Question: 9. Consider the following three projects for Ralce Co. This company is in pharmaceutical industry. It currently sells several drugs, including pain reliever and cough

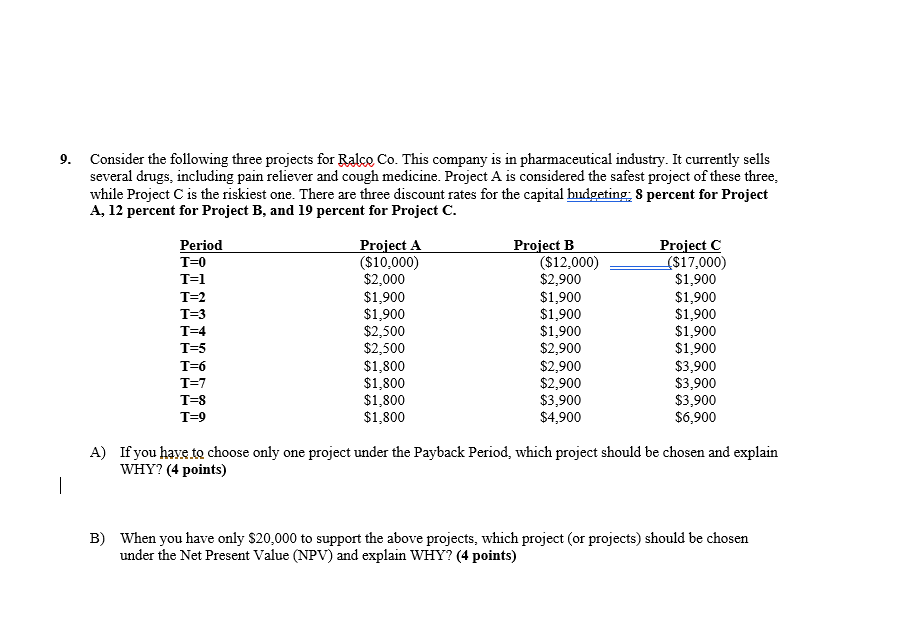

9. Consider the following three projects for Ralce Co. This company is in pharmaceutical industry. It currently sells several drugs, including pain reliever and cough medicine. Project A is considered the safest project of these three, while Project C is the riskiest one. There are three discount rates for the capital budgeting 8 percent for Project A, 12 percent for Project B, and 19 percent for Project C. Period Project A Project B Project C T=0 ($10,000) ($12,000) ($17,000) T=1 $2,000 $2,900 $1,900 T=2 $1,900 $1,900 $1,900 T=3 $1,900 $1,900 $1,900 T=4 $2,500 $1,900 $1,900 T=5 $2,500 $2,900 $1,900 $1,800 $2,900 $3,900 T=7 $1,800 $2,900 $3,900 T=8 $1,800 $3,900 $3,900 T=9 $1,800 $4,900 $6,900 A) If you have to choose only one project under the Payback Period, which project should be chosen and explain WHY? (4 points) B) When you have only $20,000 to support the above projects, which project (or projects) should be chosen under the Net Present Value (NPV) and explain WHY? (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts