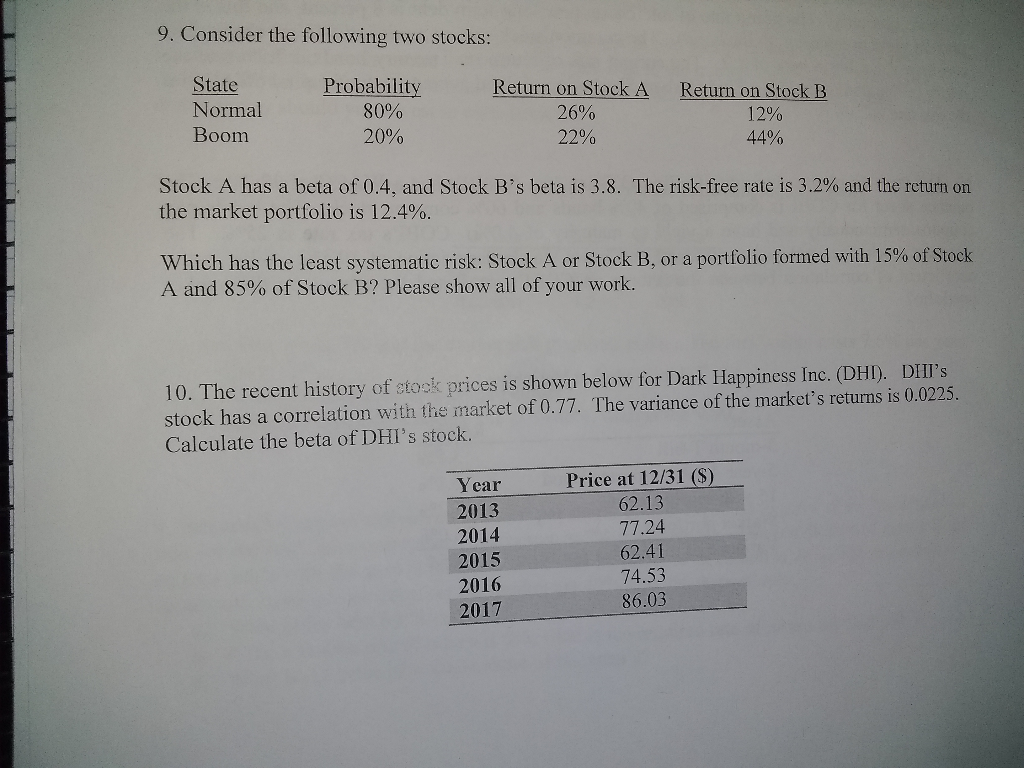

Question: 9. Consider the following two stocks: State Normal Boom Probability 80% 20% Return on Stock A 26% 22% Return on Stock B 12% 44% Stock

9. Consider the following two stocks: State Normal Boom Probability 80% 20% Return on Stock A 26% 22% Return on Stock B 12% 44% Stock A has a beta of 0.4, and Stock B's beta is 3.8. The risk-free rate is 3.2% and the return on the market portfolio is 12.4%. Which has the least systematic risk: Stock A or Stock B, or a portfolio formed with 15% of Stock A and 85% of Stock B? Please show all of your work. 10. The recent history of stock prices is shown below for Dark Happiness Inc. (DHT). DIII's stock has a correlation with the market of 0.77. The variance of the market's returns is 0.0225. Calculate the beta of DHI's stock. Year 2013 2014 2015 2016 2017 Price at 12/31 ($) 62.13 77.24 62.41 74.53 86.03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts