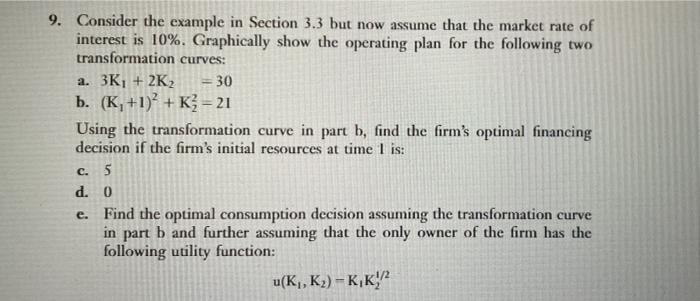

Question: 9. Consider the example in Section 3.3 but now assume that the market rate of interest is 10%. Graphically show the operating plan for the

9. Consider the example in Section 3.3 but now assume that the market rate of interest is 10%. Graphically show the operating plan for the following two transformation curves: a. 3K1 + 2K2 = 30 b. (K,+1)? + K3 = 21 Using the transformation curve in part b, find the firm's optimal financing decision if the firm's initial resources at time I is: c. 5 d. 0 e. Find the optimal consumption decision assuming the transformation curve in part b and further assuming that the only owner of the firm has the following utility function: u(K,, K2) - K,K)A 9. Consider the example in Section 3.3 but now assume that the market rate of interest is 10%. Graphically show the operating plan for the following two transformation curves: a. 3K1 + 2K2 = 30 b. (K,+1)? + K3 = 21 Using the transformation curve in part b, find the firm's optimal financing decision if the firm's initial resources at time I is: c. 5 d. 0 e. Find the optimal consumption decision assuming the transformation curve in part b and further assuming that the only owner of the firm has the following utility function: u(K,, K2) - K,K)A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts