Question: Question 1 (Mandatory) (9 points) Over the past five years, a stock produced returns of 4.25%, 8.63%, 19.02%, -4.57% and - 1.69%, respectively. Based on

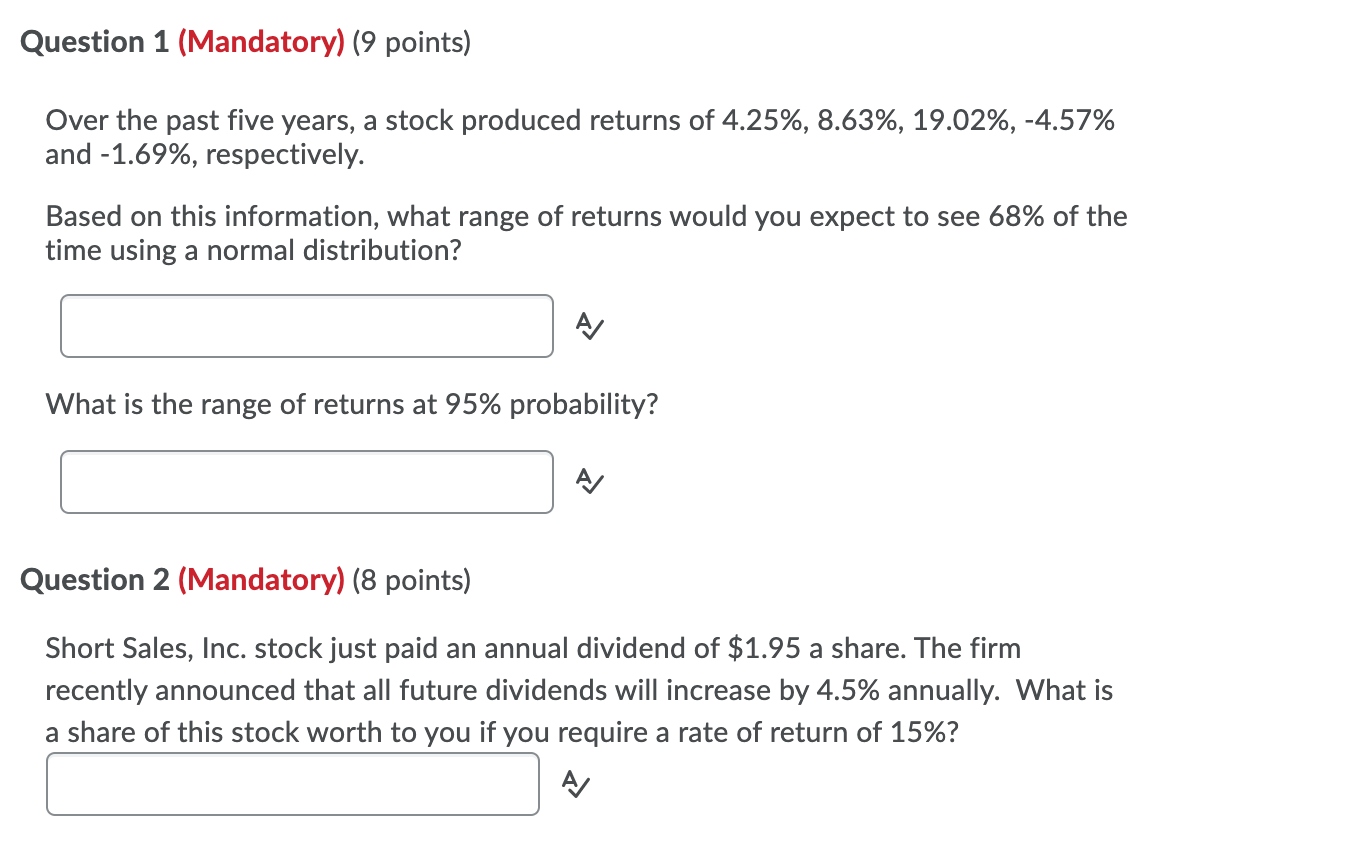

Question 1 (Mandatory) (9 points) Over the past five years, a stock produced returns of 4.25%, 8.63%, 19.02%, -4.57% and - 1.69%, respectively. Based on this information, what range of returns would you expect to see 68% of the time using a normal distribution? AJ What is the range of returns at 95% probability? AJ Question 2 (Mandatory) (8 points) Short Sales, Inc. stock just paid an annual dividend of $1.95 a share. The firm recently announced that all future dividends will increase by 4.5% annually. What is a share of this stock worth to you if you require a rate of return of 15%? AJ

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock