Question: 9. (5 points) Black Dog Cellars (BDC) expects a demand of 25,000 bottles of wine per year for its Cirius Black wine for six years.

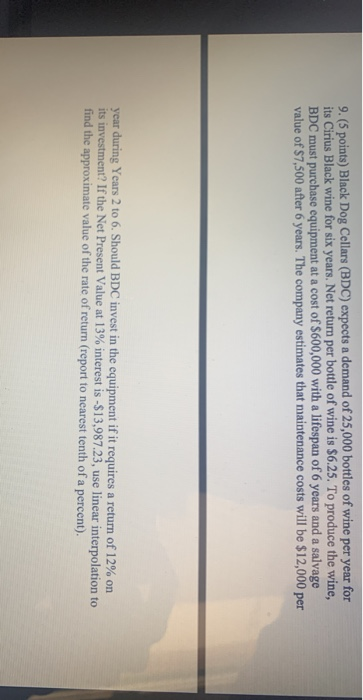

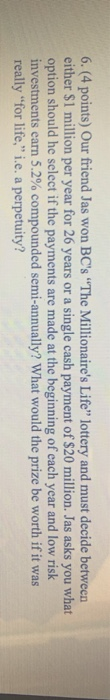

9. (5 points) Black Dog Cellars (BDC) expects a demand of 25,000 bottles of wine per year for its Cirius Black wine for six years. Net return per bottle of wine is $6.25. To produce the wine, BDC must purchase equipment at a cost of $600,000 with a lifespan of 6 years and a salvage value of $7,500 after 6 years. The company estimates that maintenance costs will be $12,000 per year during Years 2 to 6. Should BDC invest in the equipment if it requires a return of 12% on its investment? If the Net Present Value at 13% interest is -$13,987.23, use linear interpolation to find the approximate value of the rate of return (report to nearest tenth of a percent). 6. (4 points) Our friend Jas won BC's "The Millionaire's Life" lottery and must decide between either $1 million per year for 26 years or a single cash payment of $20 million. Jas asks you what option should he select if the payments are made at the beginning of each year and low risk investments earn 5.2% compounded semi-annually? What would the prize be worth if it was really "for life," i.e. a perpetuity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts