Question: 9. -T - T-2 Consider the following three projects for Ralco Co. This company is in pharmaceutical industry. It currently sells several drugs, including pain

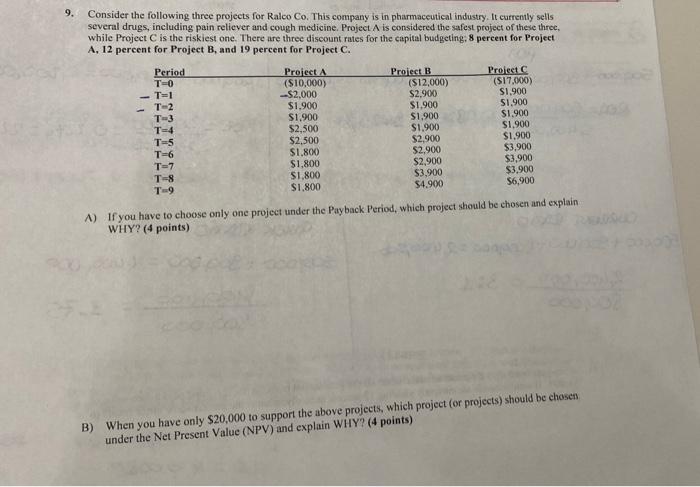

9. -T - T-2 Consider the following three projects for Ralco Co. This company is in pharmaceutical industry. It currently sells several drugs, including pain reliever and cough medicine. Project A is considered the safest project of these three while Project C is the riskiest one. There are three discount rates for the capital budgeting, 8 percent for Project A, 12 percent for Project B, and 19 percent for Project C. Period Project A Project B Project T-0 ($10,000) (S12,000) ($17.000) -$2,000 $2,900 S1,900 $1.900 $1.900 S1.900 T-3 $1,900 $1,900 $1,900 T=4 $2,500 S1.900 $1,900 T-5 $2,500 $2,900 $1,900 T-6 $1,800 $2,900 $3.900 T-7 $1,800 $2,900 $3,900 T-8 $1,800 $3.900 $3.900 T9 $1.800 $4.900 A) If you have to choose only one project under the Payback period, which project should be chosen and explain WHY? (4 points) $6,900 B) When you have only $20,000 to support the above projects, which project (or projects) should be chosen under the Net Present Value (NPV) and explain WHY? (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts