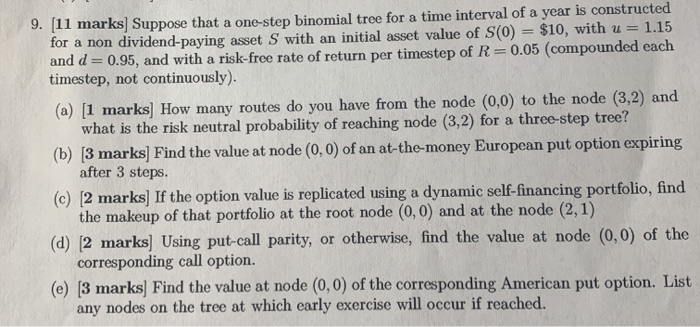

Question: 9. [11 marks Suppose that a one-step binomial tree for a time interval of a year is constructed for a non dividend-paying asset S with

9. [11 marks Suppose that a one-step binomial tree for a time interval of a year is constructed for a non dividend-paying asset S with an initial asset value of S(0) = $10, with u = 1.15 and d = 0.95, and with a risk-free rate of return per timestep of R=0.05 (compounded each timestep, not continuously). (a) (1 marks How many routes do you have from the node (0,0) to the node (3,2) and what is the risk neutral probability of reaching node (3,2) for a three-step tree? (b) 3 marks) Find the value at node (0,0) of an at-the-money European put option expiring after 3 steps. (c) 2 marks) If the option value is replicated using a dynamic self-financing portfolio, find the makeup of that portfolio at the root node (0,0) and at the node (2,1) (d) [2 marks] Using put-call parity, or otherwise, find the value at node (0,0) of the corresponding call option. (e) [3 marks) Find the value at node (0,0) of the corresponding American put option. List any nodes on the tree at which early exercise will occur if reached. 9. [11 marks Suppose that a one-step binomial tree for a time interval of a year is constructed for a non dividend-paying asset S with an initial asset value of S(0) = $10, with u = 1.15 and d = 0.95, and with a risk-free rate of return per timestep of R=0.05 (compounded each timestep, not continuously). (a) (1 marks How many routes do you have from the node (0,0) to the node (3,2) and what is the risk neutral probability of reaching node (3,2) for a three-step tree? (b) 3 marks) Find the value at node (0,0) of an at-the-money European put option expiring after 3 steps. (c) 2 marks) If the option value is replicated using a dynamic self-financing portfolio, find the makeup of that portfolio at the root node (0,0) and at the node (2,1) (d) [2 marks] Using put-call parity, or otherwise, find the value at node (0,0) of the corresponding call option. (e) [3 marks) Find the value at node (0,0) of the corresponding American put option. List any nodes on the tree at which early exercise will occur if reached