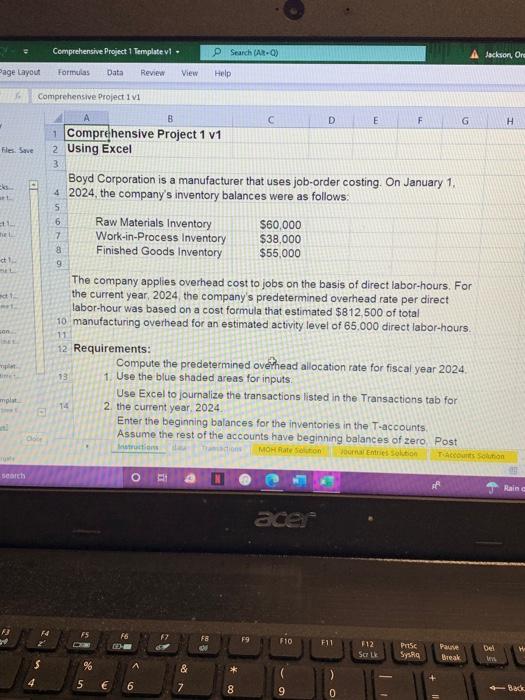

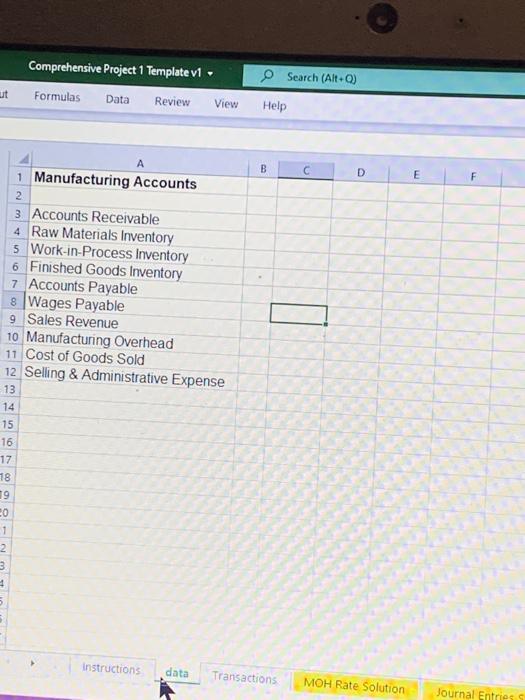

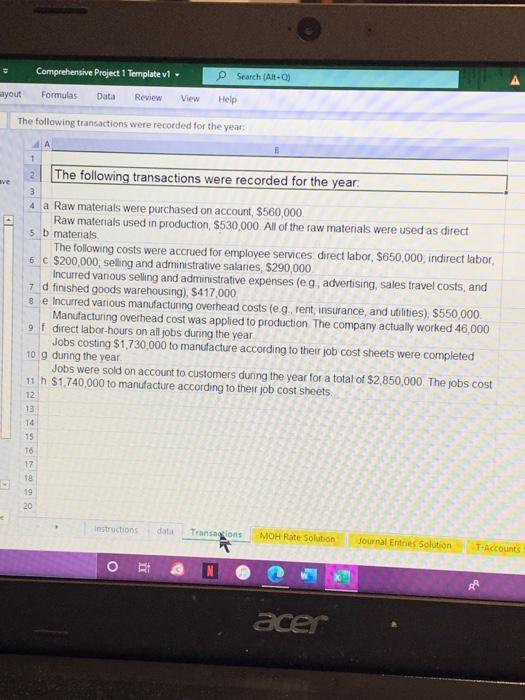

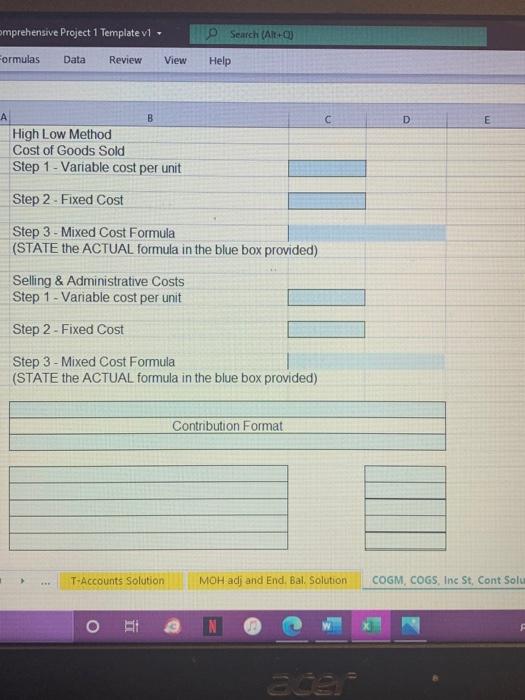

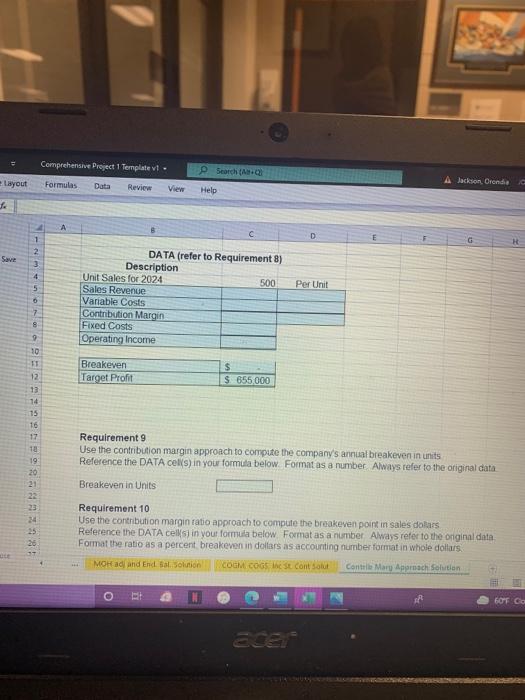

Jackson, Orondia Search (Aho) Comprehensive Project 1 Template vi. Formulas Data Review View Layout Help Change in Operating income G D 4 1 2 Save Per Unit 3 4 5 DATA (refer to Requirement 8) Description Unit Sales for 2024 500 Sales Revenue Variable Costs Contribution Margin Fixed Costs Operating Income 7 B o 10 11 Breakeven Target Profit S S 655,000 14 75 16 12 16 19 Requirement 9 Use the contribution margin approach to compute the company's annual breakeven in units Reference the DATA celks) in your formula below Format as a number. Always refer to the original data Breakeven in Units 20 21 24 25 26 Requirement 10 Use the contribution margin ratio approach to compute the breakeven point in sales dollars Reference the DATA cel(s) in your formula below Format as a number. Always refer to the original data Format the ratio as a percent breakeven in dollars as accounting number format in whole dollars MOH and End. Dal Solution COM COCS, loc St. Cont Solut Contrib Marg Approach Solution Rainc aca F5 F6 F10 F11 F12 Prisc Pause Del Competensive Project 1 Template vi Search (Alto) A lackson, Orondia JO 1 Formulas Data Review View Help Comprehensive Project i vi 6 H 25 26 27 28 29 30 D F Use the information provided the high low method and the contribution 8 margin approach to prepare a contribution format income statement Use the contribution margin approach to compute the company's annual 9 breakeven point in units Use the contribution margin ratio approach to compute the breakeven 10 point in sales dollars Use the contribution margin approach to compute the annual sales level (in units) 11 required to earn a target operating income of $655,000 Use the contribution margin approach to compute the annual increase in 12 net operating income if sales increase to 501 units Use the contribution margin approach to compute the change in net 13 operating income if sales fall by 90 units Use the contribution margin approach to compute the change in net operating income if the selling price per unit increases by $20 per unit and the sales volume 14 decreases by 50 units Use the contribution margin approach to compute the change in net operating income if the sales increase by 5% and advertising spending is increased by 15 $5.000 Use the contribution margin approach to calculate margin of safety in 16 dollars, as a percent and in units Use the contribution margin approach to calculate operating leverage What is the estimated percent increase in net income if sales increase frustration Tridion MOHR Solution Journal Erre Solution T-Account Solution 31 32 33 o Rain off and on acer FS 19 F10 B G H Fles. Se . Comprehensive Project Template vi. Search (AR) Jackson, ON Page Layout Formulas Data Review View Help Comprehensive Project 1v1 D E F Comprehensive Project 1 v1 2 Using Excel 3 Boyd Corporation is a manufacturer that uses job-order costing. On January 1, 4 2024, the company's inventory balances were as follows: Raw Materials Inventory $60,000 Work-in-Process Inventory $38,000 Finished Goods Inventory $55,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, 2024, the company's predetermined overhead rate per direct labor-hour was based on a cost formula that estimated $812.500 of total 10 manufacturing overhead for an estimated activity level of 65.000 direct labor-hours. 12 Requirements: Compute the predetermined ovelhead allocation rate for fiscal year 2024 1. Use the blue shaded areas for inputs. Use Excel to journalize the transactions listed in the Transactions tab for 2. the current year 2024 Enter the beginning balances for the inventories in the T-accounts Assume the rest of the accounts have beginning balances of zero Post MOH Rate Solution Jomar Entries Solution Tours Souton S 6 7 8 9 ct 1 11 13 amples 14 Intion SCIEL Rain ace F10 F11 PSC 12 Sc fa Spa Break De WY % & 4 5 6 7 8 9 Bad 0 Comprehensive Project 1 Template v1 - Search (Alt-0) ut Formulas Data Review View Help B D E A 1 Manufacturing Accounts 2 3 Accounts Receivable 4 Raw Materials Inventory 5 Work-in-Process Inventory 6 Finished Goods Inventory 7 Accounts Payable 8 Wages Payable 9 Sales Revenue 10 Manufacturing Overhead 11 Cost of Goods Sold 12 Selling & Administrative Expense 13 14 15 16 17 18 19 20 1 2 3 Instructions data Transactions MOH Rate Solution Journal Entries Comprehensive Project 1 Template v Search (Alt. ayout Formulas Data Review View Help The following transactions were recorded for the year: 1 2 The following transactions were recorded for the year. ave 3 4 a Raw materials were purchased on account, $560,000. Raw materials used in production $530,000. All of the raw materials were used as direct 5 b matenals The following costs were accrued for employee services direct labor, $650,000 indirect labor, 6 c $200,000, selling and administrative salaries $290,000 Incurred vanous selling and administrative expenses (eg, advertising, sales travel costs, and 7 d finished goods warehousing), S417000 8 e Incurred various manufacturing overhead costs (eg, rent, insurance, and utilities), $550,000 Manufacturing overhead cost was applied to production. The company actually worked 46,000 of direct labor-hours on all jobs during the year Jobs costing $1,730,000 to manufacture according to their job cost sheets were completed 10 g during the vear. Jobs were sold on account to customers during the year for a total of $2,850,000 The jobs cost 11 h $1,740,000 to manufacture according to their job cost sheets. 12 13 14 15 T6 17 18 19 20 Instructions data Transactions MOH Rate Solution Journal Entries solution T-Accounts ot acer a Comprehensive Project 1 Template v1. Search (0) Page Layout Formulas Data Review View Help B wery wing files. Save A D E 46 Requirement 8 Use the information provided below, the high low method and the contribution margin 47 approach to prepare a contnbution format income statement Use your mixed cost formulas to create your contribution format statement Reference the DATA cel(s) as provided to complete your statement below Format as numbers. Round to 2 decimal places where appropriate 48 diajacks met M Project 1 the Project 1 att 1 Proxect st 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 08 07 Boyd Corporation Income Statement For the Year 2023 Sales Revenue Cost of Goods Sold Gross Profit Selling and Administrative Expenses Operating Income 1,560,000 720.000 597 000 $ 123,000 ackson Boyd sold 400 units in 2023 Templat High Low Method Cost of Goods Sold Step 1 Variable cost per unit Tempat time Step 2 Fixed Cost 69 Step 3. Mixed Cost Formula Ti Account Solution MOH and End Dal Solution COGM COGS In St Cont Solut o search RE ste mprehensive Project 1 Template v1 - Search (Alt+O) Formulas Data Review View Help D E B High Low Method Cost of Goods Sold Step 1 - Variable cost per unit Step 2 - Fixed Cost Step 3 - Mixed Cost Formula (STATE the ACTUAL formula in the blue box provided) Selling & Administrative Costs Step 1 - Variable cost per unit Step 2 - Fixed Cost Step 3 - Mixed Cost Formula (STATE the ACTUAL formula in the blue box provided) Contribution Format > T-Accounts Solution MOH adi and End. Bal Solution COGM, COGS, Inc St, Cont Solu o N Comprehensive Project 1 Template vi. Search Layout A Jackson, Orende Formulas Data Review View Help So D Save 2. 3 4 5 Per Unit DATA (refer to Requirements) Description Unit Sales for 2024 500 Sales Revenue Variable Costs Contribution Margin Fixed Costs Operating Income 0 7. 8 Breakeven Target Profit $ $ 655 000 . 30 11 12 13 14 15 16 17 10 19 20 21 22 23 24 25 25 37 Requirement 9 Use the contribution margin approach to compute the company's annual breakeven in units Reference the DATA cells) in your formula below. Format as a number Always refer to the original data Breakeven in Units Requirement 10 Use the contribution margin ratio approach to compute the breakeven point in sales dollars Reference the DATA cells in your formula below. Formatas a number Always refer to the original data Format the ratio as a percent breakeven in dollars as accounting number format in whole dollars. MOH ad and End Sal Solution COGM COGS The st Cont Solut Contelle Mary Approach Solution 60F Go acer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts