Question: 9. A contractor has a contract to remove and replace the existing landscape and sidewalks around an office building. The work includes demolition of the

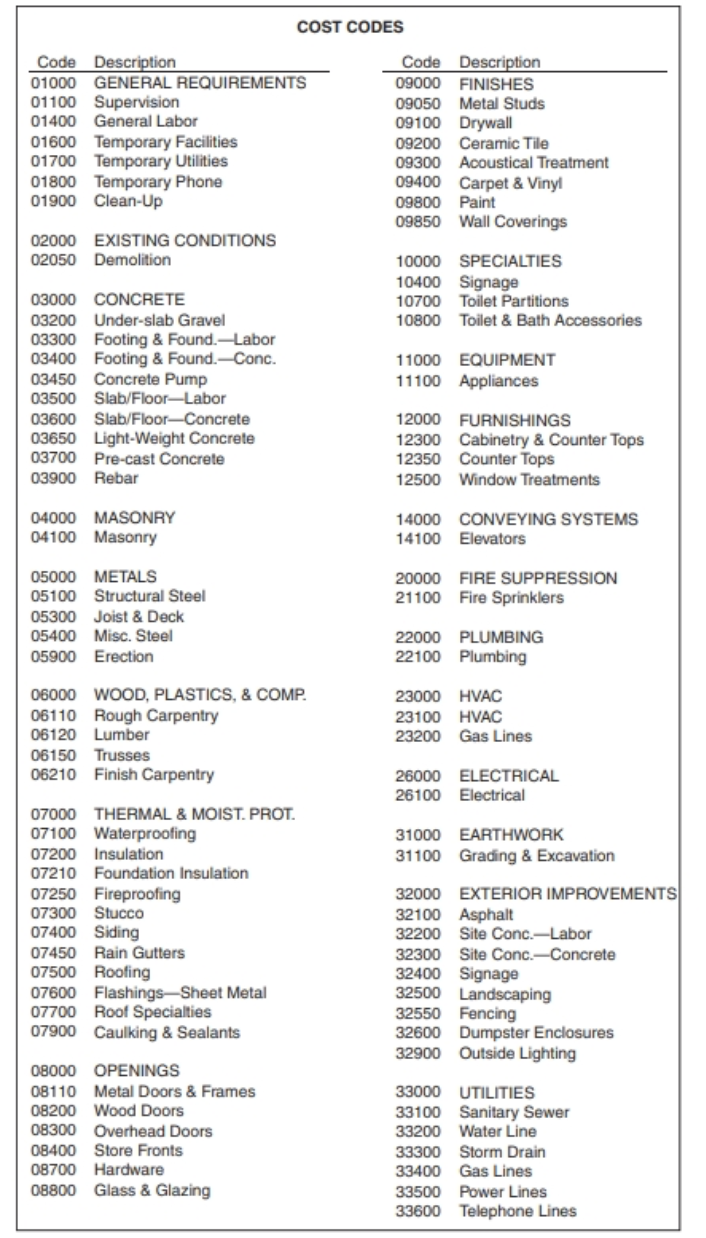

9. A contractor has a contract to remove and replace the existing landscape and sidewalks around an office building. The work includes demolition of the existing landscaping and sidewalks, importing fill and grading around the office building, constructing new concrete sidewalks, and new landscaping. The contractor uses the cost codes in Figure 2-6 (Attached). The contractor will perform all of the work except placing the site concrete and the landscaping. The original estimate for the demolition was $30,000 and a $5,000 change order has been ap-proved to remove some unexpected debris found during the demolition. The demolition work has been complet-ed at a cost of $33,562. The original estimate for the fill and grading was $17,500 and a $2,000 change order for importing additional fill to replace the debris has been approved. The fill and grading costs to date are $17,264 and the cost to complete has been estimated at $2,236. The original budget for the labor to pour the concrete was $19,200 and no changes have been made. The con-crete labor has been subcontracted out for $19,200, for which the contractor has received a bill for $15,200. The original budget for the concrete for the sidewalks was $9,900 and no changes have been made. The contractor has spent $7,425 for concrete and estimates that $1,950 of concrete will be needed to complete the project. The original estimate for the landscaping was $37,500 and no changes have been made. The landscape work has been subcontracted out for $37,500. The landscaping work has yet to start and no bills have been received. Determine the total estimated cost at completion for the project and the variance for each cost code.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts