Question: 9 Add a File Record Audio Record Video 12 Question 4 (10 points) Assume that you have the following information: Spot Rate: 3-Month Forward Exchange

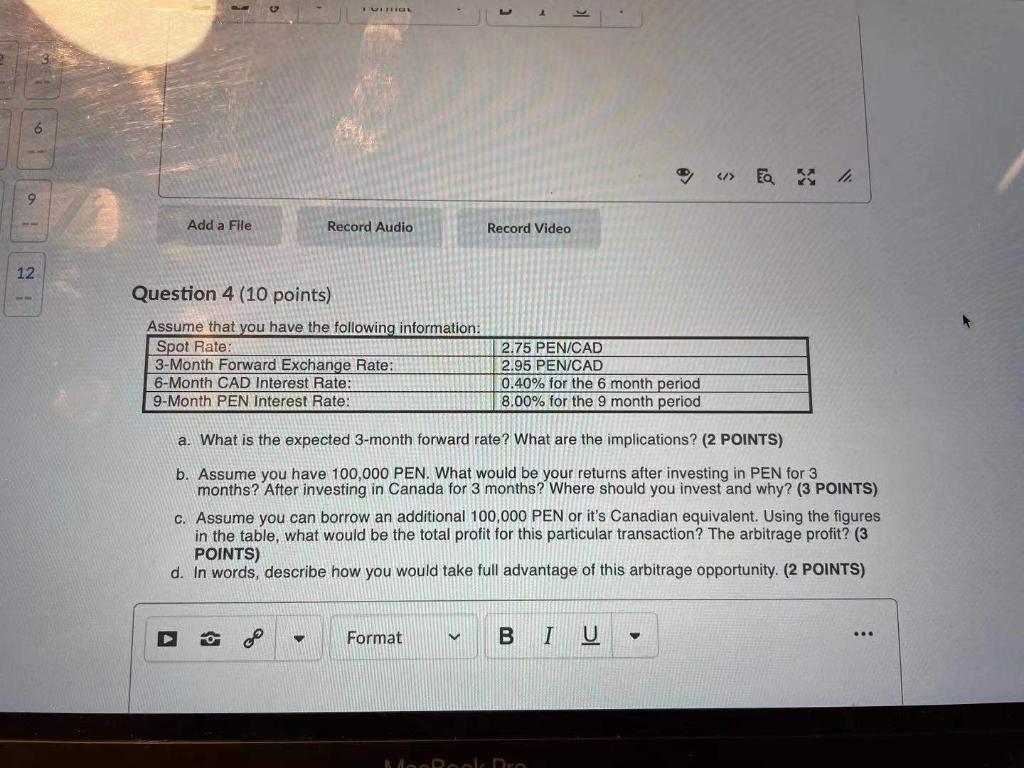

9 Add a File Record Audio Record Video 12 Question 4 (10 points) Assume that you have the following information: Spot Rate: 3-Month Forward Exchange Rate: 6-Month CAD Interest Rate: 9-Month PEN Interest Rate: 2.75 PEN/CAD 2.95 PEN/CAD 0.40% for the 6 month period 8.00% for the 9 month period a. What is the expected 3-month forward rate? What are the implications? (2 POINTS) b. Assume you have 100,000 PEN. What would be your returns after investing in PEN for 3 months? After investing in Canada for 3 months? Where should you invest and why? (3 POINTS) C. Assume you can borrow an additional 100,000 PEN or it's Canadian equivalent. Using the figures in the table, what would be the total profit for this particular transaction? The arbitrage profit? (3 POINTS) d. In words, describe how you would take full advantage of this arbitrage opportunity. (2 POINTS) Format B I U 9 Add a File Record Audio Record Video 12 Question 4 (10 points) Assume that you have the following information: Spot Rate: 3-Month Forward Exchange Rate: 6-Month CAD Interest Rate: 9-Month PEN Interest Rate: 2.75 PEN/CAD 2.95 PEN/CAD 0.40% for the 6 month period 8.00% for the 9 month period a. What is the expected 3-month forward rate? What are the implications? (2 POINTS) b. Assume you have 100,000 PEN. What would be your returns after investing in PEN for 3 months? After investing in Canada for 3 months? Where should you invest and why? (3 POINTS) C. Assume you can borrow an additional 100,000 PEN or it's Canadian equivalent. Using the figures in the table, what would be the total profit for this particular transaction? The arbitrage profit? (3 POINTS) d. In words, describe how you would take full advantage of this arbitrage opportunity. (2 POINTS) Format B I U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts