Question: 9- (2 points) Over the past five years a stock produced annual returns of 11%, 16%, 5%, 2%, and 9%, respectively. Based on this information,

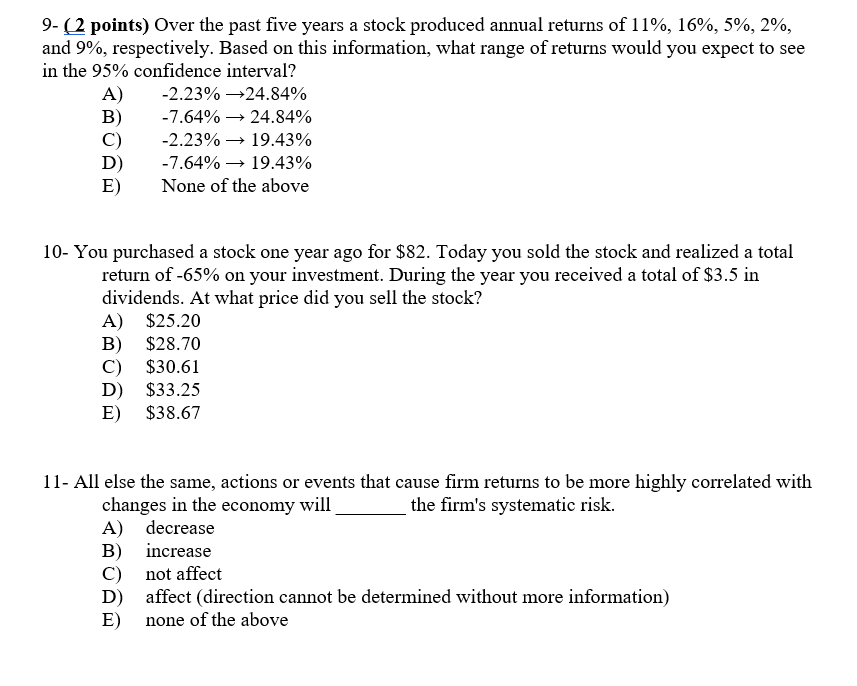

9- (2 points) Over the past five years a stock produced annual returns of 11%, 16%, 5%, 2%, and 9%, respectively. Based on this information, what range of returns would you expect to see in the 95% confidence interval? A) -2.23% +24.84% -7.64% 24.84% C) -2.23% + 19.43% D) -7.64% 19.43% E) None of the above B) 10- You purchased a stock one year ago for $82. Today you sold the stock and realized a total return of -65% on your investment. During the year you received a total of $3.5 in dividends. At what price did you sell the stock? A) $25.20 B) $28.70 C) $30.61 D) $33.25 E) $38.67 11- All else the same, actions or events that cause firm returns to be more highly correlated with changes in the economy will the firm's systematic risk. A) decrease B) increase C) not affect D) affect (direction cannot be determined without more information) E) none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts