Question: 9) (11-3) discount Chapter 21 1. Forward premium 3-2) 2K K (11-16 (11-26) Question 3 (15 Marks) Zinger Corporation manufactures i large order from a

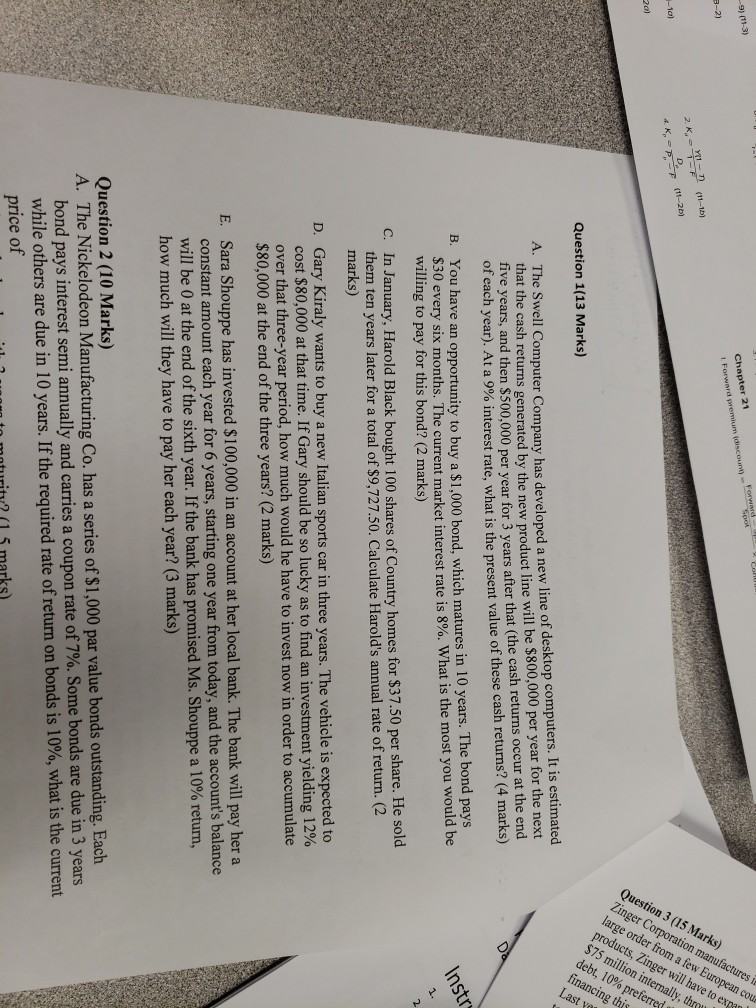

9) (11-3) discount Chapter 21 1. Forward premium 3-2) 2K "K (11-16 (11-26) Question 3 (15 Marks) Zinger Corporation manufactures i large order from a few European cour products, Zinger will have to exp $75 million internally, they debt, 10% preferred financing this D |-101 201 Question 1(13 Marks) Last ye A. The Swell Computer Company has developed a new line of desktop computers. It is estimated that the cash returns generated by the new product line will be $800,000 per year for the next five years, and then $500,000 per year for 3 years after that the cash returns occur at the end of each year). At a 9% interest rate, what is the present value of these cash returns? (4 marks) - Instru B. You have an opportunity to buy a $1.000 bond, which matures in 10 years. The bond pays Du every six months. The current market interest rate is 8%. What is the most you would be willing to pay for this bond? (2 marks) C. In January, Harold Black bought 100 shares of Country homes for $37.50 per share. He sold them ten years later for a total of $9,727.50. Calculate Harold's annual rate of return. (2 marks) D. Gary Kiraly wants to buy a new Italian sports car in three years. The vehicle is expected to cost $80,000 at that time. If Gary should be so lucky as to find an investment yielding 12% over that three-year period, how much would he have to invest now in order to accumulate $80,000 at the end of the three years? (2 marks) E. Sara Shouppe has invested $100,000 in an account at her local bank. The bank will pay her a constant amount each year for 6 years, starting one year from today, and the account's balance will be 0 at the end of the sixth year. If the bank has promised Ms. Shouppe a 10% return, how much will they have to pay her each year? (3 marks) Question 2 (10 Marks) A. The Nickelodeon Manufacturing Co. has a series of $1,000 par value bonds outstanding. Each bond pays interest semi annually and carries a coupon rate of 7%. Some bonds are due in 3 years while others are due in 10 years. If the required rate of return on bonds is 10%, what is the current price of 11 um to maturity? (1 5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts