Question: You plan to deposit amounts as shown at the beginning of this year, and at the beginning of every year until five year from

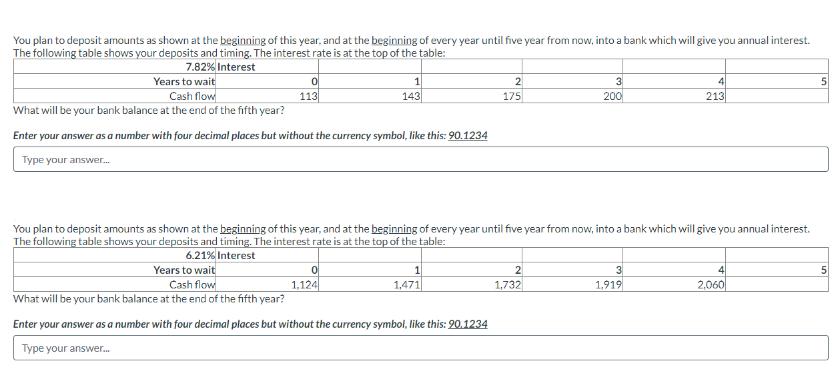

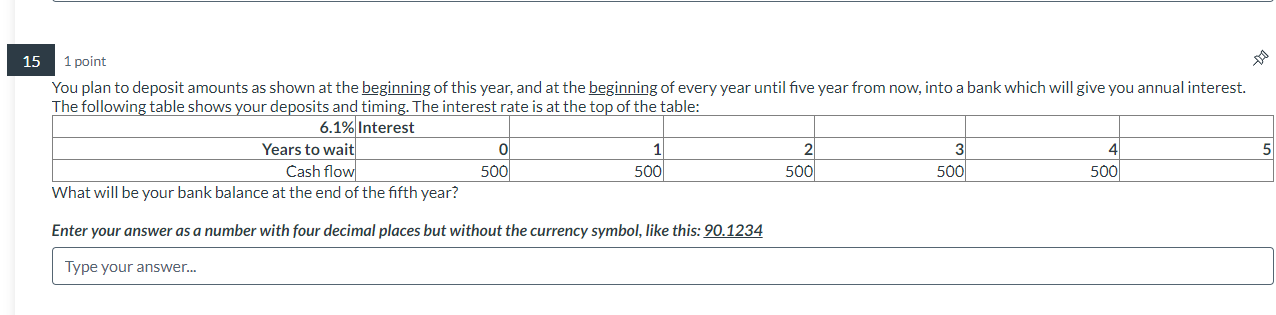

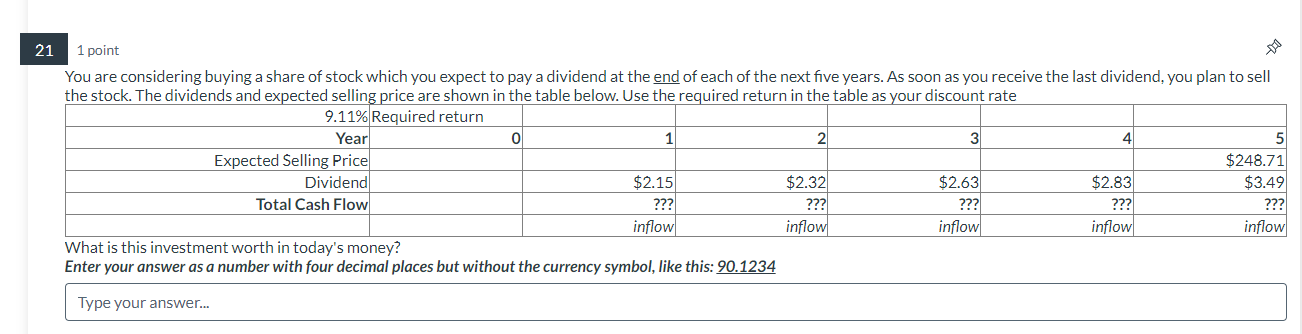

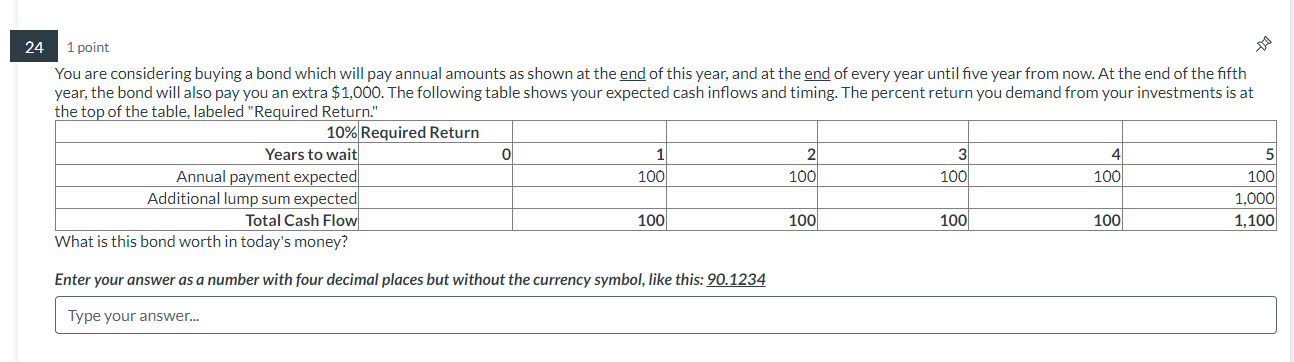

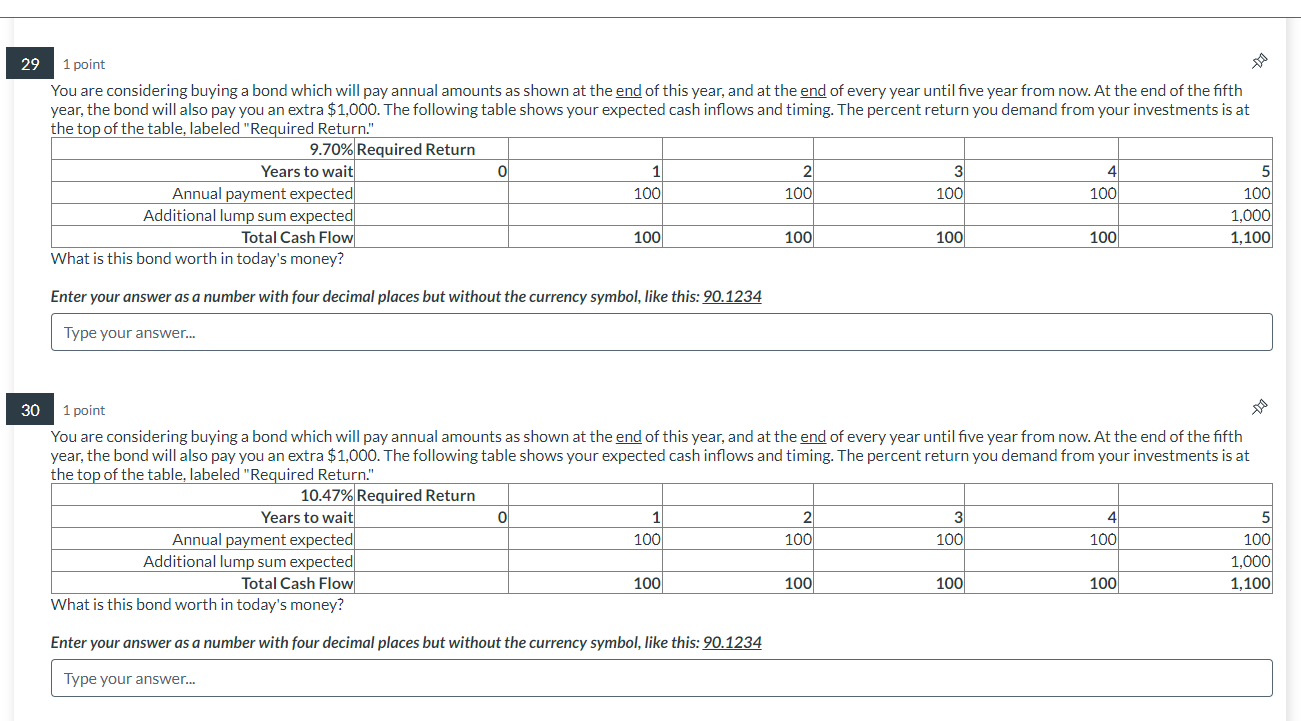

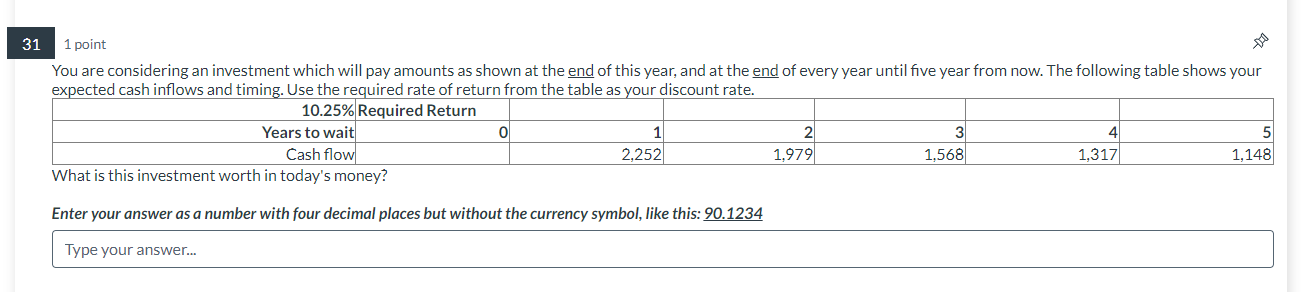

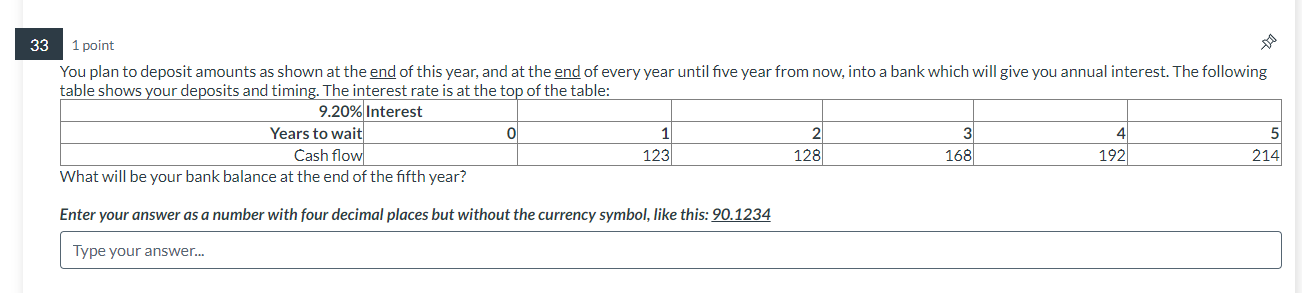

You plan to deposit amounts as shown at the beginning of this year, and at the beginning of every year until five year from now, into a bank which will give you annual interest. The following table shows your deposits and timing. The interest rate is at the top of the table: 7.82% Interest Years to wait Cash flow 0 113 1 143 What will be your bank balance at the end of the fifth year? Enter your answer as a number with four decimal places but without the currency symbol, like this: 90.1234 Type your answer... 2 3 175 200 4 213 You plan to deposit amounts as shown at the beginning of this year, and at the beginning of every year until five year from now, into a bank which will give you annual interest. The following table shows your deposits and timing. The interest rate is at the top of the table: 6.21% Interest Years to wait Cash flow 0 1,124 What will be your bank balance at the end of the fifth year? 1 2 3 4 1,471 1,732 1,919 2,060 Enter your answer as a number with four decimal places but without the currency symbol, like this: 90.1234 Type your answer... 5 5 15 1 point You plan to deposit amounts as shown at the beginning of this year, and at the beginning of every year until five year from now, into a bank which will give you annual interest. The following table shows your deposits and timing. The interest rate is at the top of the table: 6.1% Interest Years to wait Cash flow 0 500 What will be your bank balance at the end of the fifth year? 1 500 Enter your answer as a number with four decimal places but without the currency symbol, like this: 90.1234 Type your answer... 2 500 3 500 4 500 5 21 1 point You are considering buying a share of stock which you expect to pay a dividend at the end of each of the next five years. As soon as you receive the last dividend, you plan to sell the stock. The dividends and expected selling price are shown in the table below. Use the required return in the table as your discount rate 9.11% Required return Year 0 Expected Selling Price Dividend Total Cash Flow 2 3 1 $2.15 $2.32 $2.63 ??? ??? ??? inflow inflow inflow What is this investment worth in today's money? Enter your answer as a number with four decimal places but without the currency symbol, like this: 90.1234 Type your answer... $2.83 4 5 $248.71 $3.49 ??? ??? inflow inflow 24 1 point You are considering buying a bond which will pay annual amounts as shown at the end of this year, and at the end of every year until five year from now. At the end of the fifth year, the bond will also pay you an extra $1,000. The following table shows your expected cash inflows and timing. The percent return you demand from your investments is at the top of the table, labeled "Required Return." 10% Required Return Years to wait Annual payment expected 1 2 3 4 5 100 100 100 100 100 1,000 100 100 100 100 1,100 Additional lump sum expected Total Cash Flow What is this bond worth in today's money? Enter your answer as a number with four decimal places but without the currency symbol, like this: 90.1234 Type your answer... 29 1 point You are considering buying a bond which will pay annual amounts as shown at the end of this year, and at the end of every year until five year from now. At the end of the fifth year, the bond will also pay you an extra $1,000. The following table shows your expected cash inflows and timing. The percent return you demand from your investments is at the top of the table, labeled "Required Return." 9.70% Required Return Years to wait Annual payment expected Additional lump sum expected Total Cash Flow What is this bond worth in today's money? 1 2 3 100 100 100 4 100 5 100 1,000 100 100 100 100 1,100 Enter your answer as a number with four decimal places but without the currency symbol, like this: 90.1234 Type your answer... 30 1 point You are considering buying a bond which will pay annual amounts as shown at the end of this year, and at the end of every year until five year from now. At the end of the fifth year, the bond will also pay you an extra $1,000. The following table shows your expected cash inflows and timing. The percent return you demand from your investments is at the top of the table, labeled "Required Return." 10.47% Required Return Years to wait Annual payment expected Additional lump sum expected Total Cash Flow What is this bond worth in today's money? 1 100 2 3 4 5 100 100 100 100 1,000 100 100 100 100 1,100 Enter your answer as a number with four decimal places but without the currency symbol, like this: 90.1234 Type your answer... 31 1 point You are considering an investment which will pay amounts as shown at the end of this year, and at the end of every year until five year from now. The following table shows your expected cash inflows and timing. Use the required rate of return from the table as your discount rate. 10.25% Required Return Years to wait Cash flow What is this investment worth in today's money? 1 2,252 Enter your answer as a number with four decimal places but without the currency symbol, like this: 90.1234 Type your answer... 2 3 4 5 1,979 1,568 1,317 1,148 33 1 point You plan to deposit amounts as shown at the end of this year, and at the end of every year until five year from now, into a bank which will give you annual interest. The following table shows your deposits and timing. The interest rate is at the top of the table: 9.20% Interest Years to wait Cash flow What will be your bank balance at the end of the fifth year? 1 2 123 128 Enter your answer as a number with four decimal places but without the currency symbol, like this: 90.1234 Type your answer... 3 168 4 192 5 214

Step by Step Solution

There are 3 Steps involved in it

Id be glad to calculate your bank balance at the end of the fifth year for both scenarios 782 and 621 interest Scenario 1 782 Interest Year 0 Balance 113 initial deposit Year 1 Balance 113 1 00782 143 ... View full answer

Get step-by-step solutions from verified subject matter experts