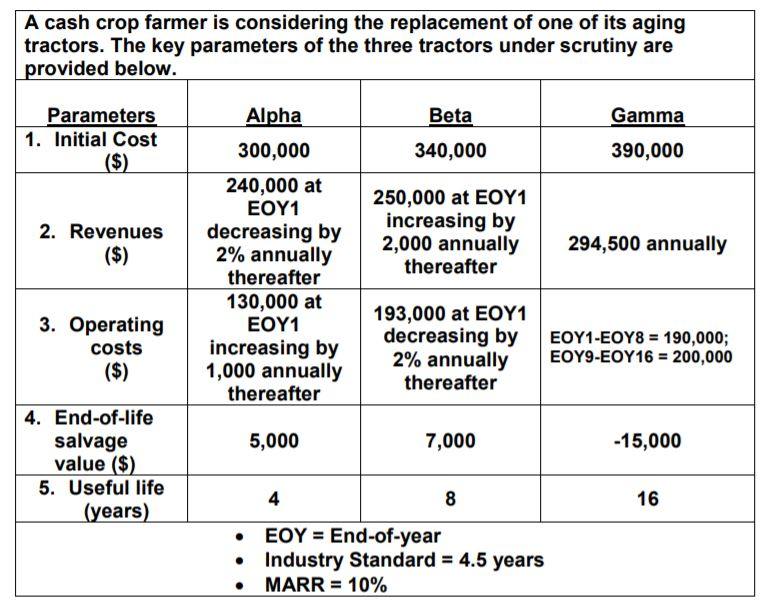

Question: 9. Based on the discounted payback method, Betas recovery period (to the nearest half or full year) is a) 7.0; b) 7.5; c) 8.0; d)

9. Based on the discounted payback method, Betas recovery period (to the nearest half or full year) is

a) 7.0; b) 7.5; c) 8.0; d) 9.0.

10. Based on the discounted payback method, Betas project balance after 2 years (rounded to the nearest $100) is

a) $-296,300; b) $-285,800; c) $-89,400; d) $36,800.

11. Based on the simple payback method, Gammas recovery period (rounded to the nearest half or full year) is

a) 3.5; b) 4.5; c) 6.0; d) 7.0.

12. Alphas benefit/cost (B/C) ratio (second decimal; no rounding) is

a) 0.88; b) 1.03; c) 1.12; d) 1.18.

13. Gammas benefit/cost (B/C) ratio (second decimal; no rounding) is

a) 0.96; b) 1.01; c) 1.04; d) 1.17.

14. The incremental B/C ratio (second decimal; no rounding) between the Alpha and Beta tractors is

a) 0.95; b) 1.07; c) 1.12; d) 1.16.

15. The incremental B/C ratio (second decimal; no rounding) between the Beta and Gamma tractors is

a) 0.67; b) 0.94; c) 1.02; d) 1.15.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts