Question: 9. Calculating an installment loan payment using the add-on method Calculating the loan payment on an add-on interest installment loan Installment loans allow borrowers to

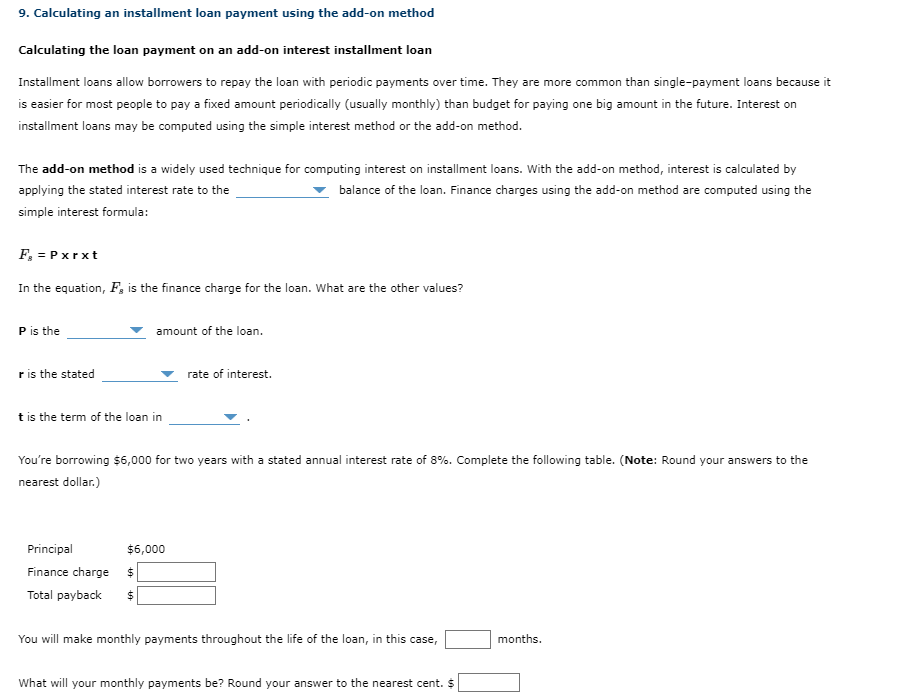

9. Calculating an installment loan payment using the add-on method Calculating the loan payment on an add-on interest installment loan Installment loans allow borrowers to repay the loan with periodic payments over time. They are more common than single-payment loans because it is easier for most people to pay a fixed amount periodically (usually monthly) than budget for paying one big amount in the future. Interest on installment loans may be computed using the simple interest method or the add-on method. The add-on method is a widely used technique for computing interest on installment loans. With the add-on method, interest is calculated by applying the stated interest rate to the balance of the loan. Finance charges using the add-on method are computed using the simple interest formula: F. = Pxrxt In the equation, F, is the finance charge for the loan. What are the other values? P is the amount of the loan. r is the stated rate of interest t is the term of the loan in You're borrowing $6,000 for two years with a stated annual interest rate of 8%. Complete the following table. (Note: Round your answers to the nearest dollar) $6,000 Principal Finance charge Total payback $ $ You will make monthly payments throughout the life of the loan, in this case, months. What will your monthly payments be? Round your answer to the nearest cent. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts