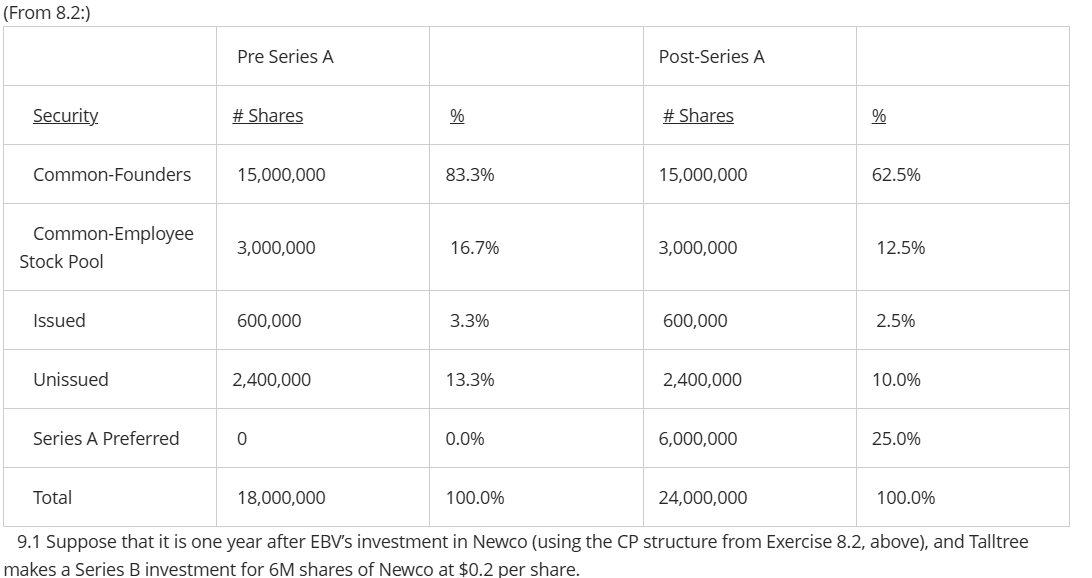

Question: 9 . 1 Suppose that it is one year after EBV s investment in Newco ( using the CP structure from Exercise 8 . 2

Suppose that it is one year after EBVs investment in Newco using the CP structure from Exercise above and Talltree makes a Series B investment for M shares of Newco at $ per share.

Following the Series B investment, what percentage of Newco fully diluted would be controlled by EBV? Consider the following cases:

Case I: Series A has no antidilution protection.

Use the information listed in a

Following the Series B investment, what percentage ofNewcofully diluted would be controlled by EBV? Consider the following cases:

Case II: Series A has fullratchet antidilution protection.

Case III: Series A has broadbase weightedaverage antidilution protection.

Case IV: Series A has narrowbase weightedaverage antidilution protection.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock